Question: In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of Nike Cola, a soft drink for active lifestyles.

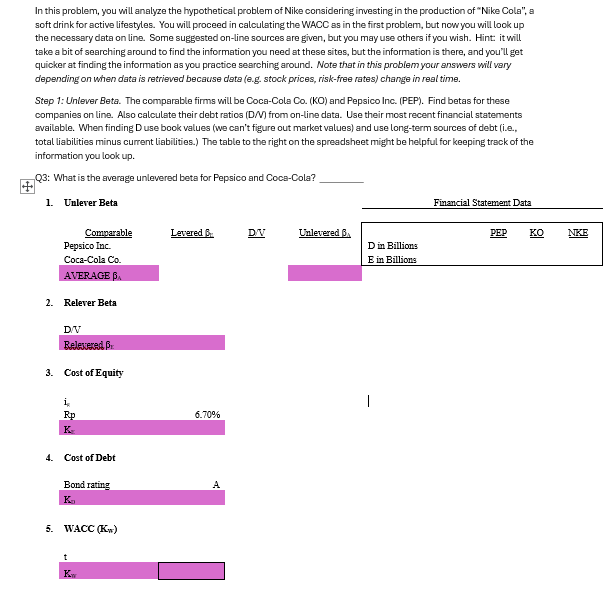

In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of "Nike Cola", a soft drink for active lifestyles. You will proceed in calculating the WACC as in the first problem, but now you will look up the necessary data on line. Some suggested online sources are given, but you may use others if you wish. Hint: it will take a bit of searching around to find the information you need at these sites, but the information is there, and you'll get quicker at finding the information as you practice searching around. Note that in this problem your answers will vary depending on when data is retrieved because data eg stock prices, riskfree rates change in real time. Step : Unlever Beta. The comparable firms will be CocaCola CoKO and Pepsico Inc. PEP Find betas for these companies on line. Also calculate their debt ratios DN from online data. Use their most recent financial statements available. When finding D use book values we can't figure out market values and use longterm sources of debt ie total liabilities minus current liabilities. The table to the right on the spreadsheet might be helpful for keeping track of the information you look up Q: What is the average unlevered beta for Pepsico and CocaCola?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock