Question: In this lab, you complete the Python program that calculates the amount of tax withheld from an employees weekly salary, the tax deduction to which

In this lab, you complete the Python program that calculates the amount of tax withheld from an employees weekly salary, the tax deduction to which the employee is entitled for each dependent, and the employees take-home pay. The program output includes state tax withheld, federal tax withheld, dependent tax deductions, salary, and take-home pay. Instructions Some variables have been assigned for you and the output statements have been written. Read the starting code carefully before you proceed to the next step. Write the Python code needed to perform the following: Calculate state withholding tax (stateTax) at 6.5 percent Calculate federal withholding tax (federalTax) at 28.0 percent. Calculate dependent deductions (dependentDeduction) at 2.5 percent of the employees salary for each dependent. Calculate total withholding (totalWithholding) as stateTax + federalTax + dependentDeduction. Calculate take-home pay (takeHomePay) as salary - totalWithholding Execute the program by clicking the Run button at the bottom. You should get the following output: State Tax: $81.25 Federal Tax: $350.00000000000006 Dependents: $62.5 Salary: $1250.0 Take-Home Pay: $756.25 In this program, the variables named salary and numDependents are initialized with the values 1250.0 and 2. To make this program more flexible, modify it to accept interactive input for salary and numDependents.

my code:

# Prompt user to enter the salary

# Convert the user response to float

salary = float(input("Enter the salary amount: "))

# Prompt user to input the number of dependents

# Convert the user input to int

numDependents = int(input("Enter the number of dependents: "))

# Initialize the state tax rate

stateTaxRate = 6.5/100

# Initialize the federal tax rate

federalTaxRate = 28.0/100

# Initialize the dependent deduction rate

dependentDeductionRate = 2.5/100

# Calculate the state tax

# Multiply salary by state tax rate

stateTax = salary * stateTaxRate

# Calculate the federal tax

# Multiply salary by federal tax rate

federalTax = salary * federalTaxRate

# Calculate the dependent deduction

# Multiply salary by number of dependents and the

# dependent deduction rate

dependentDeduction = salary * numDependents * dependentDeductionRate

# Calculate the total withholding amount

# Add the state tax, federal tax and dependent deduction

totalWithholding = stateTax + federalTax + dependentDeduction

# Calculate the take home pay

# Subtract the total withholding amount from the salary

takeHomePay = salary - totalWithholding

# print a blank line

print()

# Display the output

print("State Tax: $",stateTax)

print("Federal Tax: $",federalTax)

print("Dependents: $",dependentDeduction)

print("Salary: $",salary)

print("Take-Home Pay: $ ",takeHomePay)

task:

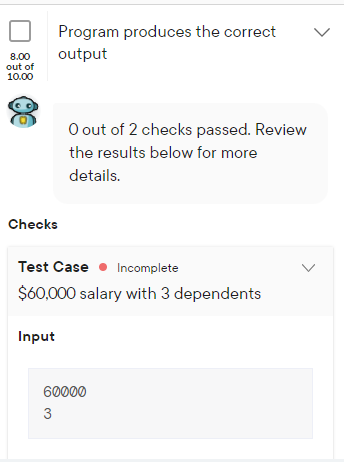

Program produces the correct output

2

0 out of 2 checks passed. Review the results below for more details.

Checks

Test CaseIncomplete

$60,000 salary with 3 dependents

Input

60000 3

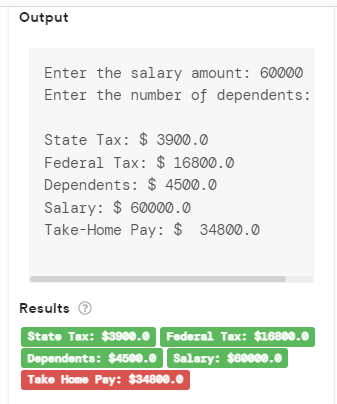

Output

Enter the salary amount: 60000 Enter the number of dependents: 3 State Tax: $ 3900.0 Federal Tax: $ 16800.0 Dependents: $ 4500.0 Salary: $ 60000.0 Take-Home Pay: $ 34800.0

Results

State Tax: $3900.0

Federal Tax: $16800.0

Dependents: $4500.0

Salary: $60000.0

Take Home Pay: $34800.0

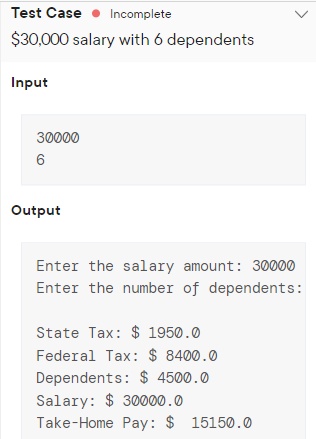

Show DetailsTest CaseIncomplete

$30,000 salary with 6 dependents

Input

30000 6

Output

Enter the salary amount: 30000 Enter the number of dependents: 6 State Tax: $ 1950.0 Federal Tax: $ 8400.0 Dependents: $ 4500.0 Salary: $ 30000.0 Take-Home Pay: $ 15150.0

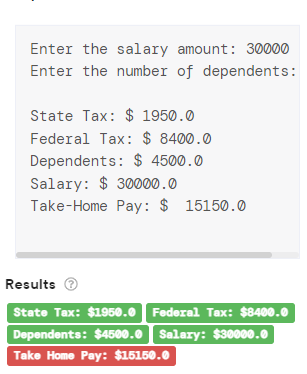

Results

State Tax: $1950.0

Federal Tax: $8400.0

Dependents: $4500.0

Salary: $30000.0

Take Home Pay: $15150.0

Show Details

Run checks

Program produces the correct output 0 out of 2 checks passed. Review the results below for more details. Enter the salary amount: 60000 Enter the number of dependents: State Tax: \$3900.0 Federal Tax: $16800.0 Dependents: $4500.0 Salary: $60000.0 Take-Home Pay: $34800.0 Output Enter the salary amount: 30000 Enter the number of dependents: State Tax: $1950.0 Federal Tax: $8400.0 Dependents: $4500.0 Salary: $30000.0 Take-Home Pay: \$15150.0 Enter the salary amount: 30000 Enter the number of dependents: State Tax: \$1950.0 Federal Tax: $8400.0 Dependents: $4500.0 Salary: $30000.0 Take-Home Pay: $15150.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts