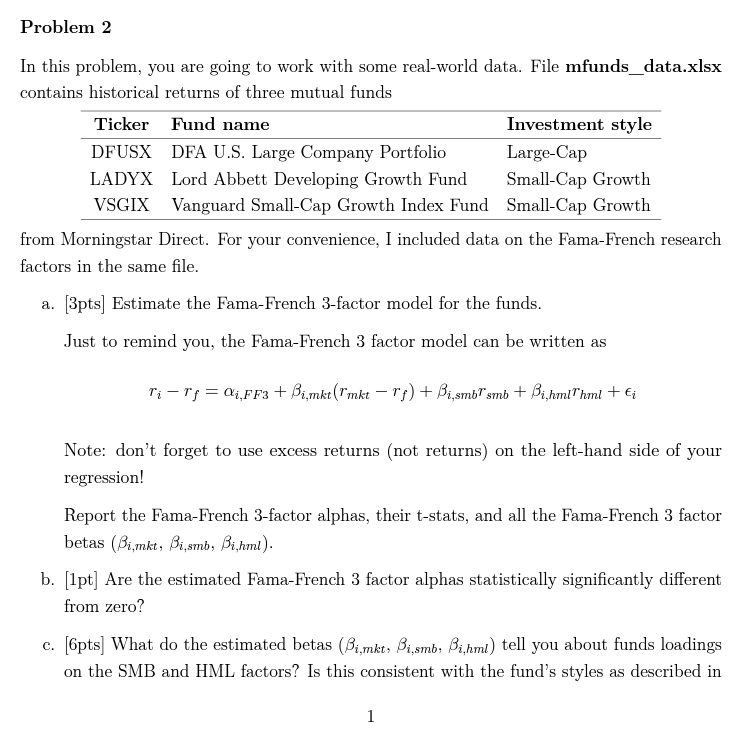

Question: In this problem, you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds from Morningstar Direct. For

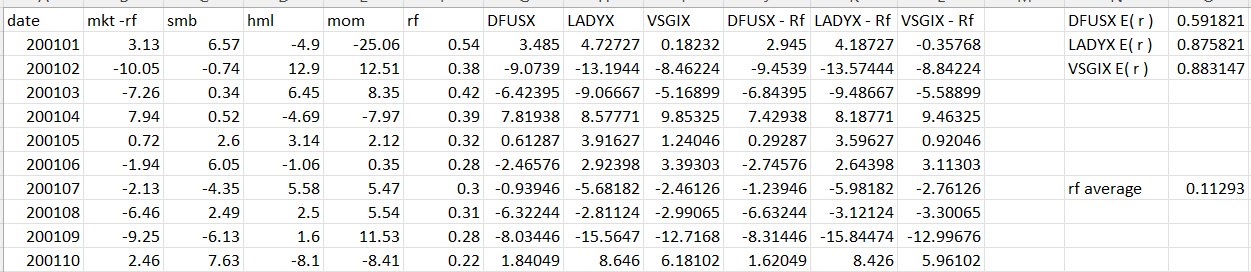

In this problem, you are going to work with some real-world data. File mfunds_data.xlsx contains historical returns of three mutual funds from Morningstar Direct. For your convenience, I included data on the Fama-French research factors in the same file. a. [3pts] Estimate the Fama-French 3-factor model for the funds. Just to remind you, the Fama-French 3 factor model can be written as rirf=i,FF3+i,mkt(rmktrf)+i,smbrsmb+i,hmlrhml+i Note: don't forget to use excess returns (not returns) on the left-hand side of your regression! Report the Fama-French 3-factor alphas, their t-stats, and all the Fama-French 3 factor betas (i,mkt,i,smb,i,hml). b. [1pt] Are the estimated Fama-French 3 factor alphas statistically significantly different from zero? c. [6pts] What do the estimated betas (i,mkt,i,smb,i,hml) tell you about funds loadings on the SMB and HML factors? Is this consistent with the fund's styles as described in

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts