Question: Pina Incis only temporary difference at the beginning and end of 2019 is caused by a $3,360,000 deferred gain for tax purposes for an instaliment

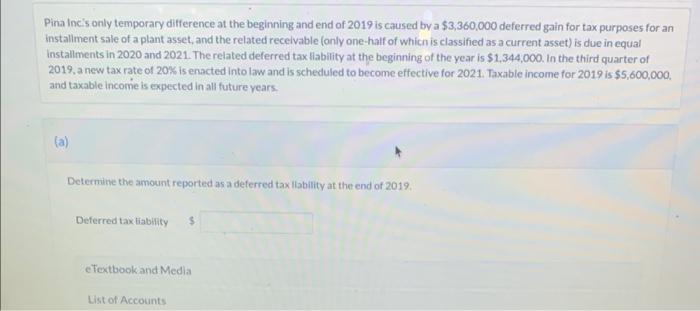

Pina Incis only temporary difference at the beginning and end of 2019 is caused by a $3,360,000 deferred gain for tax purposes for an instaliment sale of a plant asset, and the related recelvable (only one-half of whicn is classified as a current asset) is due in equal installments in 2020 and 2021 . The related deferred tax llability at the beginning of the year is $1,344,000. In the third quarter of 2019, a new tax rate of 20% is enacted into law and is scheduled to become effective for 2021. Taxable income for 2019 is $5,600,000. and taxable income is expected in all future years. (a) Determine the amount reported as a deferred tax liability at the end of 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts