Question: In this problem, we consider a so-called principal protected note (or p.p.n.), the sim- plest capital guaranteed product offered by most banks to their retail

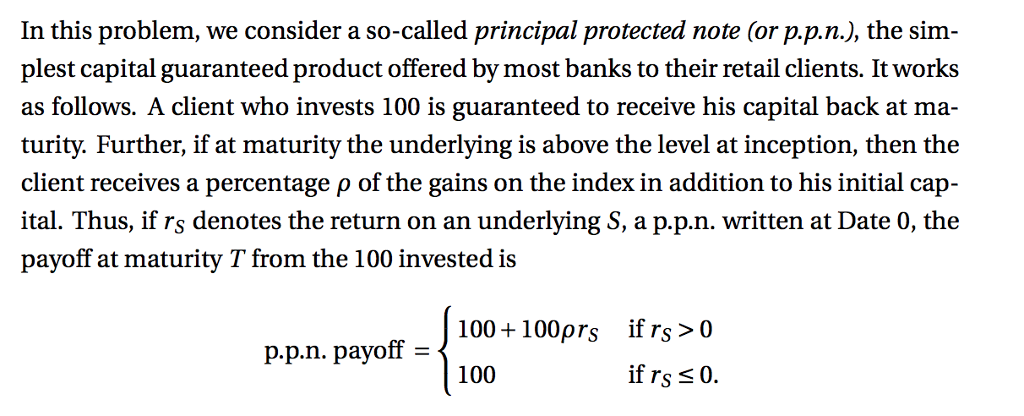

In this problem, we consider a so-called principal protected note (or p.p.n.), the sim- plest capital guaranteed product offered by most banks to their retail clients. It works as follows. A client who invests 100 is guaranteed to receive his capital back at ma- turity. Further, if at maturity the underlying is above the level at inception, then the client receives a percentage of the gains on the index in addition to his initial cap- ital. Thus, if rs denotes the return on an underlying S, a p.p.n. written at Date 0, the payoff at maturity T from the 100 invested is 100+100prs if rs>0 if rs s 0. p.p.n. payoff =) 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts