Question: IN THIS EXAMPLE WHERE DOES THE 30% TAXABLE IN STEP ONE COME FROM? PLEASE SHOW ME AND EXPLAIN, THANK YOU. 2013 Corporate Tax Rates It

IN THIS EXAMPLE WHERE DOES THE 30% TAXABLE IN STEP ONE COME FROM? PLEASE SHOW ME AND EXPLAIN, THANK YOU.

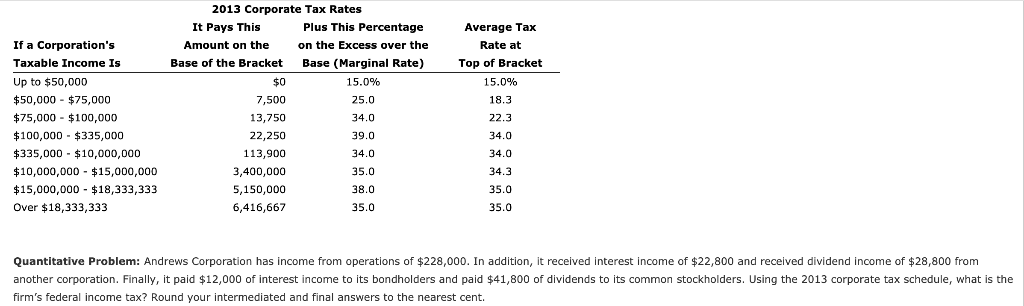

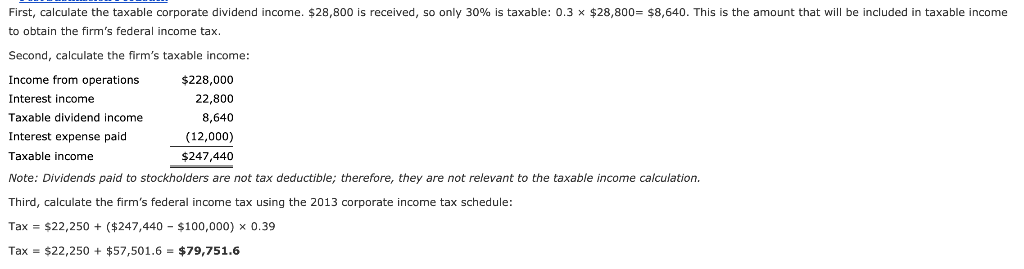

2013 Corporate Tax Rates It Pays This Plus This Percentage Average Tax If a Corporation's Amount on the on the Excess over the Rate at Taxable Income Is Base of the Bracket Base (Marginal Rate) Top of Bracket Up to $50,000 $0 15.0% 15.0% $50,000 $75,000 7,500 25.0 18.3 $75,000 $100,000 34.0 13,750 22.3 $100,000 $335,000 39.0 34.0 22,250 $335,000 $10,000,000 113,900 34.0 34.0 $10,000,000 $15,000,000 3,400,000 35.0 34.3 $15,000,000 $18,333,333 5,150,000 38.0 35.0 Over $18,333,333 6,416,667 35.0 35.0 Quantitative Problem: Andrews Corporation has income from operations of $228,000. In addition, it received interest income of $22,800 and received dividend income of $28,800 from another corporation. Finally, it paid $12,000 of interest income to its bondholders and paid $41,800 of dividends to its common stockholders. Using the 2013 corporate tax schedule, what is the firm's federal income tax? Round your intermediated and final answers to the nearest cent. First, calculate the taxable corporate dividend income. $28,800 is received, so only 30% is taxable: 0.3 x $28,800-$8,640 This is the amount that will be included in taxable income to obtain the firm's federal income tax Second, calculate the firm's taxable income Income from operations$228,000 Interest income 22,800 Taxable dividend income 8,640 Interest expense paid (12,000) $247,440 Taxable income Note: Dividends paid to stockholders are not tax deductible; therefore, they are not relevant to the taxable income calculation Third, calculate the firm's federal income tax using the 2013 corporate income tax schedule: Tax $22,250($247,440-$100,000) x 0.39 Tax = $22,250 + $57,501.6 $79,751.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts