Question: Inc., is preparing to pay its first dividend It is going to pay $0.4 , $0.60, and $1 a share over the next three years,

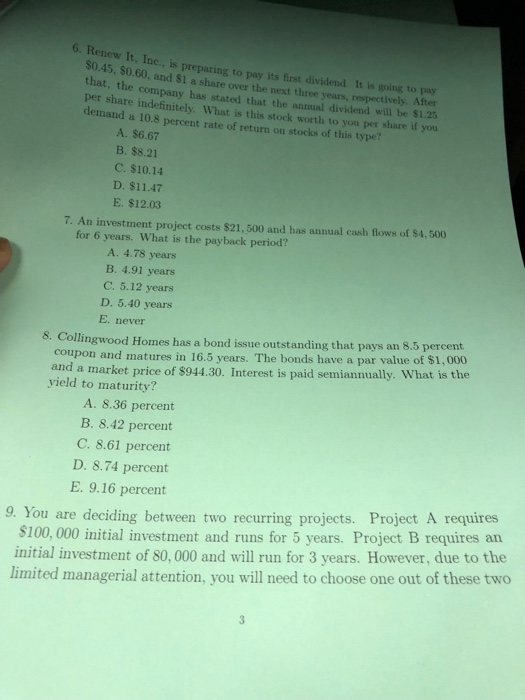

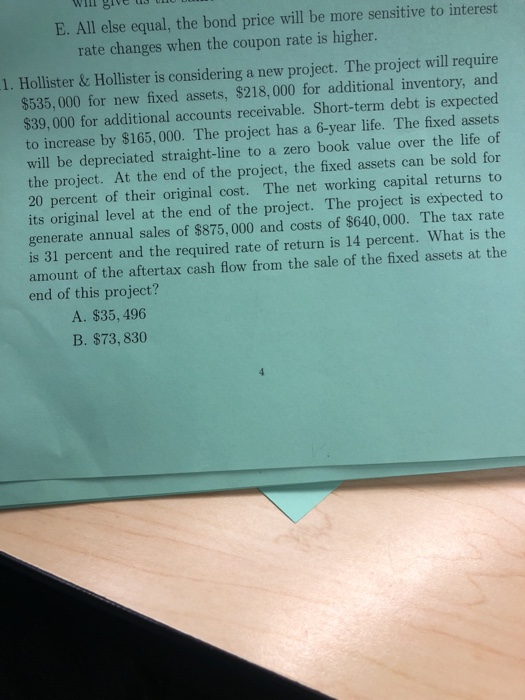

Inc., is preparing to pay its first dividend It is going to pay $0.4 , $0.60, and $1 a share over the next three years, respectively. After that, the company has stated that the annual dividend will be $1.25 per share indefinitely. What is this stock worth to you per share if you demand a 10.8 percent rate of return on stocks of this typet A. $6.67 B. $8.21 C. $10.14 D. $11.47 E. $12.03 7. An investment project costs $21, 500 and has annual cash flows of $4,500 for 6 years. What is the payback period? A. 4.78 years B. 4.91 years C. 5.12 years D. 5.40 years E. never ingwood Homes has a bond issue outstanding that pays an 8.5 percent coupon and matures in 16.5 years. The bonds have a par value of $1,000 and a market price of $944.30. Interest is paid semiannually. What is the yield to maturity? 8. A. 8.36 percent B. 8.42 percent C. 8.61 percent D. 8.74 percent E. 9.16 percent 9. You are deciding between two recurring projects. Project A requires $100,000 initial investment and runs for 5 years. Project B requires an initial investment of 80,000 and will run for 3 years. However, due to the limited managerial attention, you will need to choose one out of these two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts