Question: include and explain any other ratios in your analysis table which will assist in strengthening your position for application for applying for loan from a

include and explain any other ratios in your analysis table which will assist in strengthening your position for application for applying for loan from a bank

add working for ratios inserted.

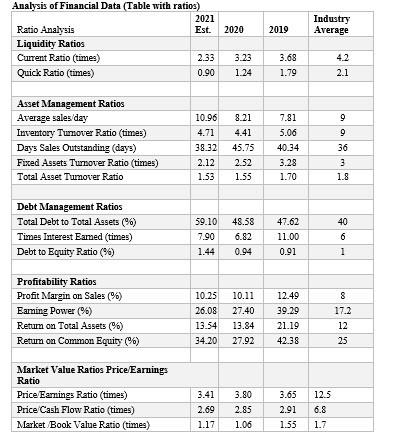

2019 Industry Average Analysis of Financial Data (Table with ratios) 2021 Ratio Analysis Est. 2020 Liquidity Ratios Current Ratio (times) 2.33 3.23 Quick Ratio (times) 0.90 1.24 3.68 1.79 4.2 2.1 Asset Management Ratios Average salesday Inventory Tumover Ratio (times) Days Sales Outstanding (days) Fixed Assets Tumover Ratio (times) Total Asset Tumover Ratio 10.96 4.71 38.32 2.12 1.53 8.21 4.41 45.75 2.52 7.81 5.06 40.34 3.28 1.70 9 9 36 3 1.8 1.55 40 Debt Management Ratios Total Debt to Total Assets (%) Times Interest Eamed (times) Debt to Equity Ratio (6) 59.10 7.90 1.44 48.58 6.82 0.94 47.62 11.00 0.91 a 1 Profitability Ratios Profit Margin on Sales (%) Earning Power ) Retum on Total Assets) Retum on Common Equity (%) 10.25 26.08 13.54 34.20 10.11 27.40 13.84 27.92 12.49 39.29 21.19 42.38 8 17.2 12 25 Market Value Ratios Price Earnings Ratio Price Earnings Ratio (times) Price Cash Flow Ratio (times) Market Book Value Ratio (times) 3.41 2.69 1.17 3.80 2.85 1.06 3.65 2.91 1.55 12.5 6.8 1.7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts