Question: Problem #2 - Nike Cola WACC In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of Nike Cola,

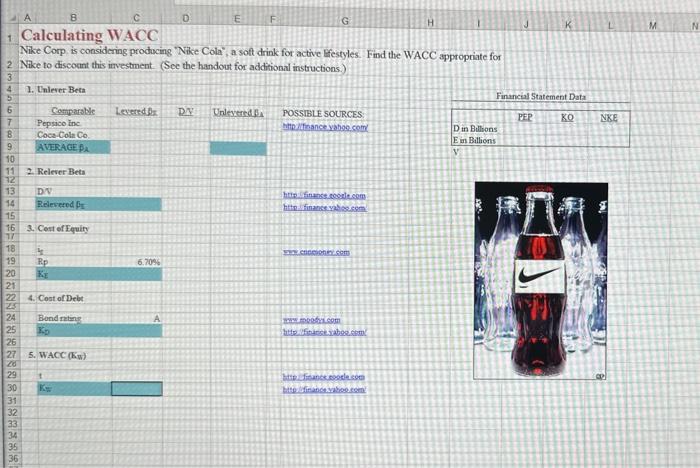

Problem #2 - Nike Cola WACC In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of "Nike Cola", a sott drink for active lifestyles. You will proceed in calculating the WACC as in the first problem, but now you will look up the necessary data on line. Some suggested on-line sources are given, but you may use others if you wish. Hint: it will take a bit of searching around to find the information you need at these sites, but the information is there, and you'll get quicker at finding the information as you practice searching around. Note that in this problem you arswers will vary depenaing on when data is retrieved because data (e. p. stock prices, risk-free rates) change in real time. Step 1: Urdeuch Beta The comparable firms will be Coca-Cola Co. (KO) and Peprice Inc. (PEP). Find betas for these companies on line. Also calculate their debt ratios (D/V) from on-line data. Use their most recent financial statements available. When finding D use book values (we can't figure out market values) and use long-term sources of debt (i.e, total liabilities minus current liabilities.) The table to the right on the spreadsheet might be helpful for keeping track of the information you look up. Q3: What is the average unlevered beta for Pepsice and Coca-Cola? Step 2: Relouse Beta. Now relever the asset beta according to Nike's (NKE) capital structure. You will not find their target debt ratio on line, so focus on their actual debt ratio from their most recent fingncial statements. Step 3: Cast of Bquity. For the riak-free rate (is), use the yield currently available on treasury securities. You can find this rate on line. The only question is what maturity of tressury to use While opinions differ on this issue, my feeling is that you should use a maturity that is close to the time horizon of the investment considered. I'Il suggest using a 10-year rate here. Step 4: Cast of Debt. To keep this step simple, let me just tell you that Nike's credit rating right now is A. Now you can look up a representative yield for bonds of this rating on line. (For example, on Yahoo finance, try Bonds under the Investing tab, and look up Composite Bond Rates.) Assume Nike would issue 10-year bonds. (Note that in this case you are entering the yield on the bonds, not a premium over trearugys.) Step 5: WACC. First, calculate Nike's tax rate from its most recent anmual financial statements. Then you have all the pieces available to put together the appropciate WACC for Nike's investment in soft drinks. Q4: What is the appropriate WACC for Nike's investment? Q5: Suppose Nike estimated that the IRR of their soft-drink investment was 5.04. How low would the market rink premium bave to be in order for their investment to be justified? can solve this with Goal Seek.) Calculating W. ACC Nike Corp, is considering producing "Nike Cola', a sott drink for active lifestyles. Find the WACC appropriate for Nike to discocnt this investment. (See the handout for additional instructions.) Problem #2 - Nike Cola WACC In this problem, you will analyze the hypothetical problem of Nike considering investing in the production of "Nike Cola", a sott drink for active lifestyles. You will proceed in calculating the WACC as in the first problem, but now you will look up the necessary data on line. Some suggested on-line sources are given, but you may use others if you wish. Hint: it will take a bit of searching around to find the information you need at these sites, but the information is there, and you'll get quicker at finding the information as you practice searching around. Note that in this problem you arswers will vary depenaing on when data is retrieved because data (e. p. stock prices, risk-free rates) change in real time. Step 1: Urdeuch Beta The comparable firms will be Coca-Cola Co. (KO) and Peprice Inc. (PEP). Find betas for these companies on line. Also calculate their debt ratios (D/V) from on-line data. Use their most recent financial statements available. When finding D use book values (we can't figure out market values) and use long-term sources of debt (i.e, total liabilities minus current liabilities.) The table to the right on the spreadsheet might be helpful for keeping track of the information you look up. Q3: What is the average unlevered beta for Pepsice and Coca-Cola? Step 2: Relouse Beta. Now relever the asset beta according to Nike's (NKE) capital structure. You will not find their target debt ratio on line, so focus on their actual debt ratio from their most recent fingncial statements. Step 3: Cast of Bquity. For the riak-free rate (is), use the yield currently available on treasury securities. You can find this rate on line. The only question is what maturity of tressury to use While opinions differ on this issue, my feeling is that you should use a maturity that is close to the time horizon of the investment considered. I'Il suggest using a 10-year rate here. Step 4: Cast of Debt. To keep this step simple, let me just tell you that Nike's credit rating right now is A. Now you can look up a representative yield for bonds of this rating on line. (For example, on Yahoo finance, try Bonds under the Investing tab, and look up Composite Bond Rates.) Assume Nike would issue 10-year bonds. (Note that in this case you are entering the yield on the bonds, not a premium over trearugys.) Step 5: WACC. First, calculate Nike's tax rate from its most recent anmual financial statements. Then you have all the pieces available to put together the appropciate WACC for Nike's investment in soft drinks. Q4: What is the appropriate WACC for Nike's investment? Q5: Suppose Nike estimated that the IRR of their soft-drink investment was 5.04. How low would the market rink premium bave to be in order for their investment to be justified? can solve this with Goal Seek.) Calculating W. ACC Nike Corp, is considering producing "Nike Cola', a sott drink for active lifestyles. Find the WACC appropriate for Nike to discocnt this investment. (See the handout for additional instructions.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts