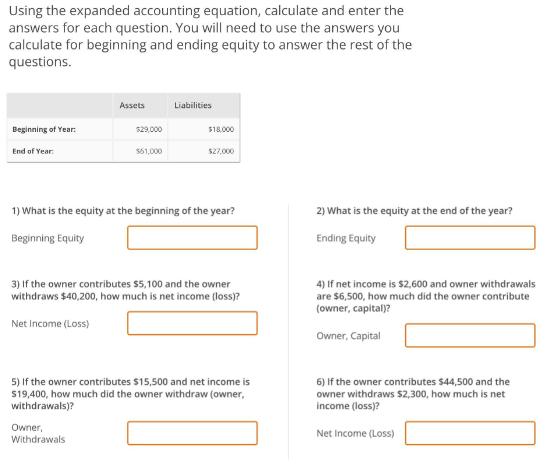

Question: Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning

Using the expanded accounting equation, calculate and enter the answers for each question. You will need to use the answers you calculate for beginning and ending equity to answer the rest of the questions. Beginning of Year: End of Year: Assets $29,000 $61,000 Owner, Withdrawals Liabilities $18,000 $27,000 1) What is the equity at the beginning of the year? Beginning Equity 3) If the owner contributes $5,100 and the owner withdraws $40,200, how much is net income (loss)? Net Income (Loss) 5) If the owner contributes $15,500 and net income is $19,400, how much did the owner withdraw (owner, withdrawals)? 2) What is the equity at the end of the year? Ending Equity 4) If net income is $2,600 and owner withdrawals are $6,500, how much did the owner contribute (owner, capital)? Owner, Capital 6) If the owner contributes $44,500 and the owner withdraws $2,300, how much is net income (loss)? Net Income (Loss)

Step by Step Solution

There are 3 Steps involved in it

Introduction Stockholders Equity Stockholders equity is a part of the accounting equation which says Assets Liabilities Equity Equity refers to the amount which is invested by the owners in the case o... View full answer

Get step-by-step solutions from verified subject matter experts