Question: paper solution with formulas. no excel The Nantucket Nugget is unlevered and is valued at $640,000. Nantucket is currently deciding whether including debt in their

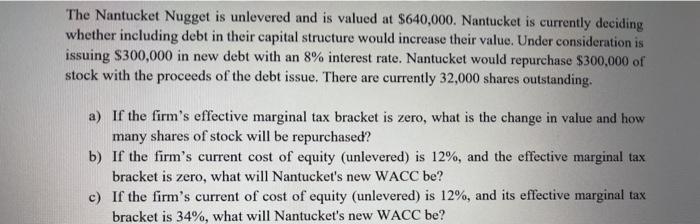

The Nantucket Nugget is unlevered and is valued at $640,000. Nantucket is currently deciding whether including debt in their capital structure would increase their value. Under consideration is issuing $300,000 in new debt with an 8% interest rate. Nantucket would repurchase $300,000 of stock with the proceeds of the debt issue. There are currently 32,000 shares outstanding. a) If the firm's effective marginal tax bracket is zero, what is the change in value and how many shares of stock will be repurchased? b) If the firm's current cost of equity (unlevered) is 12%, and the effective marginal tax bracket is zero, what will Nantucket's new WACC be? c) If the firm's current of cost of equity (unlevered) is 12%, and its effective marginal tax bracket is 34%, what will Nantucket's new WACC be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts