Question: In your textbook, read The Cohesion Case The Hershey Company, 2015 in Chapter 1, and respond to the questions in the Case Analysis Template. Download

-

In your textbook, read "The Cohesion Case The Hershey Company, 2015" in Chapter 1, and respond to the questions in the Case Analysis Template.

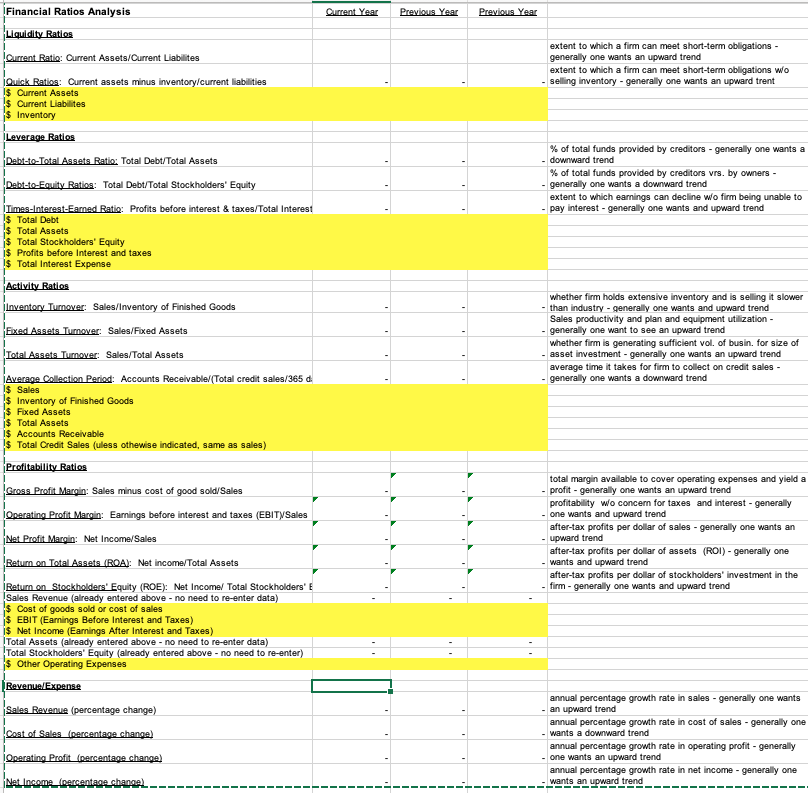

In your textbook, read "The Cohesion Case The Hershey Company, 2015" in Chapter 1, and respond to the questions in the Case Analysis Template. - Download the Financial Ratios Spreadsheet and complete it by filling in the financial statements. (The ratios will calculate themselves.) The instructions are provided on the template.

Financial Ratio excel template is attached along with the Cohesion Case

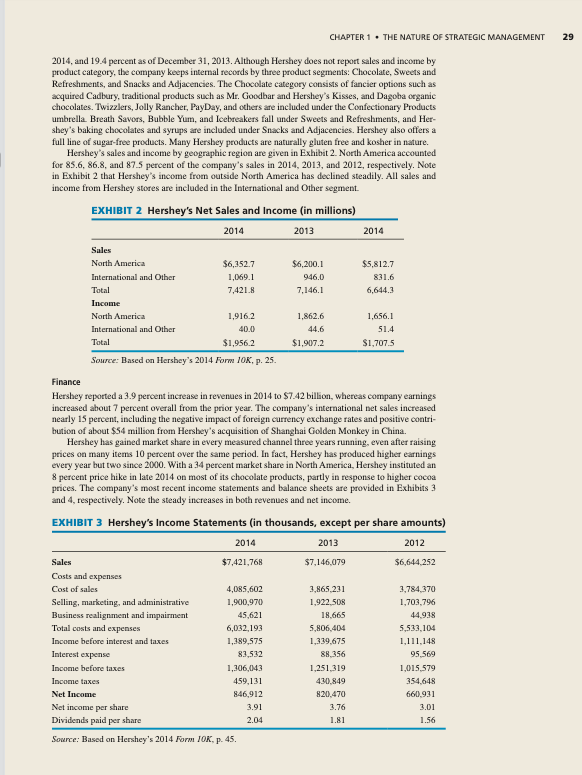

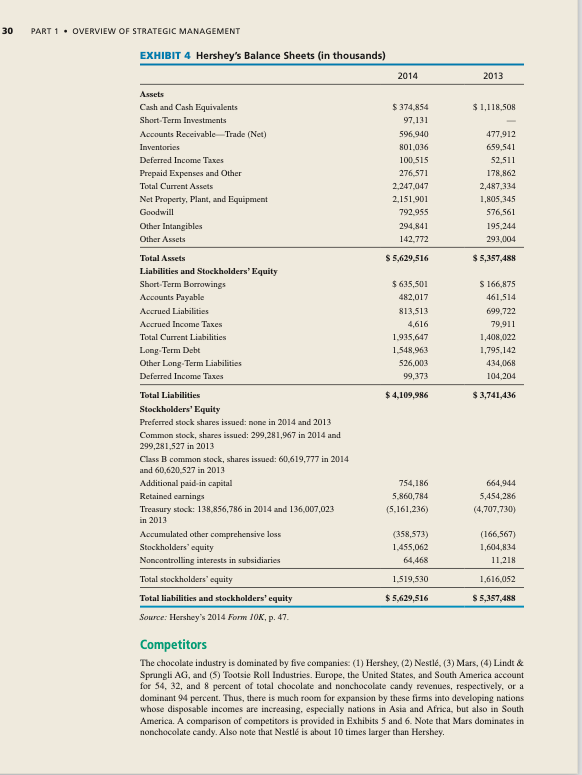

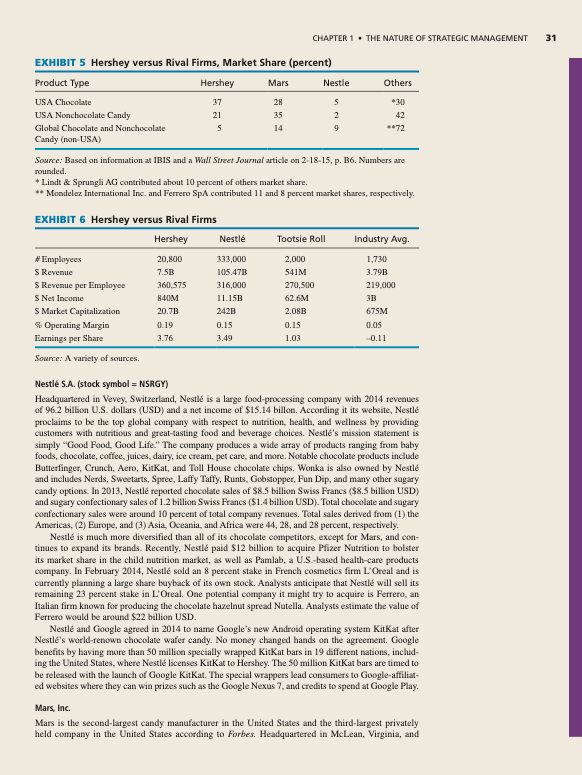

CHAPTER 1 . THE NATURE OF STRATEGIC MANAGEMENT 29 2014, and 19.4 percent as of December 31, 2013. Although Hershey does not report sales and income by product category, the company keeps internal records by three product segments: Chocolate, Sweets and Refreshments, and Snacks and Adjacencies. The Chocolate category consists of fancier options such as acquired Cadbury, traditional products such as Mr. Goodbar and Hershey's Kisses, and Dagoba organic chocolates. Twizzlers, Jolly Rancher, Pay Day, and others are included under the Confectionary Products umbrella Breath Savors, Bubble Yum, and Icebreakers fall under Sweets and Refreshments, and Her- shey's baking chocolates and syrups are included under Snacks and Adjacencies. Hershey also offers a full line of sugar-free products. Many Hershey products are naturally gluten free and kosher in nature. Hershey's sales and income by geographic region are given in Exhibit 2. North America accounted for 85.6, 86.8 and 87.5 percent of the company's sales in 2014, 2013, and 2012, respectively. Note in Exhibit 2 that Hershey's income from outside North America has declined steadily. All sales and income from Hershey stores are included in the International and Other segment. EXHIBIT 2 Hershey's Net Sales and Income (in millions) 2014 2013 2014 Sales North America $6,352.7 $6,200.1 $5,812.7 International and Other 1,069.1 946.0 831.6 Total 7,4218 7,146.1 6,644.3 Income North America 1,916.2 1,862.6 1,656.1 International and Other 40.0 44.6 51.4 Total $1,956.2 $1,907.2 $1.707.5 Source: Based on Hershey's 2014 Form 106, p. 25. Finance Hershey reported a 3.9 percent increase in revenues in 2014 to $7.42 billion, whereas company earnings increased about 7 percent overall from the prior year. The company's international net sales increased nearly 15 percent, including the negative impact of foreign currency exchange rates and positive contri- bution of about $54 million from Hershey's acquisition of Shanghai Golden Monkey in China. Hershey has gained market share in every measured channel three years running, even after raising prices on many items 10 percent over the same period. In fact, Hershey has produced higher earnings every year but two since 2000. With a 34 percent market share in North America, Hershey instituted an 8 percent price hike in late 2014 on most of its chocolate products, partly in response to higher cocoa prices. The company's most recent income statements and balance sheets are provided in Exhibits 3 and 4, respectively. Note the steady increases in both revenues and net income. EXHIBIT 3 Hershey's Income Statements (in thousands, except per share amounts) 2014 2013 2012 Sales $7,421,768 $7,146,079 $6,644,252 Costs and expenses Cost of sales 4,085,602 3,865.231 3,784,370 Selling, marketing, and administrative 1,900,970 1.922.50 1,703,796 Business realignment and impairment 45,621 18,665 44,938 Total costs and expenses 6,032,193 5,806,404 5,533,104 Income before interest and taxes 1,389.575 1,339,675 1,111,148 Interest expense 83,532 88,356 95,569 Income before taxes 1,306,043 1,251,319 1,015.579 Income taxes 459,131 430,849 354,648 Net Income 846,912 820,470 660,931 Net income per share 3.91 3.76 3.01 Dividends paid per share 2.04 1.81 1.56 Source: Based on Hershey's 2014 Form OK, p. 45. 30 PART 1 - OVERVIEW OF STRATEGIC MANAGEMENT EXHIBIT 4 Hershey's Balance Sheets (in thousands) 2014 2013 $ 1,118,508 Assets Cash and Cash Equivalents Short-Term Investments Accounts Receivable-Trade (Net) Inventories Deferred Income Taxes Prepaid Expenses and Other Total Current Assets Net Property, Plant, and Equipment Goodwill Other Intangibles Other Assets $ 374,854 97,131 596,940 801.036 100,515 276,571 2,247,047 2,151,901 792.955 294,841 142,772 477,912 659,541 52,511 178,862 2,487,334 1,805,345 576,561 195,244 293,004 $ 5,629,516 $5,357,488 $ 635,501 482,017 813,513 4,616 1.935,647 1.548,963 526,003 99,373 $ 166,875 461,514 699,722 79,911 1,408,022 1,795,142 434,068 104,204 $ 4,109.986 $3,741,436 Total Assets Liabilities and Stockholders' Equity Short-Term Borrowings Accounts Payable Accrued Liabilities Accrued Income Taxes Total Current Liabilities Long Term Debt Other Long-Term Liabilities Deferred Income Taxes Total Liabilities Stockholders' Equity Preferred stock shares issued: none in 2014 and 2013 Common stock, shares issued: 299,281,967 in 2014 and 299,281,527 in 2013 Class B common stock, shares issued: 61,619,777 in 2014 and 60,620,527 in 2013 Additional paid in capital Retained earnings Treasury stock: 138.856,786 in 2014 and 136,007,023 in 2013 Accumulated other comprehensive loss Stockholders' equity Noncontrolling interests in subsidiaries Total stockholders' equity Total liabilities and stockholders' equity Source: Hershey's 2014 Form 10K, p. 47. 754,186 5,860,784 (5,161,236) 664,944 5,454,286 (4,707,730) (358,573) 1,455,062 64,468 1,519,530 (166,567) 1,604,834 11.218 1,616,052 $ 5,629,516 $ 5,357,488 Competitors The chocolate industry is dominated by five companies: (1) Hershey, (2) Nestl, (3) Mars (4) Lindt & Sprungli AG, and (5) Tootsie Roll Industries. Europe, the United States, and South America account for 54, 32, and 8 percent of total chocolate and nonchocolate candy revenues, respectively, or a dominant 94 percent. Thus, there is much room for expansion by these firms into developing nations whose disposable incomes are increasing, especially nations in Asia and Africa, but also in South America. A comparison of competitors is provided in Exhibits 5 and 6. Note that Mars dominates in nonchocolate candy. Also note that Nestl is about 10 times larger than Hershey. CHAPTER 1 . THE NATURE OF STRATEGIC MANAGEMENT 31 **72 EXHIBIT 5 Hershey versus Rival Firms, Market Share (percent) Product Type Hershey Mars Nestle Others USA Chocolate 37 28 5 30 USA Nonchocolate Candy 21 35 2 42 Global Chocolate and Nonchocolate 5 14 9 Candy (non USA) Source: Based on information at IBIS and a Wall Street Journal article on 2-18-15, p. 36. Numbers are rounded. * Lindt & Sprungli AG contributed about 10 percent of others market share. ** Mondelez International Inc. and Ferrero SpA contributed 11 and 8 percent market shares, respectively. EXHIBIT 6 Hershey versus Rival Firms Hershey Nestl Tootsie Roll Industry Avg. #Employees 20,800 333,000 2,000 1,730 SRevenue 7.53 105.473 541M 3.798 S Revenue per Employee 360.575 316,000 270,500 219.000 SNet Income 840M 11.15B 626M 3B S Market Capitalization 20.78 2.083 675M Operating Margin 0.19 0.15 0.15 0.05 Earnings per Share 3.76 1.03 0.11 Source: A variety of sources. 2421 Nestl S.A. (stock symbol = NSRGY) Headquartered in Vevey, Switzerland, Nestl is a large food processing company with 2014 revenues of 96.2 billion U.S. dollars (USD) and a net income of $15.14 billon. According it its website, Nestl proclaims to be the top global company with respect to nutrition, health, and wellness by providing customers with nutritious and great-tasting food and beverage choices. Nestl's mission statement is simply "Good Food, Good Life." The company produces a wide array of products ranging from baby foods, chocolate, coffee, juices, dairy, ice cream, pet care, and more. Notable chocolate products include Butterfinger, Crunch, Aero, KitKat, and Toll House chocolate chips. Wonka is also owned by Nestl and includes Nerds, Sweetarts, Spree, Laffy Taffy, Runts, Gobstopper, Fun Dip, and many other sugary candy options. In 2013, Nestl reported chocolate sales of $8.5 billion Swiss Francs ($8.5 billion USD) and sugary confectionary sales of 1.2 billion Swiss Francs ($1.4 billion USD). Total chocolate and sugary confectionary sales were around 10 percent of total company revenues. Total sales derived from (1) the Americas, (2) Europe, and (3) Asia, Oceania, and Africa were 44, 28, and 28 percent, respectively. Nestl is much more diversified than all of its chocolate competitors, except for Mars, and con- tinues to expand its brands. Recently, Nestl paid $12 billion to acquire Pfizer Nutrition to bolster its market share in the child nutrition market, as well as Pamlab, a U.S.-based health care products company. In February 2014, Nestl sold an 8 percent stake in French cosmetics firm L'Oreal and is currently planning a large share buyback of its own stock. Analysts anticipate that Nestl will sell its remaining 23 percent stake in L'Oreal. One potential company it might try to acquire is Ferrero, an Italian firm known for producing the chocolate hazelnut spread Nutella. Analysts estimate the value of Ferrero would be around $22 billion USD. Nestl and Google agreed in 2014 to name Google's new Android operating system KitKat after Nestle's world-renown chocolate wafer candy. No money changed hands on the agreement. Google benefits by having more than 50 million specially wrapped KitKat bars in 19 different nations, includ- ing the United States, where Nestl licenses KitKat to Hershey. The 50 million KitKat bars are timed to be released with the launch of Google KitKat. The special wrappers lead consumers to Google-affiliat- ed websites where they can win prizes such as the Google Nexus 7, and credits to spend at Google Play. Mars, Inc. Mars is the second-largest candy manufacturer in the United States and the third-largest privately held company in the United States according to Forbes. Headquartered in McLean, Virginia, and 32 PART 1. OVERVIEW OF STRATEGIC MANAGEMENT having annual sales over $30 billion, Mars, like Nestl, is well diversified with six business units consisting of chocolate, drinks, food, symbioscience, pet care, and Wrigley chewing gum. Mars blockbuster chocolate brands include Snickers, Milky Way, M&Ms, Dove, Bounty, 3 Musketeers, Starburst, and Skittles, among others. The annual revenue of Mars in 2014 was about $35 billion- more than 50 percent higher than in 2007, largely due to the firm's 2008 acquisition of Wrigley. Since patenting recipes is difficult and producing chocolate is secretive, Mars does not allow visitors to its kitchens in its factories and facilities. Mars' first blockbuster product back in 1923 was the Milky Way candy bar, still a big seller today, Market researcher Euromonitor International recently reported that Mars' market share in the United States rose to 28 percent from 24 percent. To further battle Hershey, in 2014, Mars opened a new 500,000 square-foot chocolate factory in Topeka, Kansas, at a cost of $270 million. The factory cranks out more than 8 million miniature Snickers candy bars and 39 million peanut M&M's every day. Like Nestl, Mars advocates global sustainability of the cocoa resource but has received criticism in recent years over purchasing cocoa from West African farms that use child labor. Mars is also one of the world's biggest producers of dog food and pet-care products. Mars' Wrigley division produces chewing gums, confectionery products, and a variety of other products ranging from Uncle Ben's rice to Pamesello grated cheese and Flavia coffee. Mars' pet-food brands include Pedigree, Greenies, Sheba, and Whiskas. Interestingly, chocolate is Mars' second-largest business globally, behind pet care. Lindt & Sprungli AG Headquartered in Switzerland, Lindt purchased U.S.-based and privately held Russell Stover in 2014 for an unreported amount, making Lindt the third-largest chocolate company in the United States (with a 10 percent market share), behind Hershey and Mars, and ahead of Nestl. With the Russell Stover addition, Lindt acquired over 70,000 drugstore outlets for their products in the United States and Canada. Lindt also currently owns Ghirardelli Chocolate, based in San Francisco. Interestingly, Lindt is taking a slightly different strategic path than Hershey, Mars, and Nestl. Although many top chocolate brands are betting on emerging markets such as China and India that have growth rates over 15 percent, Lindt is betting on North America with growth rates of less than 2 percent in chocolate sales. Lindt cites the main reason for sticking with the United States and Canada are they are safer markets and still will be three times larger chocolate markets than both China and India combined, even as far out as 2018. Lindt also specializes in higher and middle-end chocolates and these products are not cost-effective options for many of the customers in China and India. Tootsie Roll Industries (stock symbol = TR) Headquartered in Chicago, Illinois, Tootsie Roll Industries' CEO and Chairman, Melvin Gordon, died at the age of 95 in January 2015. Gordon, with his wife, Ellen Gordon, who inherited control of the company from her father, were married for 65 years and together created one of the most secretive corporate cultures among publicly traded companies in the United States. The Gordons rarely gave in- terviews, indeed, they shunned media attention, issued only scant quarterly earnings reports, and tightly restricted visits to its headquarters on Chicago's South Side. An analyst once said, "I think the only way you can get a tour of Tootsie Roll's manufacturing plant is by jumping over the fence and sneaking in." Over the decades, the Gordans acquired other well-known candy brands, assembling a portfolio of similarly time-worn-but-profitable names, including Charms Blow Pops, Sugar Babies caramels, Junior Mints, and DOTS gumdrops in addition to the eponymous chocolate chews that made Tootsie Rollfa- mous. Tootsie Roll reported earnings of $12.9 million in Q1 of 2015, down from $15.0 million the prior year. The company's sales were $105 million in Q1 of 2015, down from $106 million the prior year. Toot- sie Roll Industries became the world's largest maker of lollipops when it bought the Charms Company in 1988. The company later acquired Sugar Daddy and Junior Mints and, in 2004, Concord Confections, adding Dubble Bubble and Wack-o-Wax to the candies it produces. The company was well-known for its commercials. It claims to have received more than 20,000 letters from children trying to answer a question posed by an owl in a 1970s commercial: How many licks does it take to reach the center of a Tootsie Pop? Tootsie Roll's brands, as well as its real estate assets in Chicago, and the fact that Gordon's children are not directly involved in the business, make the company an attractive firm to acquire, perhaps for Hershey Company, Mars, or Nestl. Ellen Gordan, age 83, is the largest Tootsie Roll share- holder, and was even prior to her husband's death. The Gordon family holds a controlling stake in the company. Tootsie Roll trades at about 20 times its profit and has about 2,000 employees. That gives it a higher price tag than any other similar-sized public candy maker target in the last decade, even before accounting for a premium. Tootsie Roll's shares rose & percent to a 17-month high of $33.28 following the announcement of Mr. Gordon's death, but by May 2015, shares were back down to $30. Qurrent Year Previous Year Previous Year Financial Ratios Analysis Liquidity Ratios Current Ratio: Current Assets/Current Liabilites extent to which a firm can meet short-term obligations - generally one wants an upward trend extent to which a firm can meet short-term obligations wo selling inventory - generally one wants an upward trent Quick Ratios: Current assets minus inventory/current liabilities I$ Current Assets $ Current Liabilites $ Inventory I Leverage Ratios Debt-to-Total Assets Ratio: Total Debt/Total Assets % of total funds provided by creditors - generally one wants a downward trend % of total funds provided by creditors vrs, by owners - generally one wants a downward trend extent to which earnings can decline wo firm being unable to pay interest - generally one wants and upward trend Debt-to-Equity Ratios: Total Debt/Total Stockholders' Equity Times-Interest-Eamed Ratio: Profits before interest & taxes/Total Interest $ Total Debt $ Total Assets $ Total Stockholders' Equity I$ Profits before Interest and taxes $ Total Interest Expense whether firm holds extensive inventory and is selling it slower than industry - generally one wants and upward trend Sales productivity and plan and equipment utilization - generally one want to see an upward trend whether firm is generating sufficient vol. of busin. for size of asset investment - generally one wants an upward trend average time it takes for firm to collect on credit sales - generally one wants a downward trend Activity Ratios Inventory Turnover: Sales/Inventory of Finished Goods Fixed Assets Tumover: Sales/Fixed Assets Total Assets Turnover: Sales/Total Assets Average Collection Period: Accounts Receivable/(Total credit sales/365 d $ Sales $ Inventory of Finished Goods $ Fixed Assets $ Total Assets $ Accounts Receivable $ Total Credit Sales (uless othewise indicated, same as sales) Profitability Ratios Gross Profit Margin: Sales minus cost of good sold/Sales Operating Profit Margin: Earnings before interest and taxes (EBITYSales total margin available to cover operating expenses and yield a profit - generally one wants an upward trend profitability wo concern for taxes and interest - generally one wants and upward trend after-tax profits per dollar of sales - generally one wants an upward trend after-tax profits per dollar of assets (ROI) - generally one wants and upward trend after-tax profits per dollar of stockholders' investment in the firm - generally one wants and upward trend Net Profit Marain: Net Income/Sales Return on Total Assets (ROA): Net income/Total Assets Return on Stockholders' Equity (ROE): Net Income Total Stockholders' Sales Revenue (already entered above - no need to re-enter data) $ Cost of goods sold or cost of sales $ EBIT (Earnings Before Interest and Taxes) i$ Net Income (Earnings After Interest and Taxes) Total Assets (already entered above - no need to re-enter data) Total Stockholders' Equity (already entered above - no need to re-enter) $ Other Operating Expenses Revenue/Expense Sales Revenue (percentage change) Cost of Sales (percentage change) Operating Profit (percentage change) Net Income_(percentage changel annual percentage growth rate in sales - generally one wants an upward trend annual percentage growth rate in cost of sales - generally one wants a downward trend annual percentage growth rate in operating profit - generally one wants an upward trend annual percentage growth rate in net income - generally one wants an upward trend CHAPTER 1 . THE NATURE OF STRATEGIC MANAGEMENT 29 2014, and 19.4 percent as of December 31, 2013. Although Hershey does not report sales and income by product category, the company keeps internal records by three product segments: Chocolate, Sweets and Refreshments, and Snacks and Adjacencies. The Chocolate category consists of fancier options such as acquired Cadbury, traditional products such as Mr. Goodbar and Hershey's Kisses, and Dagoba organic chocolates. Twizzlers, Jolly Rancher, Pay Day, and others are included under the Confectionary Products umbrella Breath Savors, Bubble Yum, and Icebreakers fall under Sweets and Refreshments, and Her- shey's baking chocolates and syrups are included under Snacks and Adjacencies. Hershey also offers a full line of sugar-free products. Many Hershey products are naturally gluten free and kosher in nature. Hershey's sales and income by geographic region are given in Exhibit 2. North America accounted for 85.6, 86.8 and 87.5 percent of the company's sales in 2014, 2013, and 2012, respectively. Note in Exhibit 2 that Hershey's income from outside North America has declined steadily. All sales and income from Hershey stores are included in the International and Other segment. EXHIBIT 2 Hershey's Net Sales and Income (in millions) 2014 2013 2014 Sales North America $6,352.7 $6,200.1 $5,812.7 International and Other 1,069.1 946.0 831.6 Total 7,4218 7,146.1 6,644.3 Income North America 1,916.2 1,862.6 1,656.1 International and Other 40.0 44.6 51.4 Total $1,956.2 $1,907.2 $1.707.5 Source: Based on Hershey's 2014 Form 106, p. 25. Finance Hershey reported a 3.9 percent increase in revenues in 2014 to $7.42 billion, whereas company earnings increased about 7 percent overall from the prior year. The company's international net sales increased nearly 15 percent, including the negative impact of foreign currency exchange rates and positive contri- bution of about $54 million from Hershey's acquisition of Shanghai Golden Monkey in China. Hershey has gained market share in every measured channel three years running, even after raising prices on many items 10 percent over the same period. In fact, Hershey has produced higher earnings every year but two since 2000. With a 34 percent market share in North America, Hershey instituted an 8 percent price hike in late 2014 on most of its chocolate products, partly in response to higher cocoa prices. The company's most recent income statements and balance sheets are provided in Exhibits 3 and 4, respectively. Note the steady increases in both revenues and net income. EXHIBIT 3 Hershey's Income Statements (in thousands, except per share amounts) 2014 2013 2012 Sales $7,421,768 $7,146,079 $6,644,252 Costs and expenses Cost of sales 4,085,602 3,865.231 3,784,370 Selling, marketing, and administrative 1,900,970 1.922.50 1,703,796 Business realignment and impairment 45,621 18,665 44,938 Total costs and expenses 6,032,193 5,806,404 5,533,104 Income before interest and taxes 1,389.575 1,339,675 1,111,148 Interest expense 83,532 88,356 95,569 Income before taxes 1,306,043 1,251,319 1,015.579 Income taxes 459,131 430,849 354,648 Net Income 846,912 820,470 660,931 Net income per share 3.91 3.76 3.01 Dividends paid per share 2.04 1.81 1.56 Source: Based on Hershey's 2014 Form OK, p. 45. 30 PART 1 - OVERVIEW OF STRATEGIC MANAGEMENT EXHIBIT 4 Hershey's Balance Sheets (in thousands) 2014 2013 $ 1,118,508 Assets Cash and Cash Equivalents Short-Term Investments Accounts Receivable-Trade (Net) Inventories Deferred Income Taxes Prepaid Expenses and Other Total Current Assets Net Property, Plant, and Equipment Goodwill Other Intangibles Other Assets $ 374,854 97,131 596,940 801.036 100,515 276,571 2,247,047 2,151,901 792.955 294,841 142,772 477,912 659,541 52,511 178,862 2,487,334 1,805,345 576,561 195,244 293,004 $ 5,629,516 $5,357,488 $ 635,501 482,017 813,513 4,616 1.935,647 1.548,963 526,003 99,373 $ 166,875 461,514 699,722 79,911 1,408,022 1,795,142 434,068 104,204 $ 4,109.986 $3,741,436 Total Assets Liabilities and Stockholders' Equity Short-Term Borrowings Accounts Payable Accrued Liabilities Accrued Income Taxes Total Current Liabilities Long Term Debt Other Long-Term Liabilities Deferred Income Taxes Total Liabilities Stockholders' Equity Preferred stock shares issued: none in 2014 and 2013 Common stock, shares issued: 299,281,967 in 2014 and 299,281,527 in 2013 Class B common stock, shares issued: 61,619,777 in 2014 and 60,620,527 in 2013 Additional paid in capital Retained earnings Treasury stock: 138.856,786 in 2014 and 136,007,023 in 2013 Accumulated other comprehensive loss Stockholders' equity Noncontrolling interests in subsidiaries Total stockholders' equity Total liabilities and stockholders' equity Source: Hershey's 2014 Form 10K, p. 47. 754,186 5,860,784 (5,161,236) 664,944 5,454,286 (4,707,730) (358,573) 1,455,062 64,468 1,519,530 (166,567) 1,604,834 11.218 1,616,052 $ 5,629,516 $ 5,357,488 Competitors The chocolate industry is dominated by five companies: (1) Hershey, (2) Nestl, (3) Mars (4) Lindt & Sprungli AG, and (5) Tootsie Roll Industries. Europe, the United States, and South America account for 54, 32, and 8 percent of total chocolate and nonchocolate candy revenues, respectively, or a dominant 94 percent. Thus, there is much room for expansion by these firms into developing nations whose disposable incomes are increasing, especially nations in Asia and Africa, but also in South America. A comparison of competitors is provided in Exhibits 5 and 6. Note that Mars dominates in nonchocolate candy. Also note that Nestl is about 10 times larger than Hershey. CHAPTER 1 . THE NATURE OF STRATEGIC MANAGEMENT 31 **72 EXHIBIT 5 Hershey versus Rival Firms, Market Share (percent) Product Type Hershey Mars Nestle Others USA Chocolate 37 28 5 30 USA Nonchocolate Candy 21 35 2 42 Global Chocolate and Nonchocolate 5 14 9 Candy (non USA) Source: Based on information at IBIS and a Wall Street Journal article on 2-18-15, p. 36. Numbers are rounded. * Lindt & Sprungli AG contributed about 10 percent of others market share. ** Mondelez International Inc. and Ferrero SpA contributed 11 and 8 percent market shares, respectively. EXHIBIT 6 Hershey versus Rival Firms Hershey Nestl Tootsie Roll Industry Avg. #Employees 20,800 333,000 2,000 1,730 SRevenue 7.53 105.473 541M 3.798 S Revenue per Employee 360.575 316,000 270,500 219.000 SNet Income 840M 11.15B 626M 3B S Market Capitalization 20.78 2.083 675M Operating Margin 0.19 0.15 0.15 0.05 Earnings per Share 3.76 1.03 0.11 Source: A variety of sources. 2421 Nestl S.A. (stock symbol = NSRGY) Headquartered in Vevey, Switzerland, Nestl is a large food processing company with 2014 revenues of 96.2 billion U.S. dollars (USD) and a net income of $15.14 billon. According it its website, Nestl proclaims to be the top global company with respect to nutrition, health, and wellness by providing customers with nutritious and great-tasting food and beverage choices. Nestl's mission statement is simply "Good Food, Good Life." The company produces a wide array of products ranging from baby foods, chocolate, coffee, juices, dairy, ice cream, pet care, and more. Notable chocolate products include Butterfinger, Crunch, Aero, KitKat, and Toll House chocolate chips. Wonka is also owned by Nestl and includes Nerds, Sweetarts, Spree, Laffy Taffy, Runts, Gobstopper, Fun Dip, and many other sugary candy options. In 2013, Nestl reported chocolate sales of $8.5 billion Swiss Francs ($8.5 billion USD) and sugary confectionary sales of 1.2 billion Swiss Francs ($1.4 billion USD). Total chocolate and sugary confectionary sales were around 10 percent of total company revenues. Total sales derived from (1) the Americas, (2) Europe, and (3) Asia, Oceania, and Africa were 44, 28, and 28 percent, respectively. Nestl is much more diversified than all of its chocolate competitors, except for Mars, and con- tinues to expand its brands. Recently, Nestl paid $12 billion to acquire Pfizer Nutrition to bolster its market share in the child nutrition market, as well as Pamlab, a U.S.-based health care products company. In February 2014, Nestl sold an 8 percent stake in French cosmetics firm L'Oreal and is currently planning a large share buyback of its own stock. Analysts anticipate that Nestl will sell its remaining 23 percent stake in L'Oreal. One potential company it might try to acquire is Ferrero, an Italian firm known for producing the chocolate hazelnut spread Nutella. Analysts estimate the value of Ferrero would be around $22 billion USD. Nestl and Google agreed in 2014 to name Google's new Android operating system KitKat after Nestle's world-renown chocolate wafer candy. No money changed hands on the agreement. Google benefits by having more than 50 million specially wrapped KitKat bars in 19 different nations, includ- ing the United States, where Nestl licenses KitKat to Hershey. The 50 million KitKat bars are timed to be released with the launch of Google KitKat. The special wrappers lead consumers to Google-affiliat- ed websites where they can win prizes such as the Google Nexus 7, and credits to spend at Google Play. Mars, Inc. Mars is the second-largest candy manufacturer in the United States and the third-largest privately held company in the United States according to Forbes. Headquartered in McLean, Virginia, and 32 PART 1. OVERVIEW OF STRATEGIC MANAGEMENT having annual sales over $30 billion, Mars, like Nestl, is well diversified with six business units consisting of chocolate, drinks, food, symbioscience, pet care, and Wrigley chewing gum. Mars blockbuster chocolate brands include Snickers, Milky Way, M&Ms, Dove, Bounty, 3 Musketeers, Starburst, and Skittles, among others. The annual revenue of Mars in 2014 was about $35 billion- more than 50 percent higher than in 2007, largely due to the firm's 2008 acquisition of Wrigley. Since patenting recipes is difficult and producing chocolate is secretive, Mars does not allow visitors to its kitchens in its factories and facilities. Mars' first blockbuster product back in 1923 was the Milky Way candy bar, still a big seller today, Market researcher Euromonitor International recently reported that Mars' market share in the United States rose to 28 percent from 24 percent. To further battle Hershey, in 2014, Mars opened a new 500,000 square-foot chocolate factory in Topeka, Kansas, at a cost of $270 million. The factory cranks out more than 8 million miniature Snickers candy bars and 39 million peanut M&M's every day. Like Nestl, Mars advocates global sustainability of the cocoa resource but has received criticism in recent years over purchasing cocoa from West African farms that use child labor. Mars is also one of the world's biggest producers of dog food and pet-care products. Mars' Wrigley division produces chewing gums, confectionery products, and a variety of other products ranging from Uncle Ben's rice to Pamesello grated cheese and Flavia coffee. Mars' pet-food brands include Pedigree, Greenies, Sheba, and Whiskas. Interestingly, chocolate is Mars' second-largest business globally, behind pet care. Lindt & Sprungli AG Headquartered in Switzerland, Lindt purchased U.S.-based and privately held Russell Stover in 2014 for an unreported amount, making Lindt the third-largest chocolate company in the United States (with a 10 percent market share), behind Hershey and Mars, and ahead of Nestl. With the Russell Stover addition, Lindt acquired over 70,000 drugstore outlets for their products in the United States and Canada. Lindt also currently owns Ghirardelli Chocolate, based in San Francisco. Interestingly, Lindt is taking a slightly different strategic path than Hershey, Mars, and Nestl. Although many top chocolate brands are betting on emerging markets such as China and India that have growth rates over 15 percent, Lindt is betting on North America with growth rates of less than 2 percent in chocolate sales. Lindt cites the main reason for sticking with the United States and Canada are they are safer markets and still will be three times larger chocolate markets than both China and India combined, even as far out as 2018. Lindt also specializes in higher and middle-end chocolates and these products are not cost-effective options for many of the customers in China and India. Tootsie Roll Industries (stock symbol = TR) Headquartered in Chicago, Illinois, Tootsie Roll Industries' CEO and Chairman, Melvin Gordon, died at the age of 95 in January 2015. Gordon, with his wife, Ellen Gordon, who inherited control of the company from her father, were married for 65 years and together created one of the most secretive corporate cultures among publicly traded companies in the United States. The Gordons rarely gave in- terviews, indeed, they shunned media attention, issued only scant quarterly earnings reports, and tightly restricted visits to its headquarters on Chicago's South Side. An analyst once said, "I think the only way you can get a tour of Tootsie Roll's manufacturing plant is by jumping over the fence and sneaking in." Over the decades, the Gordans acquired other well-known candy brands, assembling a portfolio of similarly time-worn-but-profitable names, including Charms Blow Pops, Sugar Babies caramels, Junior Mints, and DOTS gumdrops in addition to the eponymous chocolate chews that made Tootsie Rollfa- mous. Tootsie Roll reported earnings of $12.9 million in Q1 of 2015, down from $15.0 million the prior year. The company's sales were $105 million in Q1 of 2015, down from $106 million the prior year. Toot- sie Roll Industries became the world's largest maker of lollipops when it bought the Charms Company in 1988. The company later acquired Sugar Daddy and Junior Mints and, in 2004, Concord Confections, adding Dubble Bubble and Wack-o-Wax to the candies it produces. The company was well-known for its commercials. It claims to have received more than 20,000 letters from children trying to answer a question posed by an owl in a 1970s commercial: How many licks does it take to reach the center of a Tootsie Pop? Tootsie Roll's brands, as well as its real estate assets in Chicago, and the fact that Gordon's children are not directly involved in the business, make the company an attractive firm to acquire, perhaps for Hershey Company, Mars, or Nestl. Ellen Gordan, age 83, is the largest Tootsie Roll share- holder, and was even prior to her husband's death. The Gordon family holds a controlling stake in the company. Tootsie Roll trades at about 20 times its profit and has about 2,000 employees. That gives it a higher price tag than any other similar-sized public candy maker target in the last decade, even before accounting for a premium. Tootsie Roll's shares rose & percent to a 17-month high of $33.28 following the announcement of Mr. Gordon's death, but by May 2015, shares were back down to $30. Qurrent Year Previous Year Previous Year Financial Ratios Analysis Liquidity Ratios Current Ratio: Current Assets/Current Liabilites extent to which a firm can meet short-term obligations - generally one wants an upward trend extent to which a firm can meet short-term obligations wo selling inventory - generally one wants an upward trent Quick Ratios: Current assets minus inventory/current liabilities I$ Current Assets $ Current Liabilites $ Inventory I Leverage Ratios Debt-to-Total Assets Ratio: Total Debt/Total Assets % of total funds provided by creditors - generally one wants a downward trend % of total funds provided by creditors vrs, by owners - generally one wants a downward trend extent to which earnings can decline wo firm being unable to pay interest - generally one wants and upward trend Debt-to-Equity Ratios: Total Debt/Total Stockholders' Equity Times-Interest-Eamed Ratio: Profits before interest & taxes/Total Interest $ Total Debt $ Total Assets $ Total Stockholders' Equity I$ Profits before Interest and taxes $ Total Interest Expense whether firm holds extensive inventory and is selling it slower than industry - generally one wants and upward trend Sales productivity and plan and equipment utilization - generally one want to see an upward trend whether firm is generating sufficient vol. of busin. for size of asset investment - generally one wants an upward trend average time it takes for firm to collect on credit sales - generally one wants a downward trend Activity Ratios Inventory Turnover: Sales/Inventory of Finished Goods Fixed Assets Tumover: Sales/Fixed Assets Total Assets Turnover: Sales/Total Assets Average Collection Period: Accounts Receivable/(Total credit sales/365 d $ Sales $ Inventory of Finished Goods $ Fixed Assets $ Total Assets $ Accounts Receivable $ Total Credit Sales (uless othewise indicated, same as sales) Profitability Ratios Gross Profit Margin: Sales minus cost of good sold/Sales Operating Profit Margin: Earnings before interest and taxes (EBITYSales total margin available to cover operating expenses and yield a profit - generally one wants an upward trend profitability wo concern for taxes and interest - generally one wants and upward trend after-tax profits per dollar of sales - generally one wants an upward trend after-tax profits per dollar of assets (ROI) - generally one wants and upward trend after-tax profits per dollar of stockholders' investment in the firm - generally one wants and upward trend Net Profit Marain: Net Income/Sales Return on Total Assets (ROA): Net income/Total Assets Return on Stockholders' Equity (ROE): Net Income Total Stockholders' Sales Revenue (already entered above - no need to re-enter data) $ Cost of goods sold or cost of sales $ EBIT (Earnings Before Interest and Taxes) i$ Net Income (Earnings After Interest and Taxes) Total Assets (already entered above - no need to re-enter data) Total Stockholders' Equity (already entered above - no need to re-enter) $ Other Operating Expenses Revenue/Expense Sales Revenue (percentage change) Cost of Sales (percentage change) Operating Profit (percentage change) Net Income_(percentage changel annual percentage growth rate in sales - generally one wants an upward trend annual percentage growth rate in cost of sales - generally one wants a downward trend annual percentage growth rate in operating profit - generally one wants an upward trend annual percentage growth rate in net income - generally one wants an upward trend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts