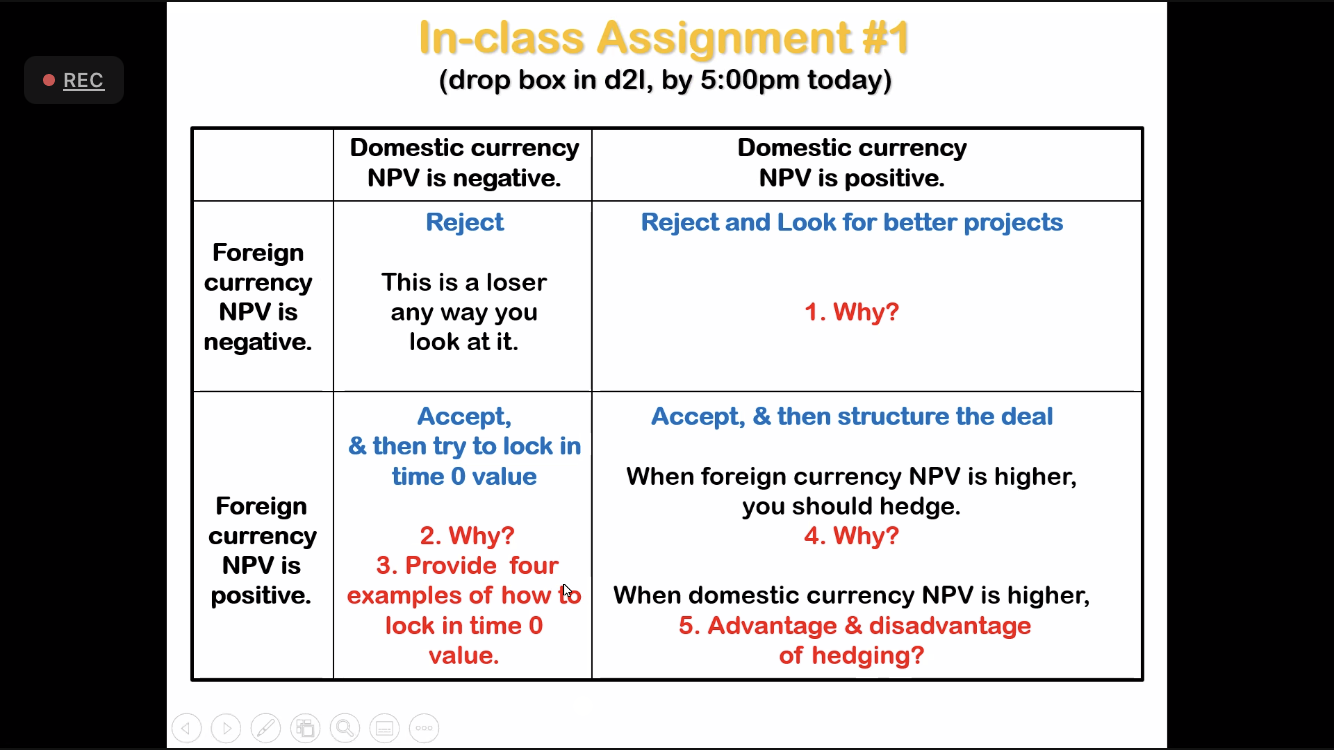

Question: In-class Assignment #1 (drop box in d21, by 5:00pm today) REC Domestic currency NPV is negative. Domestic currency NPV is positive. Reject Reject and Look

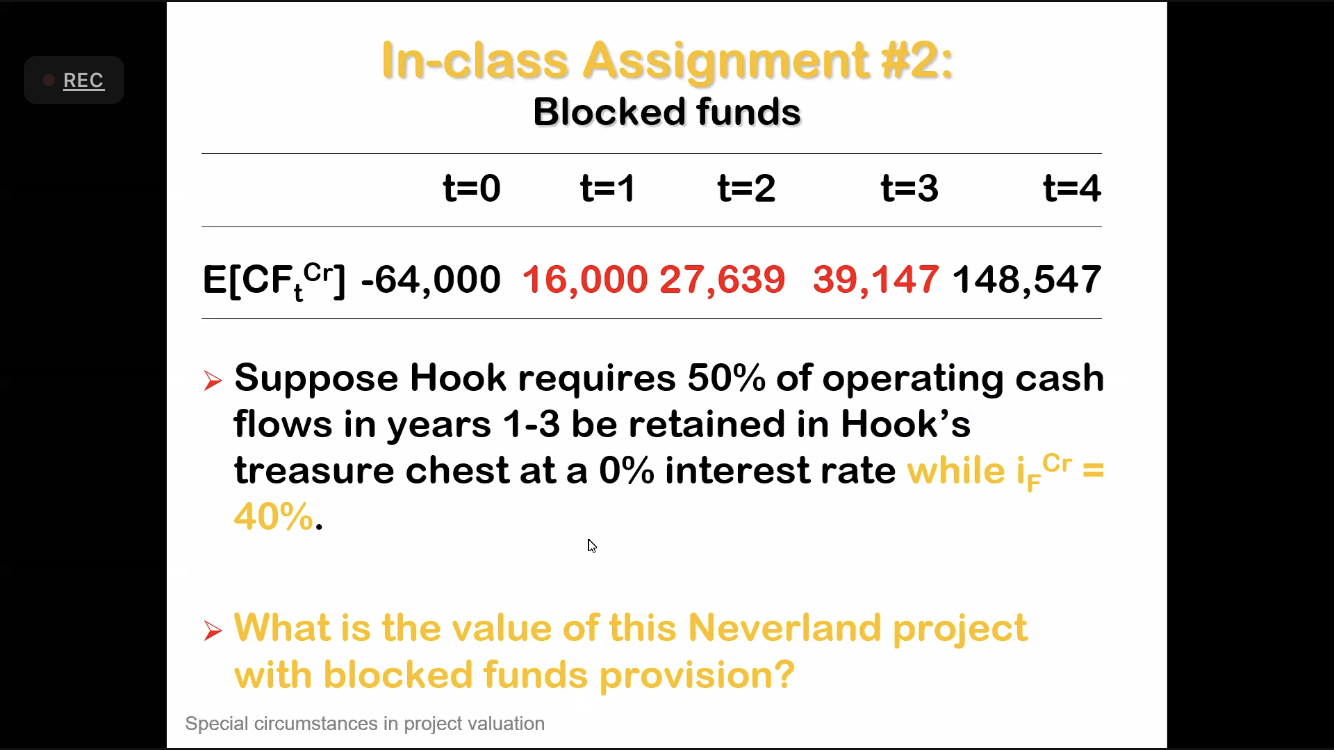

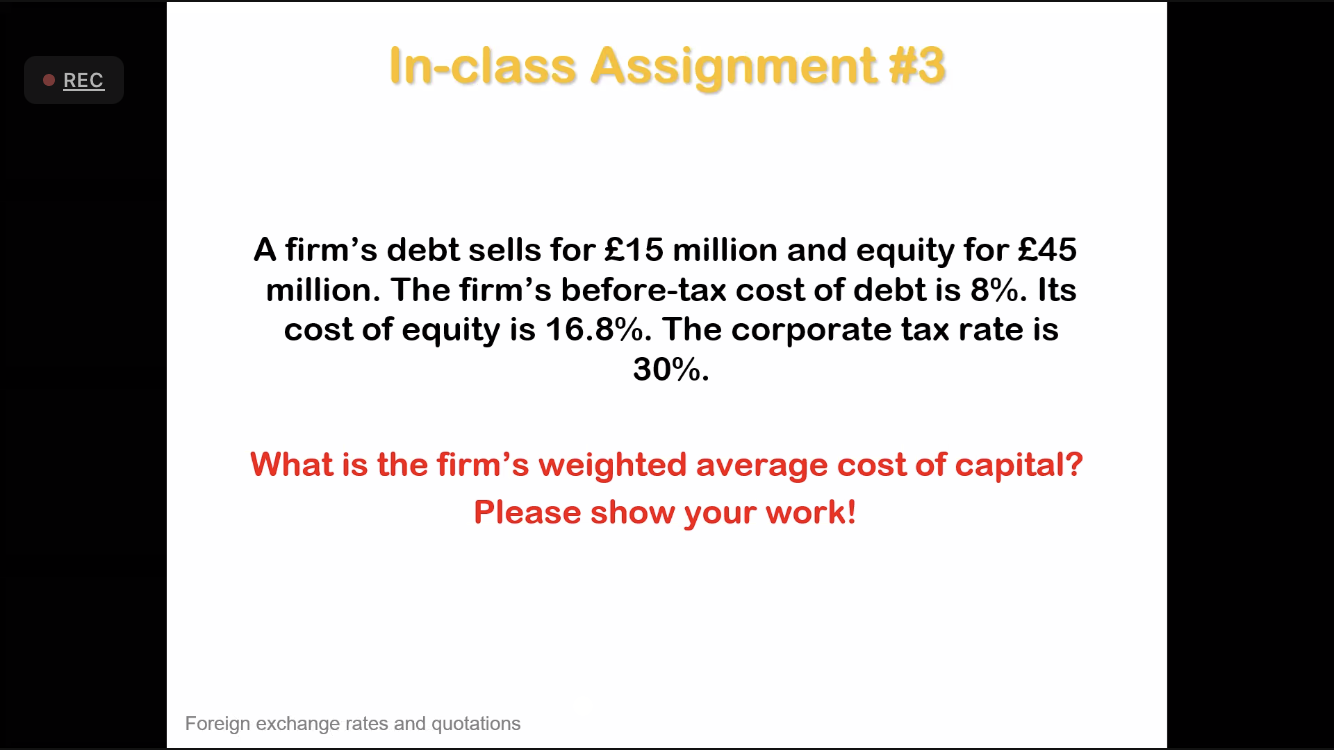

In-class Assignment #1 (drop box in d21, by 5:00pm today) REC Domestic currency NPV is negative. Domestic currency NPV is positive. Reject Reject and Look for better projects This is a loser Foreign currency NPV is negative. 1. Why? any way you look at it. Accept, & then structure the deal Accept, & then try to lock in time 0 value Foreign currency 2. Why? NPV is 3. Provide four positive. examples of how to lock in time 0 value. When foreign currency NPV is higher, you should hedge. 4. Why? When domestic currency NPV is higher, 5. Advantage & disadvantage of hedging? In-class Assignment #2: REC Blocked funds t=0 t=1 t=2 t=3 t=4 E[CF Cr] -64,000 16,000 27,639 39,147 148,547 Suppose Hook requires 50% of operating cash flows in years 1-3 be retained in Hook's treasure chest at a 0% interest rate while iFcr = 40%. > What is the value of this Neverland project with blocked funds provision? Special circumstances in project valuation In-class Assignment #3 REC A firm's debt sells for 15 million and equity for 45 million. The firm's before-tax cost of debt is 8%. Its cost of equity is 16.8%. The corporate tax rate is 30%. What is the firm's weighted average cost of capital? Please show your work! Foreign exchange rates and quotations In-class Assignment #1 (drop box in d21, by 5:00pm today) REC Domestic currency NPV is negative. Domestic currency NPV is positive. Reject Reject and Look for better projects This is a loser Foreign currency NPV is negative. 1. Why? any way you look at it. Accept, & then structure the deal Accept, & then try to lock in time 0 value Foreign currency 2. Why? NPV is 3. Provide four positive. examples of how to lock in time 0 value. When foreign currency NPV is higher, you should hedge. 4. Why? When domestic currency NPV is higher, 5. Advantage & disadvantage of hedging? In-class Assignment #2: REC Blocked funds t=0 t=1 t=2 t=3 t=4 E[CF Cr] -64,000 16,000 27,639 39,147 148,547 Suppose Hook requires 50% of operating cash flows in years 1-3 be retained in Hook's treasure chest at a 0% interest rate while iFcr = 40%. > What is the value of this Neverland project with blocked funds provision? Special circumstances in project valuation In-class Assignment #3 REC A firm's debt sells for 15 million and equity for 45 million. The firm's before-tax cost of debt is 8%. Its cost of equity is 16.8%. The corporate tax rate is 30%. What is the firm's weighted average cost of capital? Please show your work! Foreign exchange rates and quotations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts