Question: INCLUDE a comparative analysis and variance report for 2017 and 2018 EXPLAINING the reasons for the variances. For example: A variance report is a comparison

INCLUDE a comparative analysis and variance report for 2017 and 2018 EXPLAINING the reasons for the variances. For example:

A variance report is a comparison between two figures: Example: Sales in 2018 = R20 000 Sales in 2019 = R25 000 What is the difference (or variance)? It is R5 000 positivein other words we can clearly see there was an increase. Remember to pay attention to whether or not the item is an income or an expense item. You also need to EXPLAIN reasons for the variance. Use your logic and business experience here. What could be a possible reason that sales went up? Did they do more marketing? Did they win a tender? Etc. Do this for either income statement or balance sheet items.

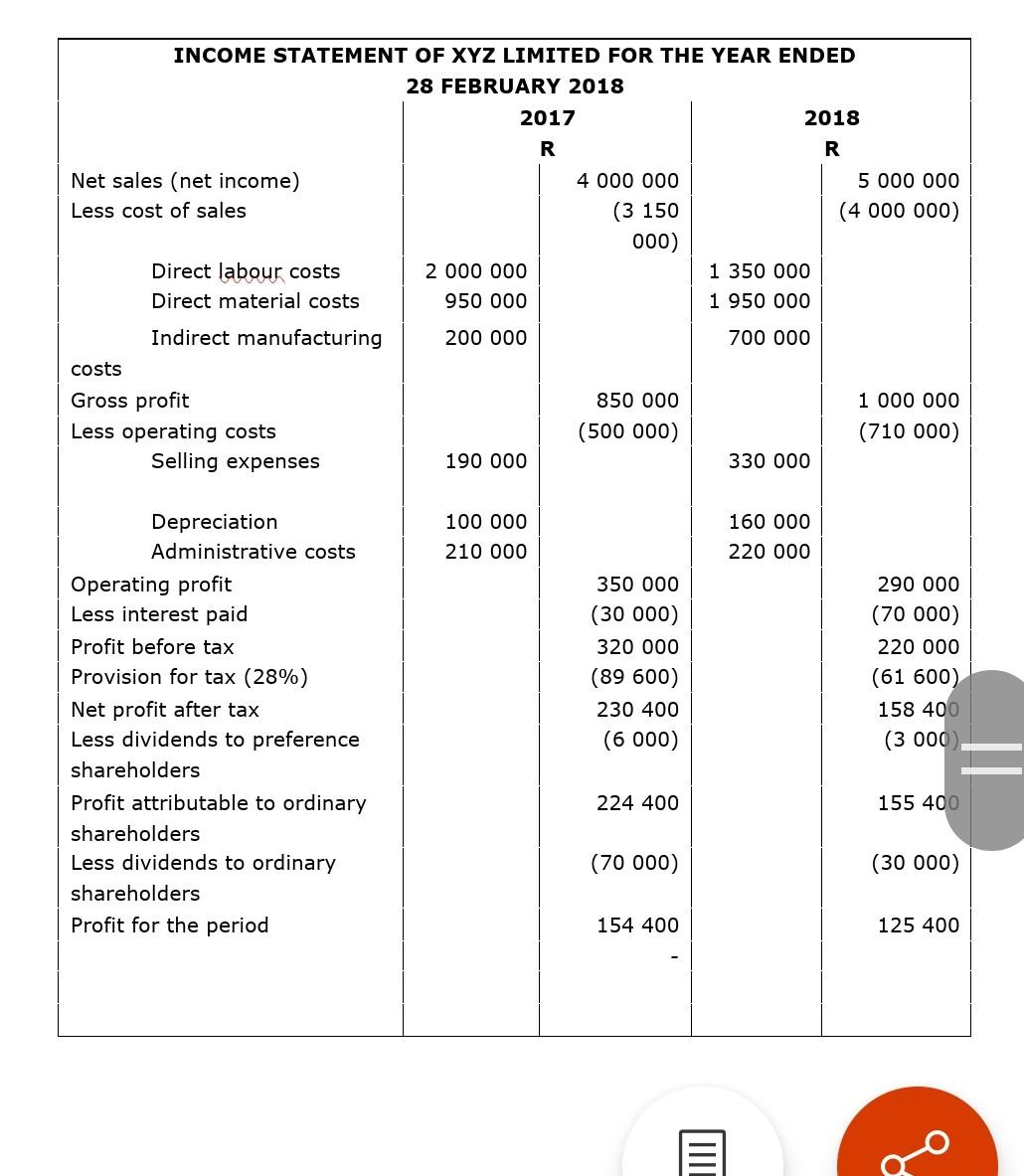

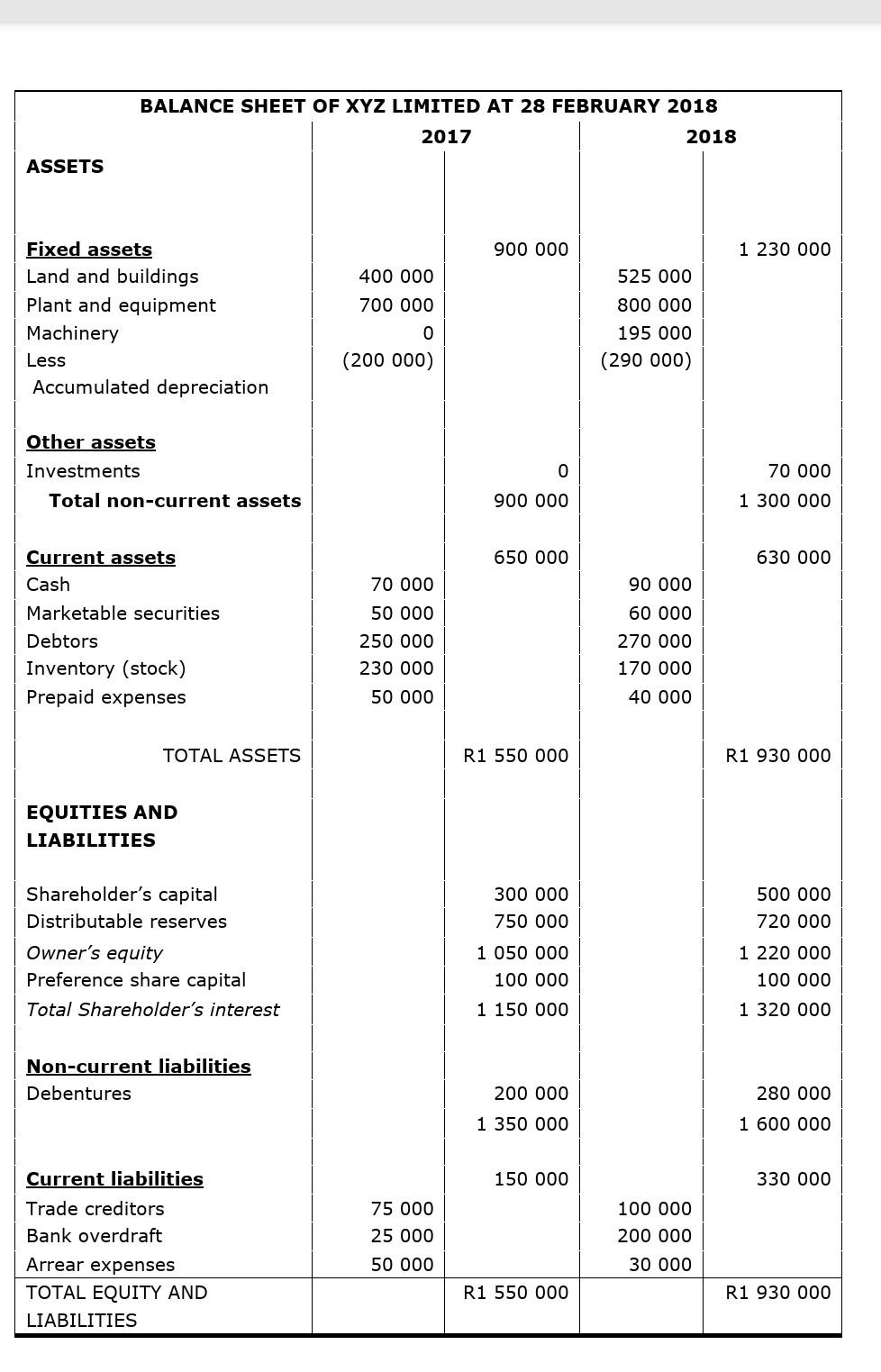

INCOME STATEMENT OF XYZ LIMITED FOR THE YEAR ENDED 28 FEBRUARY 2018 Net sales (net income) Less cost of sales Direct labour costs Direct material costs Indirect manufacturing costs Gross profit Less operating costs Selling expenses Depreciation Administrative costs Operating profit Less interest paid Profit before tax Provision for tax (28\%) Net profit after tax Less dividends to preference shareholders Profit attributable to ordinary shareholders Less dividends to ordinary shareholders Profit for the period BALANCE SHEET OF XYZ LIMITED AT 28 FEBRUARY 2018 ASSETS Fixed assets 1230000 Land and buildings Plant and equipment Machinery Less 400000 700000 0 (200000) 525000 800000 195000 (290000) Accumulated depreciation Other assets Investments 70000 Total non-current assets 1300000 Current assets Cash Marketable securities Debtors Inventory (stock) Prepaid expenses R1 930000 EQUITIES AND LIABILITIES Shareholder's capital Distributable reserves Owner's equity Preference share capital Total Shareholder's interest Non-current liabilities Debentures Current liabilities Trade creditors Bank overdraft Arrear expenses TOTAL EQUITY AND LIABILITIES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts