Question: You want to replicate a protective put using 1 year T Bills and 1 year Futures contracts on the stock. The protective put includes

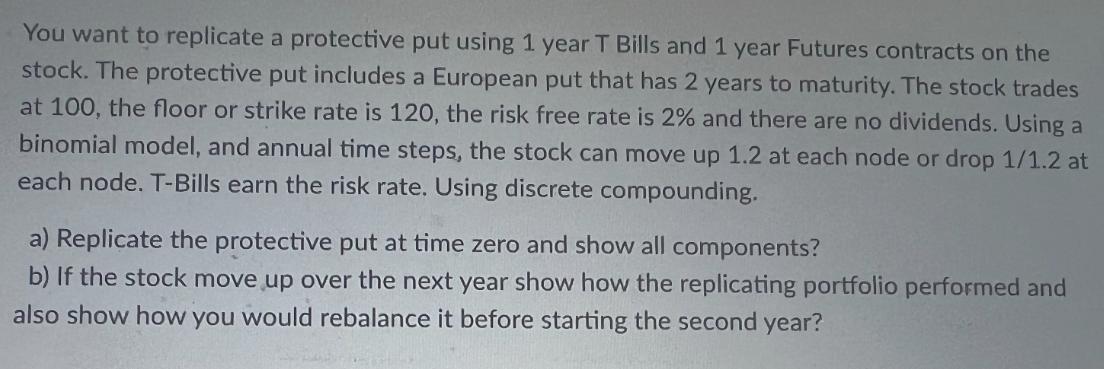

You want to replicate a protective put using 1 year T Bills and 1 year Futures contracts on the stock. The protective put includes a European put that has 2 years to maturity. The stock trades at 100, the floor or strike rate is 120, the risk free rate is 2% and there are no dividends. Using a binomial model, and annual time steps, the stock can move up 1.2 at each node or drop 1/1.2 at each node. T-Bills earn the risk rate. Using discrete compounding. a) Replicate the protective put at time zero and show all components? b) If the stock move up over the next year show how the replicating portfolio performed and also show how you would rebalance it before starting the second year?

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

SOLUTION a To replicate a protective put using Tbills and futures we need to create a portfolio that has the same cash flows as the put option at all ... View full answer

Get step-by-step solutions from verified subject matter experts