Question: In visual basic, write the code for calculating and displaying the tax according to the forgoing table. You can assume that the user will enter

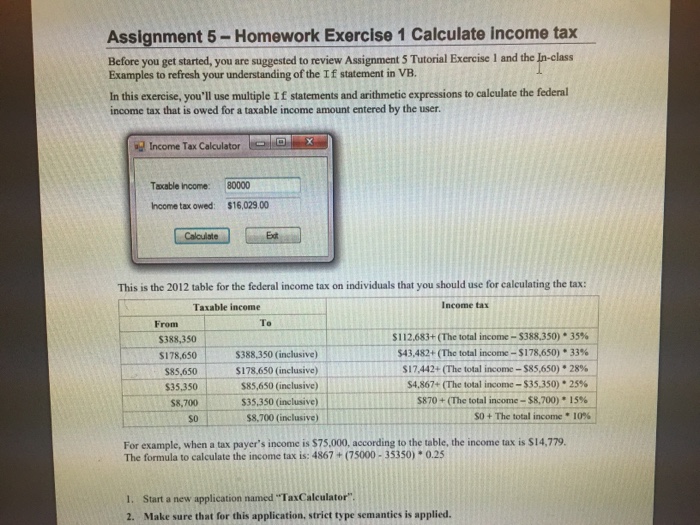

Assignment 5-Homework Exercise 1 Calculate income tax Before you get started, you are suggested to review Assignment 5 Tutorial Exercise 1 and the In-class Examples to refresh your understanding of the I f statement in VB. In this exercise, you'll use multiple I f statements and arithmetic expressions to calculate the federal income tax that is owed for a taxable income amount entered by the user Income Tax Calculator e 1 Taxcable come 8000 Income tax owed: $16,029.00 Calculate This is the 2012 table for the federal income tax on individuals that you should use for calculating the tax: Taxable income Income tarx From To $388,350 $178,650 $85,650 $35,350 $8,700 so $388,350 (inclusive $178 650 (inclusive) $85,650 (inclusive) 535,350 (inclusive $8,700 (inclusive) $112.683+ (The total income-$388,350) * 35% $43,482 + (Thc total income-$178,650)" 33% $17,442+ (The total income-$85,650) * 28% $4,867-(The total income-$35.350) * 25% $870 + (The total income-$8,700) * 1 5% S0 + The total income 10% For example, when a tax payer's income is $75,000, according to the table, the income tax is $14,779 The formula to calculate the income tax is: 4867+(75000-35350) 0.25 I. Start a new application named TaxCalculator" 2. Make sure that for this application, strict type semanties is applied

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts