Question: In this problem, we consider a so-called principal protected note (or p.p.n.), the simplest capital guaranteed product offered by most banks to their retail clients.

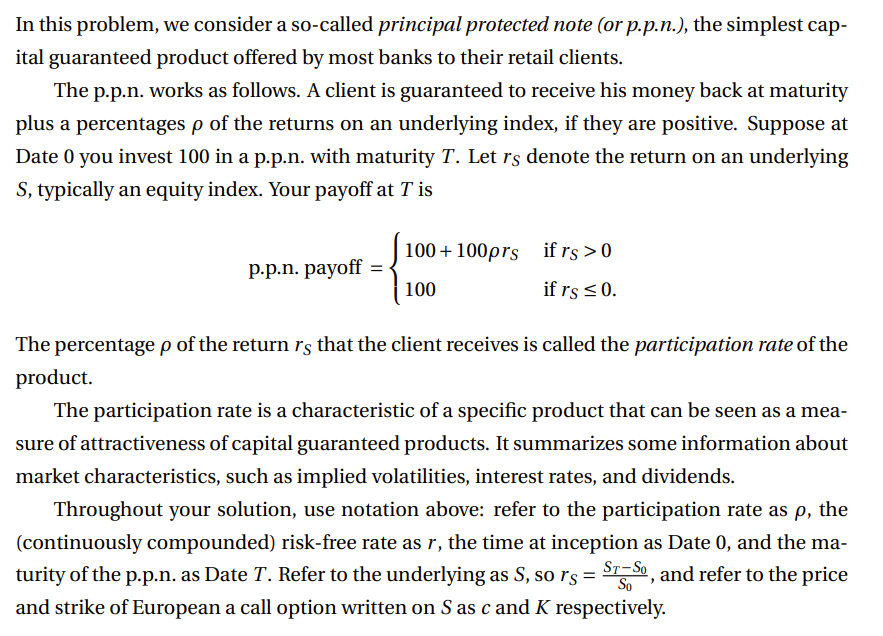

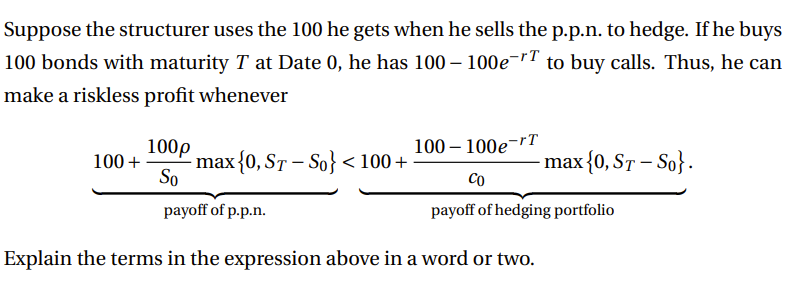

In this problem, we consider a so-called principal protected note (or p.p.n.), the simplest capital guaranteed product offered by most banks to their retail clients. The p.p.n. works as follows. A client is guaranteed to receive his money back at maturity plus a percentages of the returns on an underlying index, if they are positive. Suppose at Date 0 you invest 100 in a p.p.n. with maturity T. Let rS denote the return on an underlying S, typically an equity index. Your payoff at T is p.p.n.payoff={100+100rS100ifrS>0ifrS0. The percentage of the return rS that the client receives is called the participation rate of the product. The participation rate is a characteristic of a specific product that can be seen as a measure of attractiveness of capital guaranteed products. It summarizes some information about market characteristics, such as implied volatilities, interest rates, and dividends. Throughout your solution, use notation above: refer to the participation rate as , the (continuously compounded) risk-free rate as r, the time at inception as Date 0 , and the maturity of the p.p.n. as Date T. Refer to the underlying as S, so rS=S0STS0, and refer to the price and strike of European a call option written on S as c and K respectively. Suppose the structurer uses the 100 he gets when he sells the p.p.n. to hedge. If he buys 100 bonds with maturity T at Date 0 , he has 100100erT to buy calls. Thus, he can make a riskless profit whenever payoffofp.p.n.100+S0100max{0,STS0}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts