Question: In this lab, we will c Problem In this lab, we will calculate a simple paycheck. To be able to calculate a paycheck, you will

In this lab, we will c Problem

In this lab, we will calculate a simple paycheck. To be able to calculate a paycheck, you will need some information from the user. We need their GROSSPAY, PAYPERIOD, and FILINGSTATUS.

The calculation of a person's NETPAY, the money left over after "Uncle Sam" gets his portion, requires the computation of three tax amounts. They are Federal Income Tax FIT Social Security Tax SS and Medicare Tax

MED Once these three tax amounts are determined, tabulation of the NETPAY becomes a matter of basic subtraction as: GROSSPAY FIT SS MED NETPAY

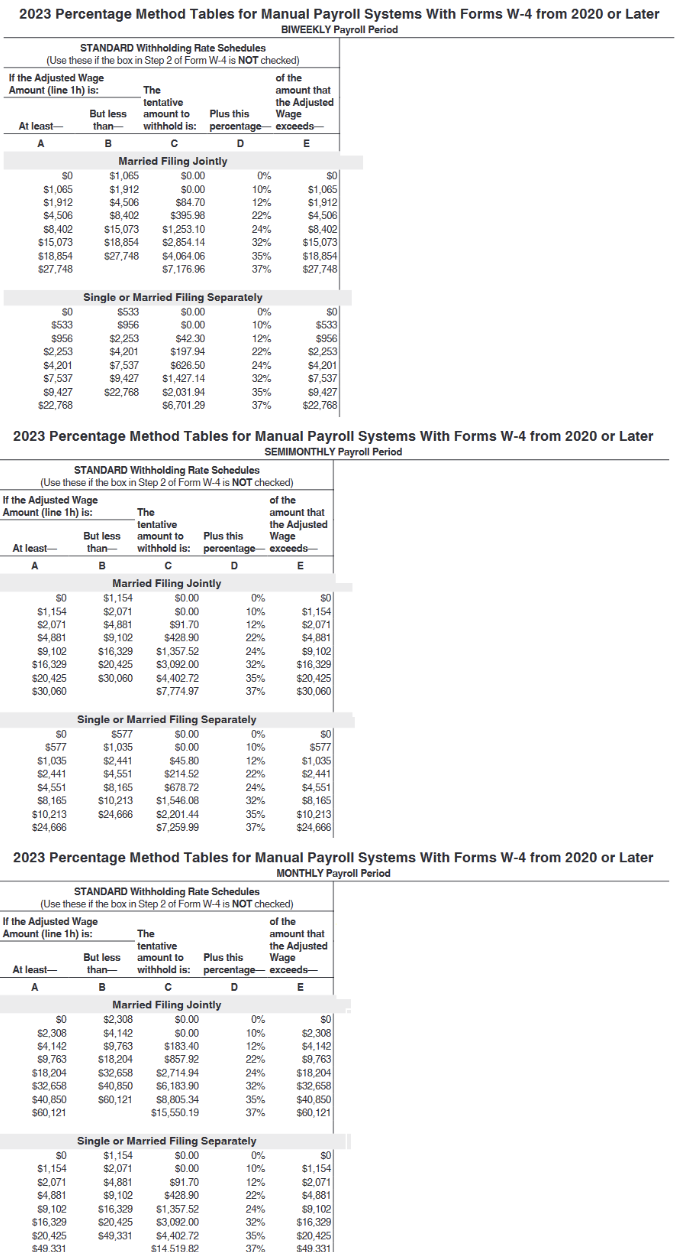

To calculate FIT, use the attached tax tables. For the purpose of this lab, we will use the Standard Tax tables for the biweekly, semimonthly, and monthly pay periods.

First, choose the proper table for the PAYPERIOD Biweekly, Semimonthly, or Monthly

Second, choose the proper bracket for the FILINGSTATUS Separate or Joint

Third, find the line where the GROSSPAY falls between COLUMNA and COLUMNB in the tax bracket.

Social Security Tax SS is calculated by multiplying GROSSPAY by or GROSSPAY

Medicare Tax MED is calculated by multiplying GROSSPAY by or GROSSPAY Screens necessary to complete this program at a minimum would include a main menu screen and a paycheck inputoutput screen.

Here's an example:alculate a simple paycheck. To be able to calculate a paycheck, you will need some information from the user. We need their GROSSPAY, PAYPERIOD, and FILINGSTATUS.

The calculation of a persons NETPAY, the money left over after Uncle Sam gets his portion, requires the computation of three tax amounts. They are Federal Income Tax FIT Social Security Tax SS and Medicare Tax MED Once these three tax amounts are determined, tabulation of the NETPAY becomes a matter of basic subtraction as: GROSSPAY FIT SS MED NETPAY

To calculate FIT, use the attached tax tables. For the purpose of this lab, we will use the Standard Tax tables for the biweekly, semimonthly, and monthly pay periods.

First, choose the proper table for the PAYPERIOD Biweekly, Semimonthly, or Monthly

Second, choose the proper bracket for the FILINGSTATUS Separate or Joint

Third, find the line where the GROSSPAY falls between COLUMNA and COLUMNB in the tax bracket.

Lastly, FIT is calculated as: COLUMNC COLUMND GROSSPAY COLUMNE

Social Security Tax SS is calculated by multiplying GROSSPAY by or GROSSPAY

Medicare Tax MED is calculated by multiplying GROSSPAY by or GROSSPAY

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock