Question: ina Incis only temporary difference at the beginning and end of 2019 is caused by a $3,360,000 deferred gain for tax purposes for a nstaliment

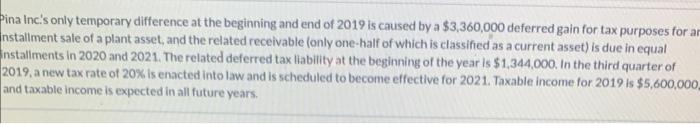

ina Incis only temporary difference at the beginning and end of 2019 is caused by a $3,360,000 deferred gain for tax purposes for a nstaliment sale of a plant asset, and the related receivable (only one-half of which is classified as a current asset) is due in equal nstaliments in 2020 and 2021 . The related deferred tax liability at the beginning of the year is $1,344,000. In the third quarter of 2019, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2021 . Taxable income for 2019 is $5,600,000 and taxable income is expected in all future years. Prepare the journal entry necessary to adjust the deferred tax liability when the new tax rate is enacted into law. (Credlt occout titles are automatically indented when amount is entered. Do not indent monually. If no entry Is requilred, select "No Entry" for the accou titles and enter O for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts