Question: In year 2008, Janet's firm is using a two stage dividend growth model to find the intrinsic value of Smile White Co. Let the risk

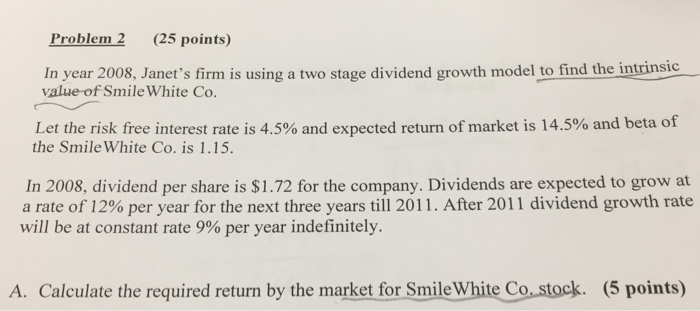

In year 2008, Janet's firm is using a two stage dividend growth model to find the intrinsic value of Smile White Co. Let the risk free interest rate is 4.5% and expected return of market is 14.5% and beta of the Smile White Co. is 1.15. In 2008, dividend per share is $1.72 for the company. Dividends are expected to grow at a rate of 12% per year for the next three years till 2011. After 2011 dividend growth rate will be at constant rate 9% per year indefinitely. A. Calculate the required return by the market for Smile White Co. stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts