Question: In this problem, we will explore how a firm can provide incentives for its executives using the firm's stocks. Suppose WeRock is a public

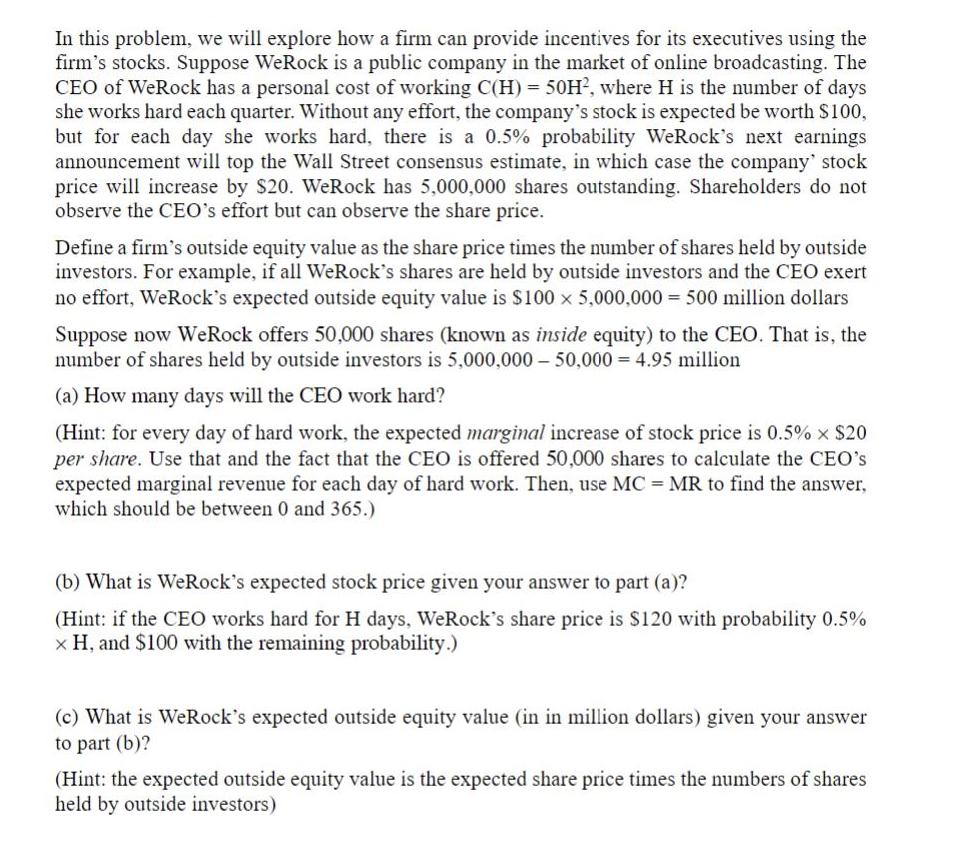

In this problem, we will explore how a firm can provide incentives for its executives using the firm's stocks. Suppose WeRock is a public company in the market of online broadcasting. The CEO of WeRock has a personal cost of working C(H) = 50H, where H is the number of days she works hard each quarter. Without any effort, the company's stock is expected be worth $100, but for each day she works hard, there is a 0.5% probability WeRock's next earnings announcement will top the Wall Street consensus estimate, in which case the company' stock price will increase by $20. WeRock has 5,000,000 shares outstanding. Shareholders do not observe the CEO's effort but can observe the share price. Define a firm's outside equity value as the share price times the number of shares held by outside investors. For example, if all WeRock's shares are held by outside investors and the CEO exert no effort, WeRock's expected outside equity value is $100 x 5,000,000 = 500 million dollars Suppose now WeRock offers 50,000 shares (known as inside equity) to the CEO. That is, the number of shares held by outside investors is 5,000,000 - 50,000 = 4.95 million (a) How many days will the CEO work hard? (Hint: for every day of hard work, the expected marginal increase of stock price is 0.5% x $20 per share. Use that and the fact that the CEO is offered 50,000 shares to calculate the CEO's expected marginal revenue for each day of hard work. Then, use MC = MR to find the answer, which should be between 0 and 365.) (b) What is WeRock's expected stock price given your answer to part (a)? (Hint: if the CEO works hard for H days, WeRock's share price is $120 with probability 0.5% x H, and $100 with the remaining probability.) (c) What is WeRock's expected outside equity value (in in million dollars) given your answer to part (b)? (Hint: the expected outside equity value is the expected share price times the numbers of shares held by outside investors)

Step by Step Solution

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Part a MR Increase in stock price x number of share... View full answer

Get step-by-step solutions from verified subject matter experts