Question: Include any excel formulas used to arrive at the answer. (16-13) Current Asset Usage Policy Payne Products had $1.6 million in sales revenues in the

Include any excel formulas used to arrive at the answer.

Include any excel formulas used to arrive at the answer.

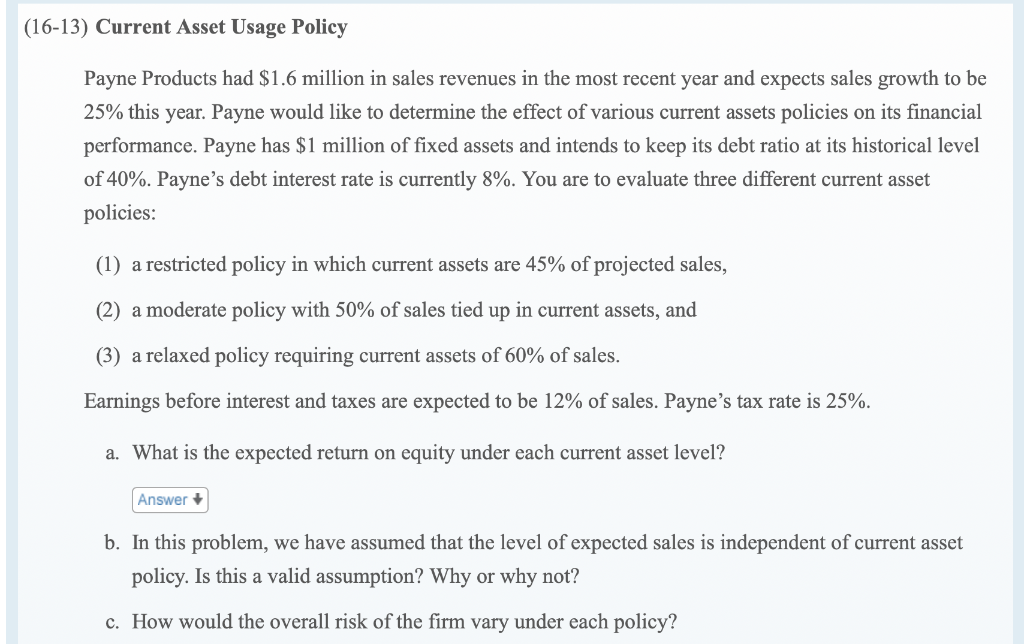

(16-13) Current Asset Usage Policy Payne Products had $1.6 million in sales revenues in the most recent year and expects sales growth to be 25% this year. Payne would like to determine the effect of various current assets policies on its financial performance. Payne has $1 million of fixed assets and intends to keep its debt ratio at its historical level of 40%. Payne's debt interest rate is currently 8%. You are to evaluate three different current asset policies: (1) a restricted policy in which current assets are 45% of projected sales, (2) a moderate policy with 50% of sales tied up in current assets, and (3) a relaxed policy requiring current assets of 60% of sales. Earnings before interest and taxes are expected to be 12% of sales. Payne's tax rate is 25%. a. What is the expected return on equity under each current asset level? Answer b. In this problem, we have assumed that the level of expected sales is independent of current asset policy. Is this a valid assumption? Why or why not? c. How would the overall risk of the firm vary under each policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts