Question: In two paragraphs, explain the problems within this case study, followed by possible solutions to these problems Thank you! of their brands is Jaco brand

In two paragraphs, explain the problems within this case study, followed by possible solutions to these problems

Thank you!

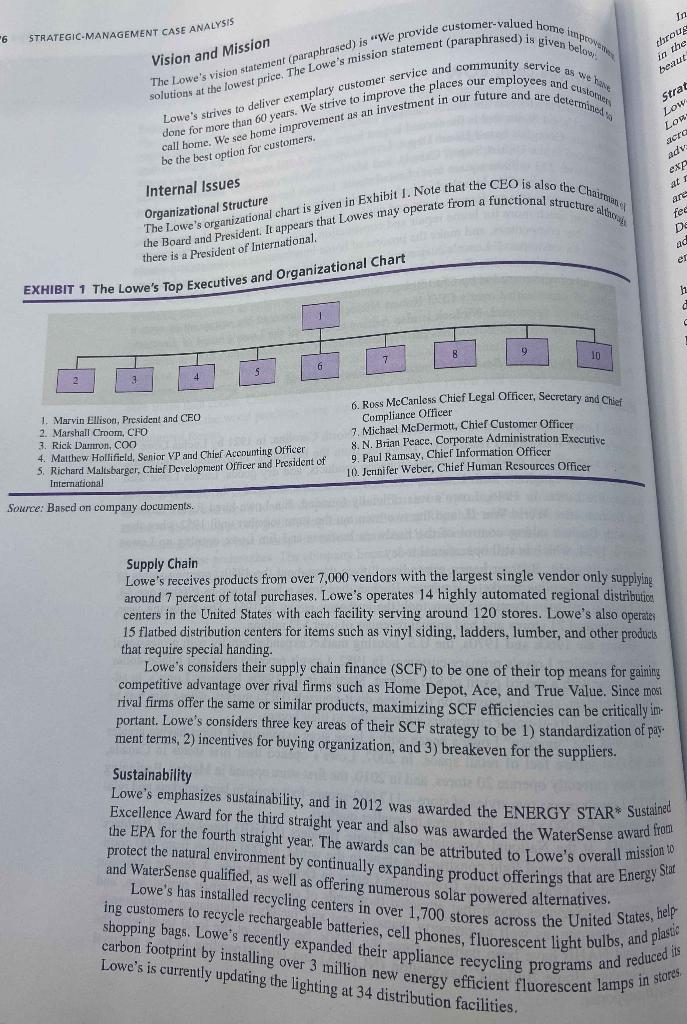

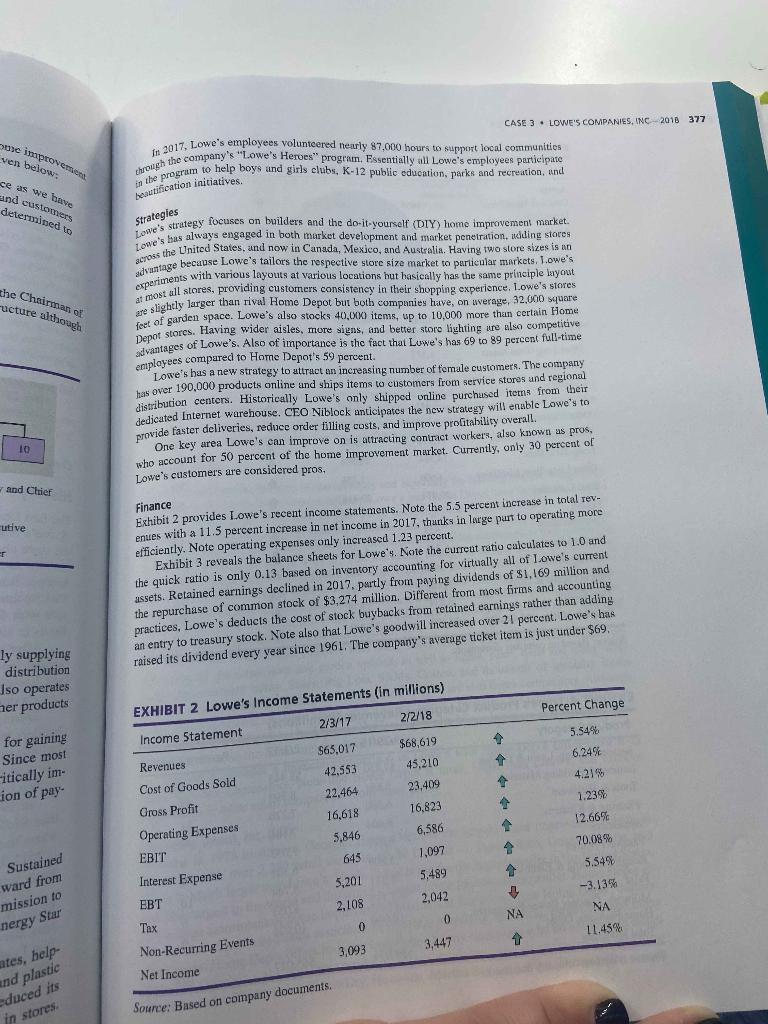

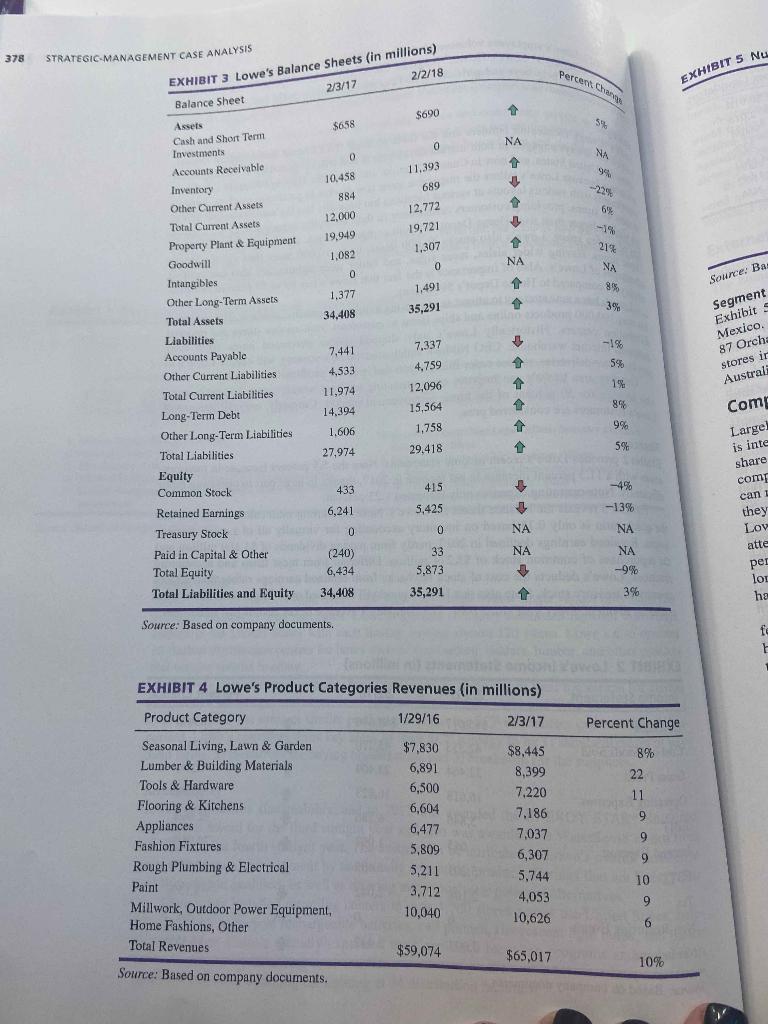

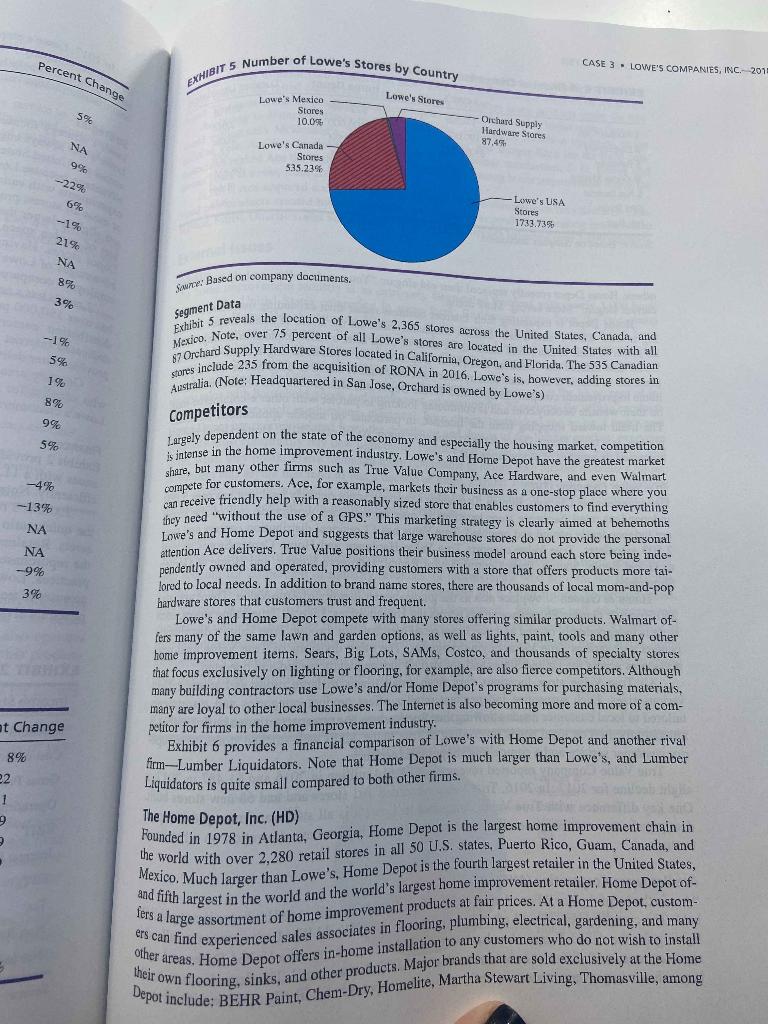

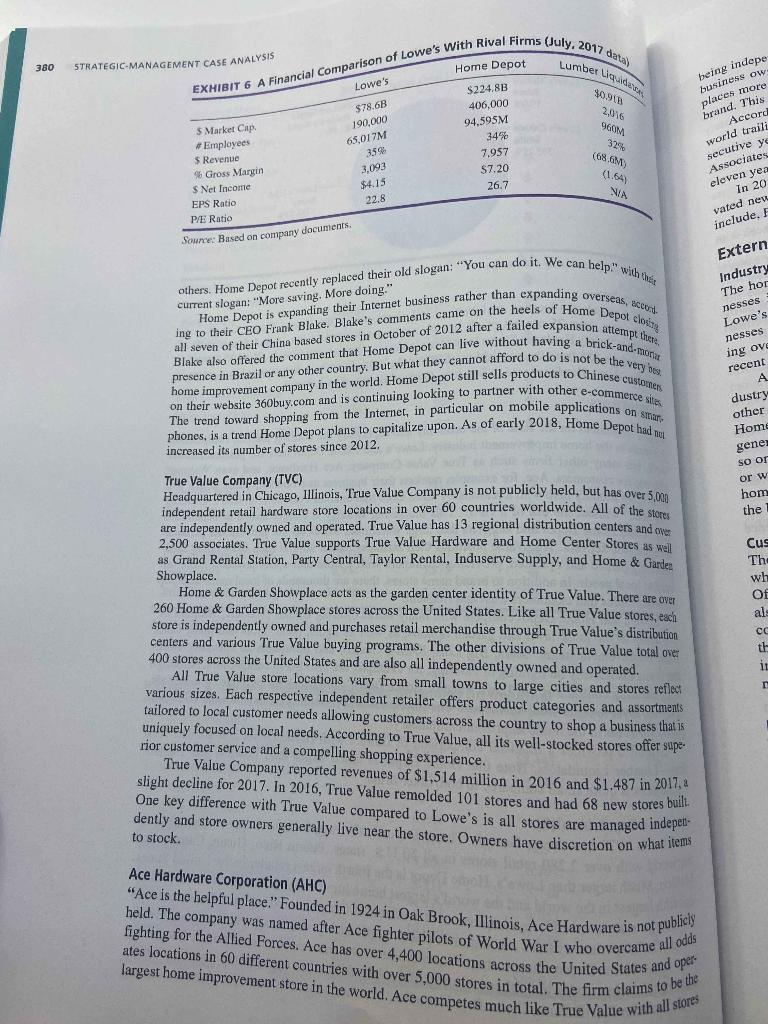

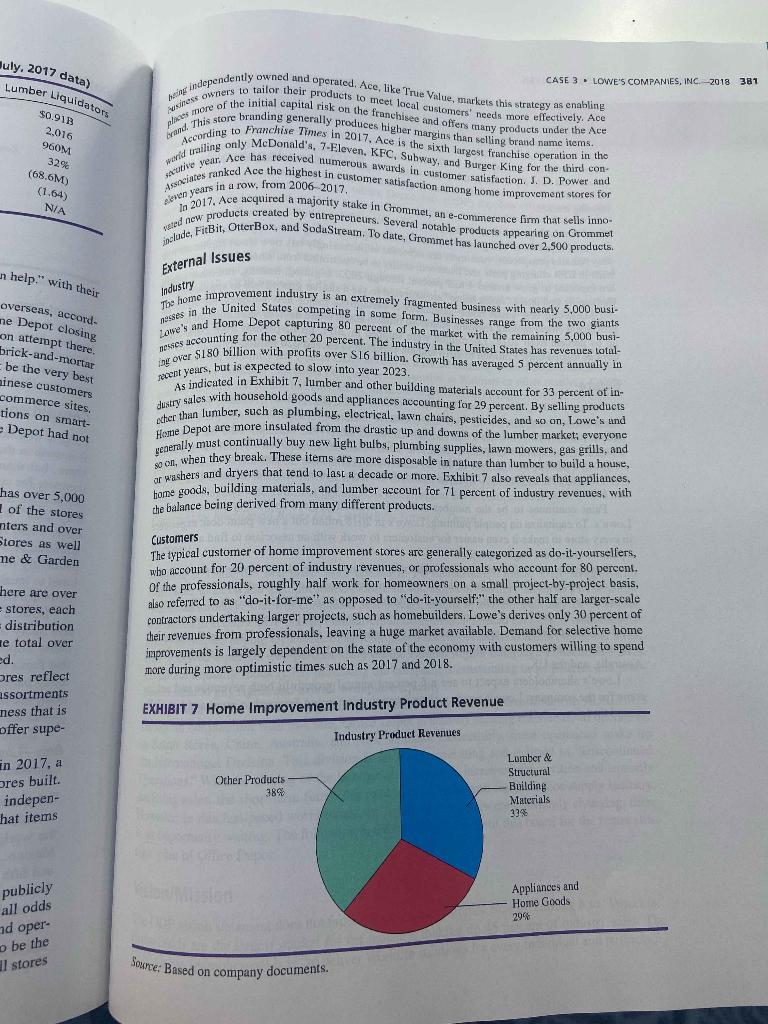

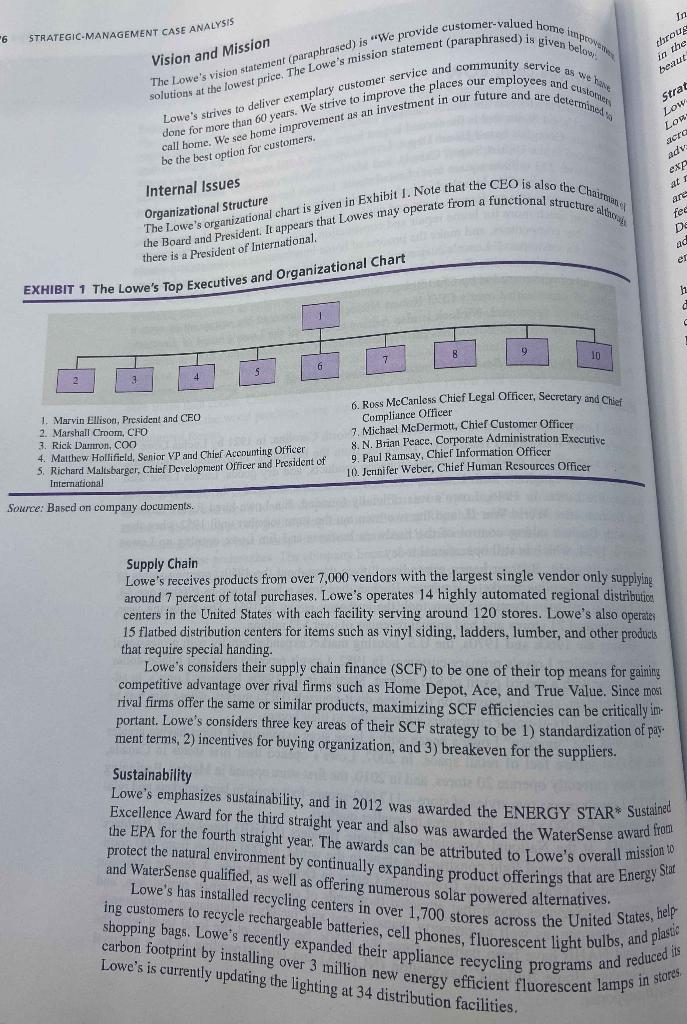

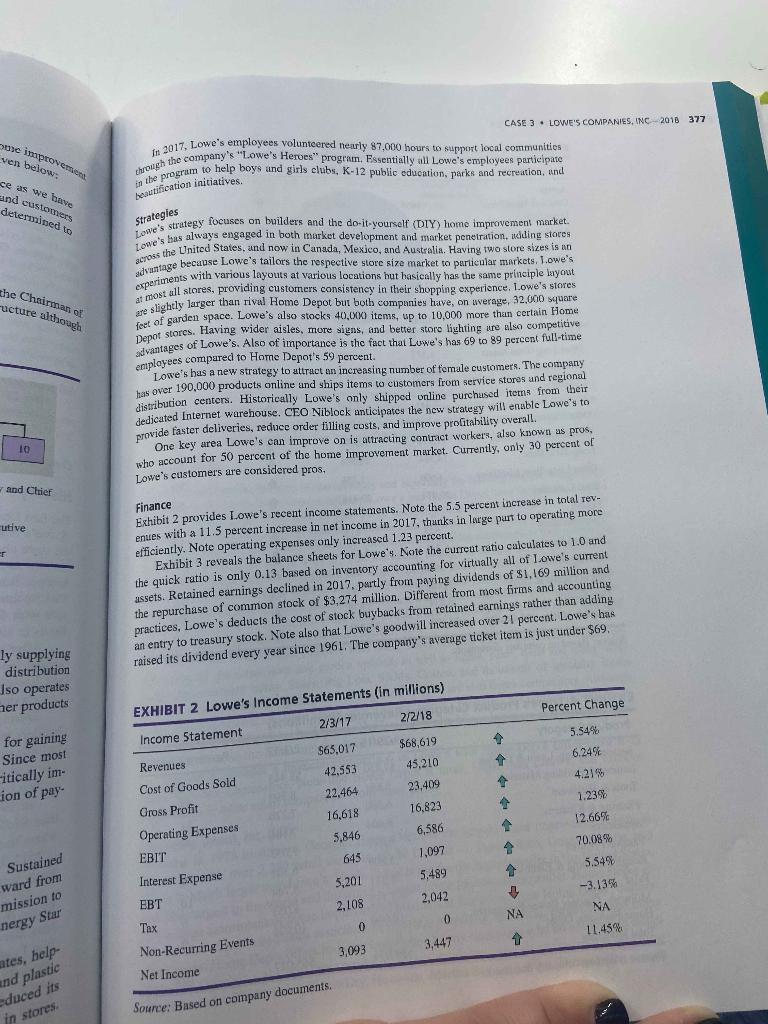

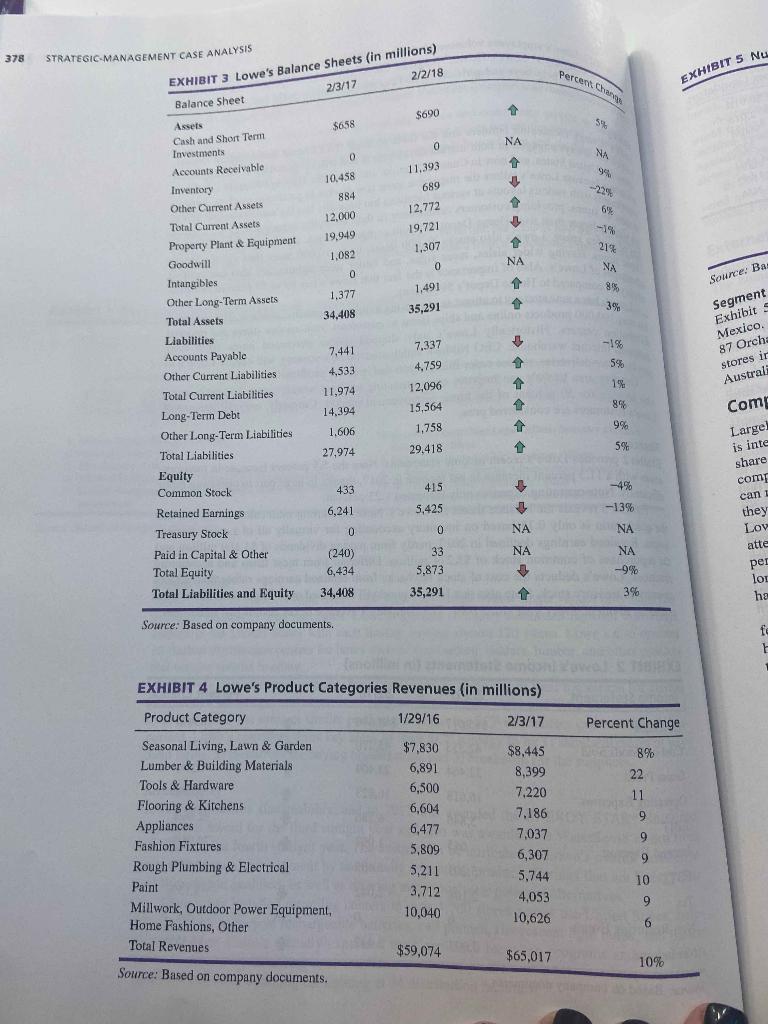

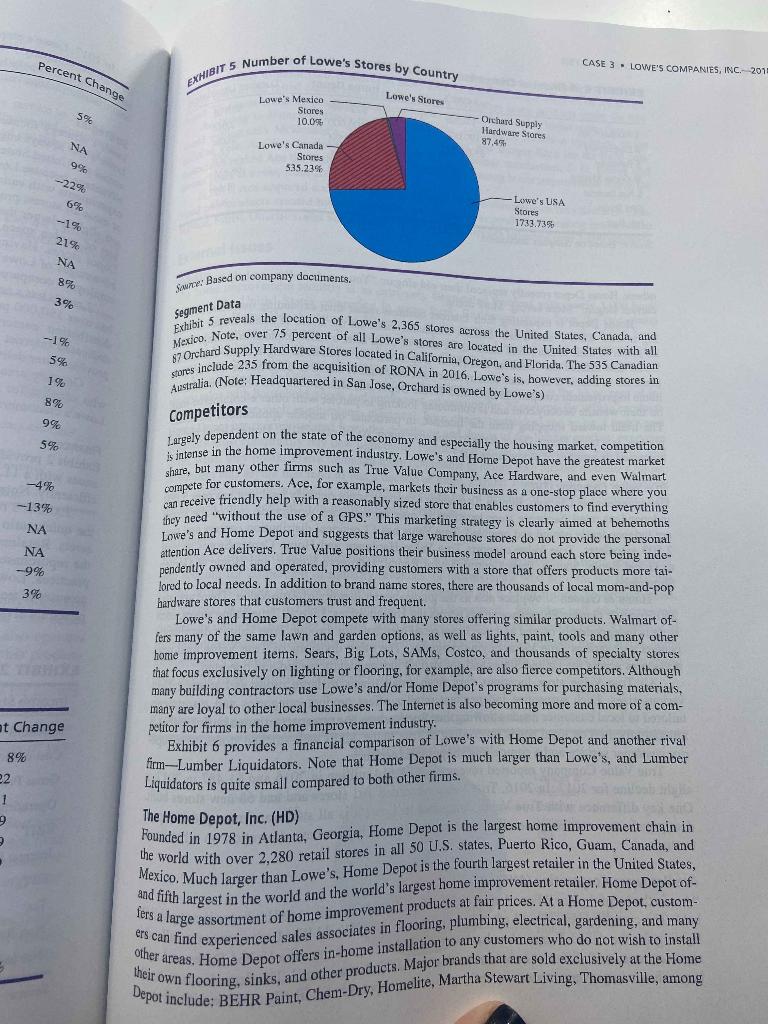

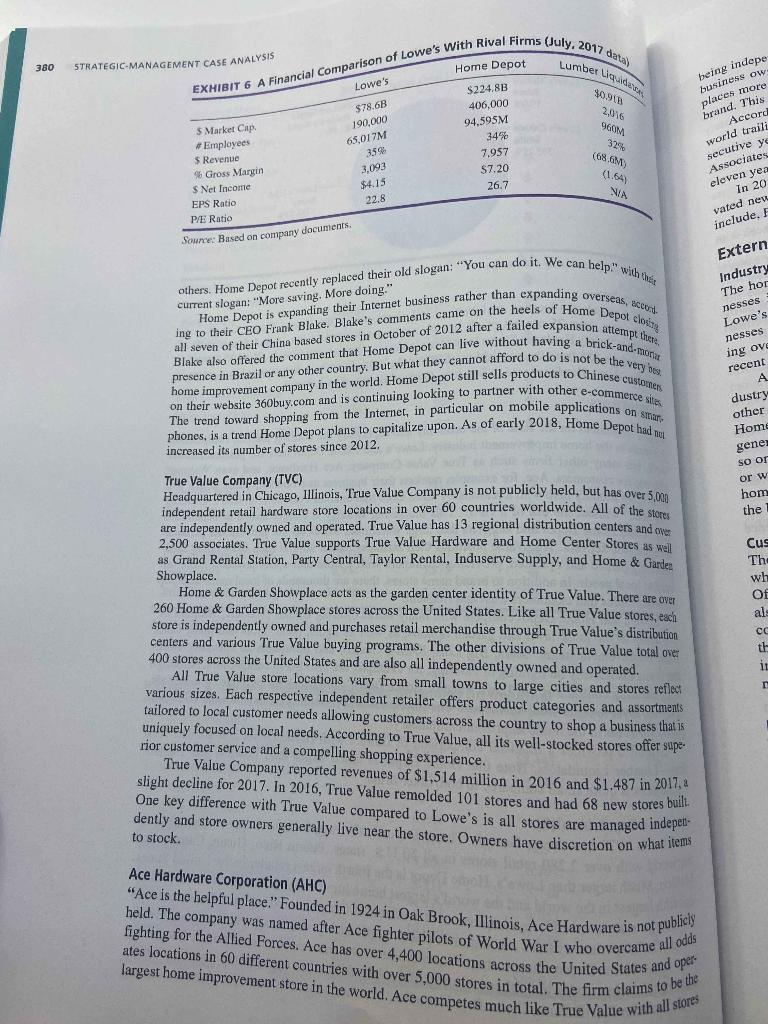

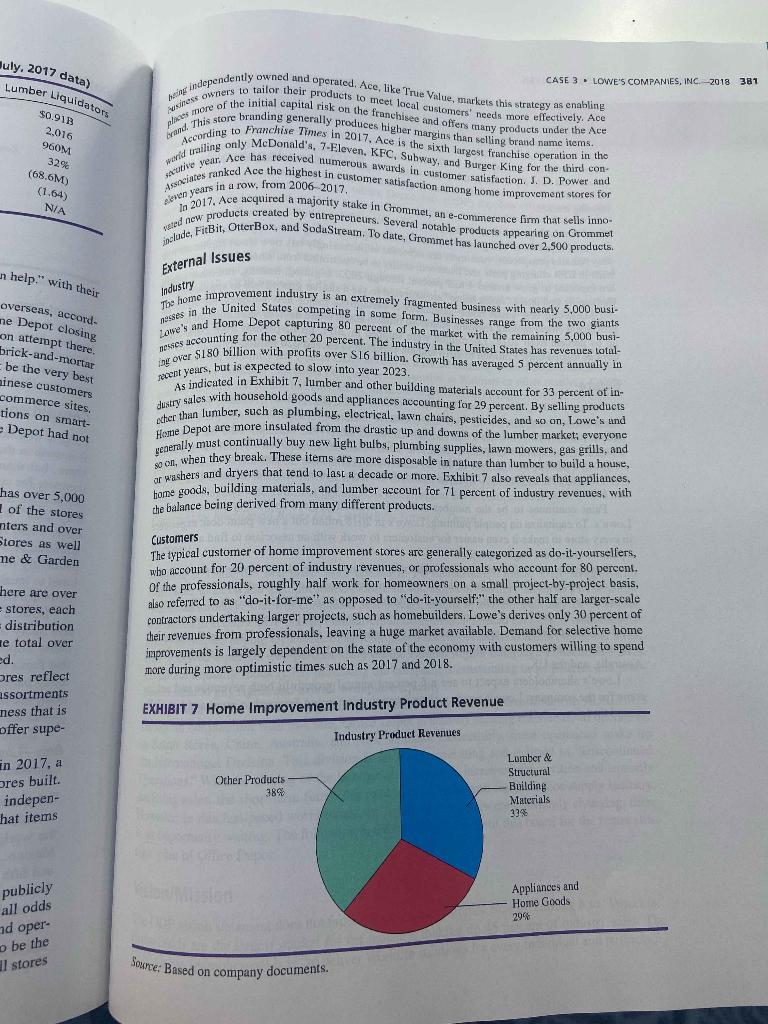

of their brands is Jaco brand CASE 3. LOWE'S COMPANIES, INC. 2018 375 dering is 2018 Lowe's Companies. Ine. www.lowes.com, Low hases account ces of clothing in the United percentages employees ac es to increase account for 2 UN erived from se a slew of thers from zed control advantages renewable pically are thein Mooresville, North Carolina, Lowe's is among Torine's top 50 largest compu- he United States and is the second largest home improvement store in the world, trailing Arng located in the United States, Canada, and Mcxico. The firm serves 17 million customers waly Atlanta, Georgia's based Home Depot. Lowe's operates 2,365 stores with all Lowes stores rely in over 213 million square feet of retail space. Lowe's has an agreement, as a one-third Wer with Australian Woolworths Litnited to develop u Lowe's-themed store in Austrulia Lowe's stores offer appliances, lawn and garden, lumber, plumbing, clectrical, power tools, flooring, and much more for home repair and construction. Lowe's principle goal is to execute hotter than our competitors, and make the process of home improvement as seamless and simplc possible for customers." Lowe's customers are primarily homeowners, renters, bomebuilders, mod commercial construction firms. Lowe's employs over 290,000 people with 190.000 Iscing ./-time, all of whom ure led by CEO Robert Niblock. successor can be appointed. Niblock is also retiring as Chair of the Lowe's board of directors. Das Fall 2018 and Marvin Ellison has just replaced Niblock as President and CEO. After 25 years with Lowe's CEO Robert Niblock has anbounced his retirement as soon a biodegrad- n difficult ved from stores, a Navy ateeds a rapidly 7 oper- oducts -hisee- ac. Lore's Caxyright by Fred David Books I.LC; written by Forest R. David. History The first Lowe's was opened in North Wilkesboro, North Carolina, in 1921 by Lucius Luwe as Lowe's North Wilkesboro Hardware." However, from the beginning, in addition to hardware, The store also offered produce, groceries, tobucco products, and dry goods. Lucius Lowe died 1940 and his daughter , Ruth Buchan, inherited the business and sold it the same year to her brother, Tim Lowo, In 1946. Lowe's was officially founded. Jim Lowe hired Ruth's hushand Carl Buchan after World War II, and the two men run the store together until 1952 when they split with Buchan taking control of the hardware business and Jim Lowe opening up Lowes Foods in 1954, which is still operational today. After the split, Buchan began expanding Lowes throughout the 1950s, opening stores in several North Carolina markets. However, Buchan died from a heart attack in 1960 at age 44, and Lowe's five-man executive team took the company public in 1961. The following year, operated 21 stores and had annual revenues of over $32 million During the 1960s and 1970s, the U.S. housing market expanded rapidly with professional builders becoming Lowe's primary customer. In 1982, Lowe's reported their first billion-dollar revenue year with a record profit of $25 million. Starting in the 1980s, however, Lowe's, in ad- dition to builders, started focusing on the home do-it-yourself (DIY) market, whose aim was to weekend fix-it-upper customers adding value to their bomes. In 1994, the "modern" Lowe's began with a large store expansion of stores having greater than 85,000 square feet of retail space. In 2007, Lowe's opened their first stores in Canada, where they currently operate 20 stores, and in 2010, the first store opened in Mexico. Beginning in 2012, Lowe's opens two styles of store--117,000-square-foot stores in large markets and rela tively smaller 94.000-square-foot stores in smaller markets. In 2018, at the National Association of Home Builders (NAHB) International Builders Show, the largest annual light construction show in the world, 60,000 visitors from 100 coun- tries attended the Orange County Convention Center in Orlando, Florida. A feature attraction was Lowe's Pro Services booth that attracted thousands of contractors, repair remodelers, and specialty tradesmen, as well as property management and facility maintenance professionals. Lowe's and NAHB have been partners since the 1950s, beginning at the local level with the North Carolina Home Builders' Association (NCHBA) and later expanding to be a national senice NAHB supporter. In throus in the beaut "6 STRATEGIC MANAGEMENT CASE ANALYSIS Vision and Mission solutions at the lowest price. The Lowe's mission statement (paraphrased) is given below The Lowe's vision statement (paraphrased) is "We provide customer-valued home i Lowe's strives to deliver exemplary customer service and community service as we are call home. We see home improvement as an investment in our future and are deterwca done for more than 60 years. We strive to improve the places our employees and customer be the best option for customers. Internal Issues Organizational Structure The Lowe's organizational chart is given in Exhibit I. Note that the CEO is also the Chains the Board and President. It appears that Lowes may operate from a functional structure alla there is a President of International EXHIBIT 1 The Lowe's Top Executives and Organizational Chart Strat Low LOR acra adv exp at ang fed al 12 B 10 4 1. Marvin Ellison, President and CEO 2. Marshall Croom, CFO 3. Rick Damron, COO 4. Matthew Hollifield, Senior VP and Chief Accounting Officer 5. Richard Maltsbarger. Chief Development Officer and President of International 6. Ross McCanless Chief Legal Officer, Secretary and Chief Compliance Officer 7. Michael McDermott, Chief Customer Officer 8. N. Brian Peace Corporate Administration Executive 9. Paul Ramsay, Chief Information Officer 10. Jennifer Weber, Chief Human Resources Officer Source: Based on company documents. Supply Chain Lowe's receives products from over 7,000 vendors with the largest single vendor only supplying around 7 percent of total purchases. Lowe's operates 14 highly automated regional distributica centers in the United States with each facility serving around 120 stores. Lowe's also operates 15 flatbed distribution centers for items such as vinyl siding, ladders, lumber, and other products that require special handing. Lowe's considers their supply chain finance (SCF) to be one of their top means for gaining competitive advantage over rival firms such as Home Depot, Ace, and True Value. Since mest rival firms offer the same or similar products, maximizing SCF efficiencies can be critically im- portant. Lowe's considers three key areas of their SCF strategy to be 1) standardization of pas ment terms, 2) incentives for buying organization, and 3) breakeven for the suppliers. Sustainability Lowe's emphasizes sustainability, and in 2012 was awarded the ENERGY STAR* Sustained Excellence Award for the third straight year and also was awarded the WaterSense award from the EPA for the fourth straight year. The awards can be attributed to Lowe's overall mission to and WaterSense qualified, as well as offering numerous solar powered alternatives, Lowe's has installed recycling centers in over 1,700 stores across the United States, help ing customers to recycle rechargeable batteries, cell phones, fluorescent light bulbs, and plastic carbon footprint by installing over 3 million new energy efficient fluorescent lamps in stores shopping bags. Lowe's recently expanded their appliance recycling programs and reduced its Star Lowe's is currently updating the lighting at 34 distribution facilities. ay improvement ven below in the ce as we have and customers determined to Strategies the Chairman of ucture although CASE 3. LOWE'S COMPANIES, INC-2018 377 through the company's "Lowe's Heroes" program, Essentially all Lowe's employees participate In 2017, Lowe's employees volunteered nearly 87,000 hours to support local communities beauticandran to help boys and girls clubs, K-12 public education, parks and recreation, and initiatives. Lowe's strategy focuses on builders and the do-it-yourself (DIY) home improvement market. Lowe's has always engaged in both market development and market penetration, adding stores Boss the United States, and now in Canada, Mexico, and Australia. Having two store sizes is an advantage because Lowe's tailors the respective store size market to particular markets. L.owe's experiments with various layouts at various locations hut hasically has the same principle layout almost all stores, providing customers consistency in their shopping experience. Lowe's stores are slightly larger than rival Home Depot but both companies have, on average, 32,000 square Depot stores. Having wider aisles, more signs, and better store lighting are also competitive feet of garden space. Lowe's also stocks 40,XXI items, up to 10,000 more than certain Home avantages of Lowe's. Also of importance is the fact that Lowe's has 69 to 89 percent full-time employees compared to Home Depot's 59 percent Lowe's bas a new strategy to attract an increasing number of female customers. The company has over 190,000 products online and ships items to customers from service stores and regionul distribution centers. Historically Lowe's only shipped online purchased items from their dedicated Internet warehouse. CEO Niblock anticipates the new strategy will enable Lowe's to provide faster deliveries, reduce order filling costs, and improve profitability overall One key area Lowe's can improve on is attracting contract workers, also known as pros, who account for 50 percent of the home improvement market. Currently, only 30 percent of Lowe's customers are considered pros. 10 and Chief utive ET Finance Exhibit 2 provides Lowe's recent income statements. Note the 5.5 percent increase in total rev- enues with a 11.5 percent increase in net income in 2017, thunks in large part to operating more efficiently. Note operating expenses only increased 1.23 percent. Exhibit 3 reveals the balance sheets for Lowe's. Note the current ratio calculates to 1.0 and the quick ratio is only 0.13 based on inventory accounting for virtually all of Lowe's current assets. Retained earnings declined in 2017. partly from paying dividends of S1,169 million and the repurchase of common stock of $3.274 million. Different from most firms and accounting practices, Lowe's deducts the cost of stock buybacks from retained earnings rather than adding an entry to treasury stock. Note also that Lowe's goodwill increased over 21 percent. Lowe's has raised its dividend every year since 1961. The company's average ticket item is just under $69. ly supplying distribution Iso operates her products Percent Change 5.549 for gaining Since most itically im- ion of pay. EXHIBIT 2 Lowe's Income Statements (in millions) Income Statement 2/3/17 2/2/18 Revenues $65,017 $68,619 Cost of Goods Sold 42.553 45.210 Gross Profit 22.464 23,409 16,618 16,823 Operating Expenses EBIT 643 Interest Expense 1,097 EBT 5,201 5,489 2,042 0 0 Non-Recurring Events 3,093 3,447 Net Income 6.249 4.21% 1.23% 12.669 70.08% 5.54% -3.139 6,586 5.846 Sustained ward from mission 2,108 NA nergy Star NA 11.45% ates, help and plastic educed its in stores Source: Based on company documents. 378 STRATEGIC MANAGEMENT CASE ANALYSIS PercerCha EXHIBIT 5 Ne EXHIBIT 3 Lowe's Balance Sheets (in millions) 2/3/17 2/2/18 Balance Sheet $690 $658 5% 0 NA 0 NA 1 11,393 99 -229, 10.458 884 12,000 19,949 689 12,772 69 19.721 1.307 21% 1,082 NA 0 NA 0 Source: Bas 8% Assets Cash and Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Equity Common Stock 1.377 34.408 1,491 35,291 3% Segment Exhibits Mexico. 87 Orch: stores ir -1% 5% 7,441 4,533 11,974 1% Australi 7.337 4,759 12,096 15,564 1,758 29.418 14,394 1 + 1 1 1.606 9% 5% 27,974 433 415 -4% 6,241 5,425 Com Large) is inte share com cant they Lov atte per lo ha -13% 0 0 NA NA Retained Earnings Treasury Stock Paid in Capital & Other Total Equity Total Liabilities and Equity NA NA (240) 6,434 34,408 33 5.873 -9% 3% 396 35,291 Source: Based on company documents. f E EXHIBIT 4 Lowe's Product Categories Revenues (in millions) Product Category 1/29/16 2/3/17 Percent Change 8% 22 11 9 Seasonal Living, Lawn & Garden Lumber & Building Materials Tools & Hardware Flooring & Kitchens Appliances Fashion Fixtures Rough Plumbing & Electrical Paint Millwork, Outdoor Power Equipment, Home Fashions, Other Total Revenues $7,830 6,891 6,500 6,604 6,477 5,809 5,211 3.712 10,040 $8.445 8,399 7.220 7.186 7,037 6,307 5.744 4.053 10,626 9 9 10 9 6 $59,074 $65,017 10% Source: Based on company documents. Percent Change CASE 3. LOWE'S COMPANIES, INC.- 2010 EXHIBIT 5 Number of Lowe's Stores by Country Lowe's Mexico Stores 10.09 Lowe's Stores 5% Orchard Supply Hardware Stores 87.4% NA Lowe's Canada Stores 535.239 99 - 22% 696 -19 Lowe's USA Stores 1732.735 21% NA 896 3% Suree: Based on company documents. Segment Data --19 5% 19 Exhibit 5 reveals the location of Lowe's 2.365 stores across the United States, Canada, and Mexico. Note, over 75 percent of all Lowe's stores are located in the United States with all 87 Orchard Supply Hardware Stores located in California, Oregon, and Florida. The 535 Canadian stores include 235 from the acquisition of RONA in 2016. Lowe's is, however, adding stores in Australia. (Note: Headquartered in San Jose, Orchard is owned by Lowe's) 8% Competitors 9% 5% -4% --13% they NA NA -99 3% Largely dependent on the state of the economy and especially the housing market, competition s intense in the home improvement industry. Lowe's and Home Depot have the great share, but many other firms such as True Value Company, Ace Hardware, and even Walmart market compete for customers. Ace, for example, markets their business as a one-stop place where you can receive friendly help with a reasonably sized store that enables customers to find everything y need "without the use of a GPS." This marketing strategy is clearly aimed at behemoths Lowe's and Home Depot and suggests that larye warchouse stores do not provide the personal mention Ace delivers. True Value positions their business model around each store being inde- pendently owned and operated, providing customers with a store that offers products more tai- lored to local needs. In addition to brand name stores, there are thousands of local mom-and-pop hardware stores that customers trust and frequent. Lowe's and Home Depot compete with many stores offering similar products. Walmart of- fers many of the same lawn and garden options, as well as lights, paint, tools and many other home improvement items. Sears, Big Lots, SAMs, Costco, and thousands of specialty stores that focus exclusively on lighting or flooring, for example, are also fierce competitors. Although many building contractors use Lowe's and/or Home Depot's programs for purchasing materials, many are loyal to other local businesses. The Internet is also becoming more and more of a com- petitor for firms in the home improvement industry. Exhibit 6 provides a financial comparison of Lowe's with Home Depot and another rival firm-Lumber Liquidators. Note that Home Depot is much larger than Lowe's, and Lumber Liquidators is quite small compared to both other firms. The Home Depot, Inc. (HD) Founded in 1978 in Atlanta, Georgia, Home Depot is the largest home improvement chain in the world with over 2,280 retail stores in all 50 U.S. states, Puerto Rico, Guam, Canada, and Mexico. Much larger than Lowe's, Home Depot is the fourth largest retailer in the United States, and fifth largest in the world and the world's largest home improvement retailer. Home Depot of ers can find experienced sales associates in flooring, plumbing, electrical, gardening, and many fers a large assortment of home improvement products at fair prices. At a Home Depot, custom- other areas. Home Depot offers in-home installation to any customers who do not wish to install their own flooring, sinks, and other products. Major brands that are sold exclusively at the Home Depot include: BEHR Paint, Chem-Dry, Homelite, Martha Stewart Living, Thomasville, among at Change 89 22 1 9 Lumber where 380 Lowe's 94,595M STRATEGIC-MANAGEMENT CASE ANALYSIS EXHIBIT 6 A Financial Comparison of Lowe's With Rival Firms (July, 2017 data) Home Depot $214,8B 406,000 S Market Cap # Employees 34% Revenue Gross Margin 7.957 SNet Income $7.20 EPS Ratio 26.7 PE Ratio Source: Based on company documents, $78.68 190,000 65,017M 35% 3,093 $4.15 22,8 $0.913 2.046 960M 329 (68.6M) (1.647 NA being indepe business ow places more brand. This Accord world traili secutive yo Associates eleven yea In 20 vated nev include. Extern Industry The hor current slogan: "More saving. More doing." neste attempt Where others. Home Depot recently replaced their old slogan: "You can do it. We can help with Wix ing to their CEO Frank Blake. Blake's comments came on the heels of Home Depot Cle Home Depot is expanding their Internet business rather than expanding overseas, accord expansion t having a brick- presence in Brazil or any other country. But what they cannot afford to do is not be the very best. on their website 360buy.com and is continuing looking to partner with other e-commerce sites The trend toward shopping from the Internet, in particular on mobile applications on Star phones, is a trend Home Depot plans to capitalize upon. As of early 2018, Home Depot had w increased its number f stores since 2012 -and Lowe nesses ing ove d-moria all seven of their China based stores in October of 2012 after a failed Blake also offered the comment that Home Depot can live without home improvement company in the world. Home Depot still sells products to Chinese customers recent A dustry- other Home genes or w hom the Cus Th wh Of al tr True Value Company (TVC) Hoadquartered in Chicago, Illinois, True Value Company is not publicly held, but has over 5.0 independent retail hardware store locations in over 60 countries worldwide. All of the store are independently owned and operated. True Value has 13 regional distribution centers and over 2,500 associates. True Value supports True Value Hardware and Home Center Stores as well as Grand Rental Station, Party Central, Taylor Rental, Induserve Supply, and Home & Garden SH Showplace. Home & Garden Showplace acts as the garden center identity of True Value. There are over 260 Home & Garden Showplace stores across the United States. Like all True Value stores, each store is independently owned and purchases retail merchandise through True Value's distribution centers and various True Value buying programs. The other divisions of True Value total over 400 stores across the United States and are also all independently owned and operated. All True Value store locations vary from small towns to large cities and stores reflect various sizes. Each respective independent retailer offers product categories and assortments tailored to local customer needs allowing customers across the country to shop a business that is uniquely focused on local needs. According to True Value, all its well-stocked stores offer supe rior customer service and a compelling shopping experience. True Value Company reported revenues of $1,514 million in 2016 and $1.487 in 2017, slight decline for 2017. In 2016, True Value remolded 101 stores and had 68 new stores built- One key difference with True Value compared to Lowe's is all stores are managed indepen- dently and store owners generally live near the store. Owners have discretion on what items to stock. 11 Ace Hardware Corporation (AHC) "Ace is the helpful place." Founded in 1924 in Oak Brook, Illinois, Ace Hardware is not publicly held. The company was named after Ace fighter pilots of World War I who overcame all odds fighting for the Allied Forces. Ace has over 4,400 locations across the United States and oper largest home improvement store in the world. Ace competes much like True Value with all stores ates locations in 60 different countries with over 5,000 stores in total. The firm claims to be the uly, 2017 data) Lumber Liquidators $0.911 2,016 960M 32% (68.6M) (1.64) CASE 3 LOWE'S COMPANIES, INC. -2018 381 Ang independently owned and operated. Ace, like TrueValue, markets this strategy as enabling winess owners to tailor their products to meet local customers' needs more effectively. Ace plant more of the initial capital risk on the franchisee and offers many products under the Ace brandThis store branding generally produces higher margins than selling brand name items. According to Franchise Times in 2017, Ace is the sixth largest franchise operation in the wurid talling only McDonald's, 7-Eleven, KFC, Subway, and Burger King for the third con- Associates ranked Ace the highest in customer satisfaction among home improvement stores for cutive year. Ace has received numerous awards in customer satisfaction. J. D. Power and in 2017. Ace acquired a majority stake in Grommel, an e-commerence firm that sells inno- sisted new products created by entrepreneurs. Several notable products appearing on Grommet selude, FitBit, OtterBox, and SodaStream, To date, Grommet has launched over 2.500 products. Aboven years in a row, from 2006 2017, n help" with their External Issues Industry overseas, accord. ne Depot closing on attempt there. brick-and-mortar be the very best ainese customers commerce sites. tions on smart- nesses in the United States competing in some form. Businesses range from the two giants The home improvement industry is an extremely fraginented business with nearly 5,000 busi- Love's and Home Depot capturing 80 percent of the market with the remaining 5,000 busi- ses accounting for the other 20 percent. The industry in the United States has revenues total recent years, but is expected to slow into year 2023. De over $180 billion with profits over S16 billion. Growth has uverged 5 percent annually in As indicated in Exhibit 7, lumber and other building materials account for 33 percent of in- Austes sales with household goods and appliances accounting for 29 percent. By selling products ther than lumber, such as plumbing, electrical, lawn chairs, pesticides, and so on, Lowe's and Home Depot are more insulated from the drastic up and downs of the lumber market; everyone geoerally must continually buy new light bulbs, plumbing supplies, lawn mowers, gas grills, and con, when they break. These items are more disposable in nature than lumber to build a house, or washers and dryers that tend to last a decade or more. Exhibit 7 also reveals that appliances, tome goods, building materials, and lumber account for 71 percent of industry revenues, with the balance being derived from many different products. Depot had not has over 5,000 of the stores nters and over Stores as well me & Garden here are over - stores, each distribution ne total over Customers The typical customer of home improvement stores are generally categorized as do-it-yourselfers, who account for 20 percent of industry revenues, or professionals who account for 80 percent. of the professionals, roughly half work for homeowners on a small project-by-project basis, also referred to as "do-it-for-me as opposed to "do-it-yourself;" the other half are larger-scale contractors undertaking larger projects, such as homebuilders. Lowe's derives only 30 percent of their revenues from professionals, leaving a huge market available. Demand for selective home improvements is largely dependent on the state of the economy with customers willing to spend more during more optimistic times such as 2017 and 2018. ed. Dres reflect assortments ness that is offer supe- EXHIBIT 7 Home Improvement Industry Product Revenue Industry Product Revenues En 2017, a Ores built. indepen- that items Other Products 389 Lumber & Structural Building Materials 33% publicly all odds Appliances and Home Goods 29% ad oper o be the 1 stores Source: Based on company documents. 82 STRATEGIC-MANAGEMENT CASE ANALYSIS are for through Housing Starts Housing starts continue to increase from over 900.000 units in 2013 to over 1.2 million in 2016. However, growth was relatively flat in 2017 and forecasts moving forward possible growth to 1.3 million in 2018 and around 100,000 extra housing starts annually 60 percent of all loan capital in 2017 went to customers earning an Equifax Risk score of 766 2023. One key area subduing new home construction is the availability of loans. Approximates 620 and 659. Banks are hesitant to loan to customers with lower credit scores, hurting the overal greater and only 5 percent of the dollar value of capital went to customers with scores between housing market www Headqu services North as Home Furnishings and Smart Homes One area expected to see growth is home furnishings, including home appliances. If the econ omy remains prosperous, customers are expected to increasingly buy new smart appliances with built-in USB charging ports and Bluetooth ability to be controlled from smartphones. Appliances are expected to grow around 4 to 7 percent through 2022. Lighting, heating, and other aspects that can be tied into a "smart home" are expected to see a similar growth rate as appliances Marketing new smart home appliances is certainly a major new category for home in. provement stores moving forward. About 80 million smart home devices were shipped in 2016, up 64 percent from 2015; 130 million were shipped in 2017, up 62 percent from 2016. Start devices totaled only 1 million in 2014 and are expected to exceed 220 million by 2020. tions, cor and se teleph year- State Offic and ness offe mo larg OL ye: G bu Future In February 2018, Lowe's and Sherwin-Williams Company (NYSE: SHW) announced an expanded partnership whereby Lowe's became the only nationwide home center to offer top selling stain brands-Minwax, Cabot, Thompson's, Water Sealas well as the top paintbrush brand, Purdy, and industry-leading spray paint, Krylon. Lowe's introduced Krylon spray paint in its fiscal Q1 2018. Also as part of the new partnership, Sherwin-Williams became the only na- tionwide supplier to Lowe's U.S. retail outlets for interior and exterior paints, including Valspar and HGTV Home Paint continues to be the number one do-it-yourself project and a big profit-maker for Lowe's. To capitalize on people painting, Lowe's in 2018 rolled out a new paint desk experience in every store to make it even easier for customers to work with an associate to find a color, pick a paint or stain, and begin a project. Headquartered in Cleveland, Ohio, Sherwin Williams is the global leader in the manufac- ture, development, distribution, and sale of paints, coatings, and related products to profes- sional, industrial, commercial, and retail customers. Sherwin Williams acquired The Valspar Corporation in 2017, and the combined company generated pro forma 2016 revenues of $15.8 billion and employs approximately 60,000 employees worldwide. Sherwin-Williams has a prominent market position in architectural paint in North America, South America, China, Australia, and the UK. H Lowe's shareholders expect to see a 5 percent annual growth in both revenues and net in- come for the company. Lowe's needs a clear strategic plan going forward to meet and hopefully exceed these expectations, of their brands is Jaco brand CASE 3. LOWE'S COMPANIES, INC. 2018 375 dering is 2018 Lowe's Companies. Ine. www.lowes.com, Low hases account ces of clothing in the United percentages employees ac es to increase account for 2 UN erived from se a slew of thers from zed control advantages renewable pically are thein Mooresville, North Carolina, Lowe's is among Torine's top 50 largest compu- he United States and is the second largest home improvement store in the world, trailing Arng located in the United States, Canada, and Mcxico. The firm serves 17 million customers waly Atlanta, Georgia's based Home Depot. Lowe's operates 2,365 stores with all Lowes stores rely in over 213 million square feet of retail space. Lowe's has an agreement, as a one-third Wer with Australian Woolworths Litnited to develop u Lowe's-themed store in Austrulia Lowe's stores offer appliances, lawn and garden, lumber, plumbing, clectrical, power tools, flooring, and much more for home repair and construction. Lowe's principle goal is to execute hotter than our competitors, and make the process of home improvement as seamless and simplc possible for customers." Lowe's customers are primarily homeowners, renters, bomebuilders, mod commercial construction firms. Lowe's employs over 290,000 people with 190.000 Iscing ./-time, all of whom ure led by CEO Robert Niblock. successor can be appointed. Niblock is also retiring as Chair of the Lowe's board of directors. Das Fall 2018 and Marvin Ellison has just replaced Niblock as President and CEO. After 25 years with Lowe's CEO Robert Niblock has anbounced his retirement as soon a biodegrad- n difficult ved from stores, a Navy ateeds a rapidly 7 oper- oducts -hisee- ac. Lore's Caxyright by Fred David Books I.LC; written by Forest R. David. History The first Lowe's was opened in North Wilkesboro, North Carolina, in 1921 by Lucius Luwe as Lowe's North Wilkesboro Hardware." However, from the beginning, in addition to hardware, The store also offered produce, groceries, tobucco products, and dry goods. Lucius Lowe died 1940 and his daughter , Ruth Buchan, inherited the business and sold it the same year to her brother, Tim Lowo, In 1946. Lowe's was officially founded. Jim Lowe hired Ruth's hushand Carl Buchan after World War II, and the two men run the store together until 1952 when they split with Buchan taking control of the hardware business and Jim Lowe opening up Lowes Foods in 1954, which is still operational today. After the split, Buchan began expanding Lowes throughout the 1950s, opening stores in several North Carolina markets. However, Buchan died from a heart attack in 1960 at age 44, and Lowe's five-man executive team took the company public in 1961. The following year, operated 21 stores and had annual revenues of over $32 million During the 1960s and 1970s, the U.S. housing market expanded rapidly with professional builders becoming Lowe's primary customer. In 1982, Lowe's reported their first billion-dollar revenue year with a record profit of $25 million. Starting in the 1980s, however, Lowe's, in ad- dition to builders, started focusing on the home do-it-yourself (DIY) market, whose aim was to weekend fix-it-upper customers adding value to their bomes. In 1994, the "modern" Lowe's began with a large store expansion of stores having greater than 85,000 square feet of retail space. In 2007, Lowe's opened their first stores in Canada, where they currently operate 20 stores, and in 2010, the first store opened in Mexico. Beginning in 2012, Lowe's opens two styles of store--117,000-square-foot stores in large markets and rela tively smaller 94.000-square-foot stores in smaller markets. In 2018, at the National Association of Home Builders (NAHB) International Builders Show, the largest annual light construction show in the world, 60,000 visitors from 100 coun- tries attended the Orange County Convention Center in Orlando, Florida. A feature attraction was Lowe's Pro Services booth that attracted thousands of contractors, repair remodelers, and specialty tradesmen, as well as property management and facility maintenance professionals. Lowe's and NAHB have been partners since the 1950s, beginning at the local level with the North Carolina Home Builders' Association (NCHBA) and later expanding to be a national senice NAHB supporter. In throus in the beaut "6 STRATEGIC MANAGEMENT CASE ANALYSIS Vision and Mission solutions at the lowest price. The Lowe's mission statement (paraphrased) is given below The Lowe's vision statement (paraphrased) is "We provide customer-valued home i Lowe's strives to deliver exemplary customer service and community service as we are call home. We see home improvement as an investment in our future and are deterwca done for more than 60 years. We strive to improve the places our employees and customer be the best option for customers. Internal Issues Organizational Structure The Lowe's organizational chart is given in Exhibit I. Note that the CEO is also the Chains the Board and President. It appears that Lowes may operate from a functional structure alla there is a President of International EXHIBIT 1 The Lowe's Top Executives and Organizational Chart Strat Low LOR acra adv exp at ang fed al 12 B 10 4 1. Marvin Ellison, President and CEO 2. Marshall Croom, CFO 3. Rick Damron, COO 4. Matthew Hollifield, Senior VP and Chief Accounting Officer 5. Richard Maltsbarger. Chief Development Officer and President of International 6. Ross McCanless Chief Legal Officer, Secretary and Chief Compliance Officer 7. Michael McDermott, Chief Customer Officer 8. N. Brian Peace Corporate Administration Executive 9. Paul Ramsay, Chief Information Officer 10. Jennifer Weber, Chief Human Resources Officer Source: Based on company documents. Supply Chain Lowe's receives products from over 7,000 vendors with the largest single vendor only supplying around 7 percent of total purchases. Lowe's operates 14 highly automated regional distributica centers in the United States with each facility serving around 120 stores. Lowe's also operates 15 flatbed distribution centers for items such as vinyl siding, ladders, lumber, and other products that require special handing. Lowe's considers their supply chain finance (SCF) to be one of their top means for gaining competitive advantage over rival firms such as Home Depot, Ace, and True Value. Since mest rival firms offer the same or similar products, maximizing SCF efficiencies can be critically im- portant. Lowe's considers three key areas of their SCF strategy to be 1) standardization of pas ment terms, 2) incentives for buying organization, and 3) breakeven for the suppliers. Sustainability Lowe's emphasizes sustainability, and in 2012 was awarded the ENERGY STAR* Sustained Excellence Award for the third straight year and also was awarded the WaterSense award from the EPA for the fourth straight year. The awards can be attributed to Lowe's overall mission to and WaterSense qualified, as well as offering numerous solar powered alternatives, Lowe's has installed recycling centers in over 1,700 stores across the United States, help ing customers to recycle rechargeable batteries, cell phones, fluorescent light bulbs, and plastic carbon footprint by installing over 3 million new energy efficient fluorescent lamps in stores shopping bags. Lowe's recently expanded their appliance recycling programs and reduced its Star Lowe's is currently updating the lighting at 34 distribution facilities. ay improvement ven below in the ce as we have and customers determined to Strategies the Chairman of ucture although CASE 3. LOWE'S COMPANIES, INC-2018 377 through the company's "Lowe's Heroes" program, Essentially all Lowe's employees participate In 2017, Lowe's employees volunteered nearly 87,000 hours to support local communities beauticandran to help boys and girls clubs, K-12 public education, parks and recreation, and initiatives. Lowe's strategy focuses on builders and the do-it-yourself (DIY) home improvement market. Lowe's has always engaged in both market development and market penetration, adding stores Boss the United States, and now in Canada, Mexico, and Australia. Having two store sizes is an advantage because Lowe's tailors the respective store size market to particular markets. L.owe's experiments with various layouts at various locations hut hasically has the same principle layout almost all stores, providing customers consistency in their shopping experience. Lowe's stores are slightly larger than rival Home Depot but both companies have, on average, 32,000 square Depot stores. Having wider aisles, more signs, and better store lighting are also competitive feet of garden space. Lowe's also stocks 40,XXI items, up to 10,000 more than certain Home avantages of Lowe's. Also of importance is the fact that Lowe's has 69 to 89 percent full-time employees compared to Home Depot's 59 percent Lowe's bas a new strategy to attract an increasing number of female customers. The company has over 190,000 products online and ships items to customers from service stores and regionul distribution centers. Historically Lowe's only shipped online purchased items from their dedicated Internet warehouse. CEO Niblock anticipates the new strategy will enable Lowe's to provide faster deliveries, reduce order filling costs, and improve profitability overall One key area Lowe's can improve on is attracting contract workers, also known as pros, who account for 50 percent of the home improvement market. Currently, only 30 percent of Lowe's customers are considered pros. 10 and Chief utive ET Finance Exhibit 2 provides Lowe's recent income statements. Note the 5.5 percent increase in total rev- enues with a 11.5 percent increase in net income in 2017, thunks in large part to operating more efficiently. Note operating expenses only increased 1.23 percent. Exhibit 3 reveals the balance sheets for Lowe's. Note the current ratio calculates to 1.0 and the quick ratio is only 0.13 based on inventory accounting for virtually all of Lowe's current assets. Retained earnings declined in 2017. partly from paying dividends of S1,169 million and the repurchase of common stock of $3.274 million. Different from most firms and accounting practices, Lowe's deducts the cost of stock buybacks from retained earnings rather than adding an entry to treasury stock. Note also that Lowe's goodwill increased over 21 percent. Lowe's has raised its dividend every year since 1961. The company's average ticket item is just under $69. ly supplying distribution Iso operates her products Percent Change 5.549 for gaining Since most itically im- ion of pay. EXHIBIT 2 Lowe's Income Statements (in millions) Income Statement 2/3/17 2/2/18 Revenues $65,017 $68,619 Cost of Goods Sold 42.553 45.210 Gross Profit 22.464 23,409 16,618 16,823 Operating Expenses EBIT 643 Interest Expense 1,097 EBT 5,201 5,489 2,042 0 0 Non-Recurring Events 3,093 3,447 Net Income 6.249 4.21% 1.23% 12.669 70.08% 5.54% -3.139 6,586 5.846 Sustained ward from mission 2,108 NA nergy Star NA 11.45% ates, help and plastic educed its in stores Source: Based on company documents. 378 STRATEGIC MANAGEMENT CASE ANALYSIS PercerCha EXHIBIT 5 Ne EXHIBIT 3 Lowe's Balance Sheets (in millions) 2/3/17 2/2/18 Balance Sheet $690 $658 5% 0 NA 0 NA 1 11,393 99 -229, 10.458 884 12,000 19,949 689 12,772 69 19.721 1.307 21% 1,082 NA 0 NA 0 Source: Bas 8% Assets Cash and Short Term Investments Accounts Receivable Inventory Other Current Assets Total Current Assets Property Plant & Equipment Goodwill Intangibles Other Long-Term Assets Total Assets Liabilities Accounts Payable Other Current Liabilities Total Current Liabilities Long-Term Debt Other Long-Term Liabilities Total Liabilities Equity Common Stock 1.377 34.408 1,491 35,291 3% Segment Exhibits Mexico. 87 Orch: stores ir -1% 5% 7,441 4,533 11,974 1% Australi 7.337 4,759 12,096 15,564 1,758 29.418 14,394 1 + 1 1 1.606 9% 5% 27,974 433 415 -4% 6,241 5,425 Com Large) is inte share com cant they Lov atte per lo ha -13% 0 0 NA NA Retained Earnings Treasury Stock Paid in Capital & Other Total Equity Total Liabilities and Equity NA NA (240) 6,434 34,408 33 5.873 -9% 3% 396 35,291 Source: Based on company documents. f E EXHIBIT 4 Lowe's Product Categories Revenues (in millions) Product Category 1/29/16 2/3/17 Percent Change 8% 22 11 9 Seasonal Living, Lawn & Garden Lumber & Building Materials Tools & Hardware Flooring & Kitchens Appliances Fashion Fixtures Rough Plumbing & Electrical Paint Millwork, Outdoor Power Equipment, Home Fashions, Other Total Revenues $7,830 6,891 6,500 6,604 6,477 5,809 5,211 3.712 10,040 $8.445 8,399 7.220 7.186 7,037 6,307 5.744 4.053 10,626 9 9 10 9 6 $59,074 $65,017 10% Source: Based on company documents. Percent Change CASE 3. LOWE'S COMPANIES, INC.- 2010 EXHIBIT 5 Number of Lowe's Stores by Country Lowe's Mexico Stores 10.09 Lowe's Stores 5% Orchard Supply Hardware Stores 87.4% NA Lowe's Canada Stores 535.239 99 - 22% 696 -19 Lowe's USA Stores 1732.735 21% NA 896 3% Suree: Based on company documents. Segment Data --19 5% 19 Exhibit 5 reveals the location of Lowe's 2.365 stores across the United States, Canada, and Mexico. Note, over 75 percent of all Lowe's stores are located in the United States with all 87 Orchard Supply Hardware Stores located in California, Oregon, and Florida. The 535 Canadian stores include 235 from the acquisition of RONA in 2016. Lowe's is, however, adding stores in Australia. (Note: Headquartered in San Jose, Orchard is owned by Lowe's) 8% Competitors 9% 5% -4% --13% they NA NA -99 3% Largely dependent on the state of the economy and especially the housing market, competition s intense in the home improvement industry. Lowe's and Home Depot have the great share, but many other firms such as True Value Company, Ace Hardware, and even Walmart market compete for customers. Ace, for example, markets their business as a one-stop place where you can receive friendly help with a reasonably sized store that enables customers to find everything y need "without the use of a GPS." This marketing strategy is clearly aimed at behemoths Lowe's and Home Depot and suggests that larye warchouse stores do not provide the personal mention Ace delivers. True Value positions their business model around each store being inde- pendently owned and operated, providing customers with a store that offers products more tai- lored to local needs. In addition to brand name stores, there are thousands of local mom-and-pop hardware stores that customers trust and frequent. Lowe's and Home Depot compete with many stores offering similar products. Walmart of- fers many of the same lawn and garden options, as well as lights, paint, tools and many other home improvement items. Sears, Big Lots, SAMs, Costco, and thousands of specialty stores that focus exclusively on lighting or flooring, for example, are also fierce competitors. Although many building contractors use Lowe's and/or Home Depot's programs for purchasing materials, many are loyal to other local businesses. The Internet is also becoming more and more of a com- petitor for firms in the home improvement industry. Exhibit 6 provides a financial comparison of Lowe's with Home Depot and another rival firm-Lumber Liquidators. Note that Home Depot is much larger than Lowe's, and Lumber Liquidators is quite small compared to both other firms. The Home Depot, Inc. (HD) Founded in 1978 in Atlanta, Georgia, Home Depot is the largest home improvement chain in the world with over 2,280 retail stores in all 50 U.S. states, Puerto Rico, Guam, Canada, and Mexico. Much larger than Lowe's, Home Depot is the fourth largest retailer in the United States, and fifth largest in the world and the world's largest home improvement retailer. Home Depot of ers can find experienced sales associates in flooring, plumbing, electrical, gardening, and many fers a large assortment of home improvement products at fair prices. At a Home Depot, custom- other areas. Home Depot offers in-home installation to any customers who do not wish to install their own flooring, sinks, and other products. Major brands that are sold exclusively at the Home Depot include: BEHR Paint, Chem-Dry, Homelite, Martha Stewart Living, Thomasville, among at Change 89 22 1 9 Lumber where 380 Lowe's 94,595M STRATEGIC-MANAGEMENT CASE ANALYSIS EXHIBIT 6 A Financial Comparison of Lowe's With Rival Firms (July, 2017 data) Home Depot $214,8B 406,000 S Market Cap # Employees 34% Revenue Gross Margin 7.957 SNet Income $7.20 EPS Ratio 26.7 PE Ratio Source: Based on company documents, $78.68 190,000 65,017M 35% 3,093 $4.15 22,8 $0.913 2.046 960M 329 (68.6M) (1.647 NA being indepe business ow places more brand. This Accord world traili secutive yo Associates eleven yea In 20 vated nev include. Extern Industry The hor current slogan: "More saving. More doing." neste attempt Where others. Home Depot recently replaced their old slogan: "You can do it. We can help with Wix ing to their CEO Frank Blake. Blake's comments came on the heels of Home Depot Cle Home Depot is expanding their Internet business rather than expanding overseas, accord expansion t having a brick- presence in Brazil or any other country. But what they cannot afford to do is not be the very best. on their website 360buy.com and is continuing looking to partner with other e-commerce sites The trend toward shopping from the Internet, in particular on mobile applications on Star phones, is a trend Home Depot plans to capitalize upon. As of early 2018, Home Depot had w increased its number f stores since 2012 -and Lowe nesses ing ove d-moria all seven of their China based stores in October of 2012 after a failed Blake also offered the comment that Home Depot can live without home improvement company in the world. Home Depot still sells products to Chinese customers recent A dustry- other Home genes or w hom the Cus Th wh Of al tr True Value Company (TVC) Hoadquartered in Chicago, Illinois, True Value Company is not publicly held, but has over 5.0 independent retail hardware store locations in over 60 countries worldwide. All of the store are independently owned and operated. True Value has 13 regional distribution centers and over 2,500 associates. True Value supports True Value Hardware and Home Center Stores as well as Grand Rental Station, Party Central, Taylor Rental, Induserve Supply, and Home & Garden SH Showplace. Home & Garden Showplace acts as the garden center identity of True Value. There are over 260 Home & Garden Showplace stores across the United States. Like all True Value stores, each store is independently owned and purchases retail merchandise through True Value's distribution centers and various True Value buying programs. The other divisions of True Value total over 400 stores across the United States and are also all independently owned and operated. All True Value store locations vary from small towns to large cities and stores reflect various sizes. Each respective independent retailer offers product categories and assortments tailored to local customer needs allowing customers across the country to shop a business that is uniquely focused on local needs. According to True Value, all its well-stocked stores offer supe rior customer service and a compelling shopping experience. True Value Company reported revenues of $1,514 million in 2016 and $1.487 in 2017, slight decline for 2017. In 2016, True Value remolded 101 stores and had 68 new stores built- One key difference with True Value compared to Lowe's is all stores are managed indepen- dently and store owners generally live near the store. Owners have discretion on what items to stock. 11 Ace Hardware Corporation (AHC) "Ace is the helpful place." Founded in 1924 in Oak Brook, Illinois, Ace Hardware is not publicly held. The company was named after Ace fighter pilots of World War I who overcame all odds fighting for the Allied Forces. Ace has over 4,400 locations across the United States and oper largest home improvement store in the world. Ace competes much like True Value with all stores ates locations in 60 different countries with over 5,000 stores in total. The firm claims to be the uly, 2017 data) Lumber Liquidators $0.911 2,016 960M 32% (68.6M) (1.64) CASE 3 LOWE'S COMPANIES, INC. -2018 381 Ang independently owned and operated. Ace, like TrueValue, markets this strategy as enabling winess owners to tailor their products to meet local customers' needs more effectively. Ace plant more of the initial capital risk on the franchisee and offers many products under the Ace brandThis store branding generally produces higher margins than selling brand name items. According to Franchise Times in 2017, Ace is the sixth largest franchise operation in the wurid talling only McDonald's, 7-Eleven, KFC, Subway, and Burger King for the third con- Associates ranked Ace the highest in customer satisfaction among home improvement stores for cutive year. Ace has received numerous awards in customer satisfaction. J. D. Power and in 2017. Ace acquired a majority stake in Grommel, an e-commerence firm that sells inno- sisted new products created by entrepreneurs. Several notable products appearing on Grommet selude, FitBit, OtterBox, and SodaStream, To date, Grommet has launched over 2.500 products. Aboven years in a row, from 2006 2017, n help" with their External Issues Industry overseas, accord. ne Depot closing on attempt there. brick-and-mortar be the very best ainese customers commerce sites. tions on smart- nesses in the United States competing in some form. Businesses range from the two giants The home improvement industry is an extremely fraginented business with nearly 5,000 busi- Love's and Home Depot capturing 80 percent of the market with the remaining 5,000 busi- ses accounting for the other 20 percent. The industry in the United States has revenues total recent years, but is expected to slow into year 2023. De over $180 billion with profits over S16 billion. Growth has uverged 5 percent annually in As indicated in Exhibit 7, lumber and other building materials account for 33 percent of in- Austes sales with household goods and appliances accounting for 29 percent. By selling products ther than lumber, such as plumbing, electrical, lawn chairs, pesticides, and so on, Lowe's and Home Depot are more insulated from the drastic up and downs of the lumber market; everyone geoerally must continually buy new light bulbs, plumbing supplies, lawn mowers, gas grills, and con, when they break. These items are more disposable in nature than lumber to build a house, or washers and dryers that tend to last a decade or more. Exhibit 7 also reveals that appliances, tome goods, building materials, and lumber account for 71 percent of industry revenues, with the balance being derived from many different products. Depot had not has over 5,000 of the stores nters and over Stores as well me & Garden here are over - stores, each distribution ne total over Customers The typical customer of home improvement stores are generally categorized as do-it-yourselfers, who account for 20 percent of industry revenues, or professionals who account for 80 percent. of the professionals, roughly half work for homeowners on a small project-by-project basis, also referred to as "do-it-for-me as opposed to "do-it-yourself;" the other half are larger-scale contractors undertaking larger projects, such as homebuilders. Lowe's derives only 30 percent of their revenues from professionals, leaving a huge market available. Demand for selective home improvements is largely dependent on the state of the economy with customers willing to spend more during more optimistic times such as 2017 and 2018. ed. Dres reflect assortments ness that is offer supe- EXHIBIT 7 Home Improvement Industry Product Revenue Industry Product Revenues En 2017, a Ores built. indepen- that items Other Products 389 Lumber & Structural Building Materials 33% publicly all odds Appliances and Home Goods 29% ad oper o be the 1 stores Source: Based on company documents. 82 STRATEGIC-MANAGEMENT CASE ANALYSIS are for through Housing Starts Housing starts continue to increase from over 900.000 units in 2013 to over 1.2 million in 2016. However, growth was relatively flat in 2017 and forecasts moving forward possible growth to 1.3 million in 2018 and around 100,000 extra housing starts annually 60 percent of all loan capital in 2017 went to customers earning an Equifax Risk score of 766 2023. One key area subduing new home construction is the availability of loans. Approximates 620 and 659. Banks are hesitant to loan to customers with lower credit scores, hurting the overal greater and only 5 percent of the dollar value of capital went to customers with scores between housing market www Headqu services North as Home Furnishings and Smart Homes One area expected to see growth is home furnishings, including home appliances. If the econ omy remains prosperous, customers are expected to increasingly buy new smart appliances with built-in USB charging ports and Bluetooth ability to be controlled from smartphones. Appliances are expected to grow around 4 to 7 percent through 2022. Lighting, heating, and other aspects that can be tied into a "smart home" are expected to see a similar growth rate as appliances Marketing new smart home appliances is certainly a major new category for home in. provement stores moving forward. About 80 million smart home devices were shipped in 2016, up 64 percent from 2015; 130 million were shipped in 2017, up 62 percent from 2016. Start devices totaled only 1 million in 2014 and are expected to exceed 220 million by 2020. tions, cor and se teleph year- State Offic and ness offe mo larg OL ye: G bu Future In February 2018, Lowe's and Sherwin-Williams Company (NYSE: SHW) announced an expanded partnership whereby Lowe's became the only nationwide home center to offer top selling stain brands-Minwax, Cabot, Thompson's, Water Sealas well as the top paintbrush brand, Purdy, and industry-leading spray paint, Krylon. Lowe's introduced Krylon spray paint in its fiscal Q1 2018. Also as part of the new partnership, Sherwin-Williams became the only na- tionwide supplier to Lowe's U.S. retail outlets for interior and exterior paints, including Valspar and HGTV Home Paint continues to be the number one do-it-yourself project and a big profit-maker for Lowe's. To capitalize on people painting, Lowe's in 2018 rolled out a new paint desk experience in every store to make it even easier for customers to work with an associate to find a color, pick a paint or stain, and begin a project. Headquartered in Cleveland, Ohio, Sherwin Williams is the global leader in the manufac- ture, development, distribution, and sale of paints, coatings, and related products to profes- sional, industrial, commercial, and retail customers. Sherwin Williams acquired The Valspar Corporation in 2017, and the combined company generated pro forma 2016 revenues of $15.8 billion and employs approximately 60,000 employees worldwide. Sherwin-Williams has a prominent market position in architectural paint in North America, South America, China, Australia, and the UK. H Lowe's shareholders expect to see a 5 percent annual growth in both revenues and net in- come for the company. Lowe's needs a clear strategic plan going forward to meet and hopefully exceed these expectations