Question: In this question, please explain how we use convert to 2.7595%, 3.112% and 3.2632% with quarterly compounding, where are these numbers from? With continuous compounding

In this question, please explain how we use convert to 2.7595%, 3.112% and 3.2632% with quarterly compounding, where are these numbers from?

In this question, please explain how we use convert to 2.7595%, 3.112% and 3.2632% with quarterly compounding, where are these numbers from?

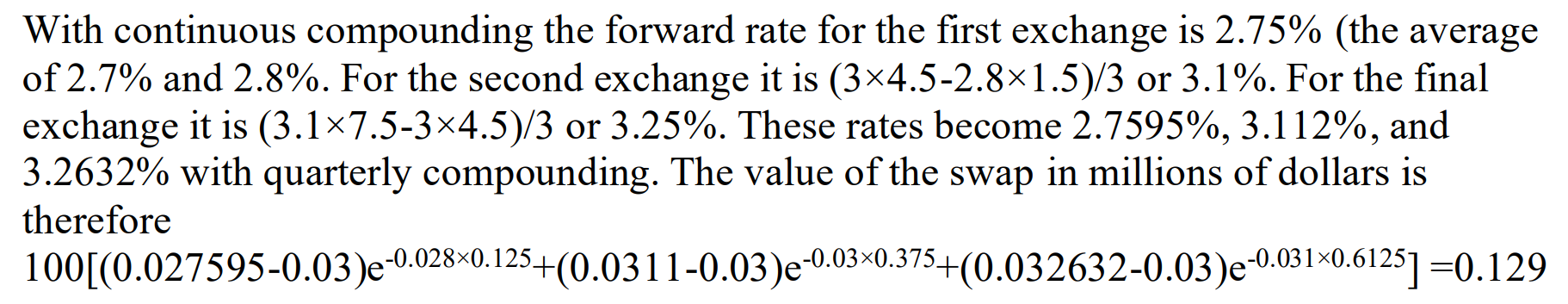

With continuous compounding the forward rate for the first exchange is 2.75% (the average of 2.7% and 2.8%. For the second exchange it is (34.52.81.5)/3 or 3.1%. For the final exchange it is (3.17.534.5)/3 or 3.25%. These rates become 2.7595%,3.112%, and 3.2632% with quarterly compounding. The value of the swap in millions of dollars is therefore 100[(0.0275950.03)e0.0280.125+(0.03110.03)e0.030.375+(0.0326320.03)e0.0310.6125]=0.129 With continuous compounding the forward rate for the first exchange is 2.75% (the average of 2.7% and 2.8%. For the second exchange it is (34.52.81.5)/3 or 3.1%. For the final exchange it is (3.17.534.5)/3 or 3.25%. These rates become 2.7595%,3.112%, and 3.2632% with quarterly compounding. The value of the swap in millions of dollars is therefore 100[(0.0275950.03)e0.0280.125+(0.03110.03)e0.030.375+(0.0326320.03)e0.0310.6125]=0.129

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts