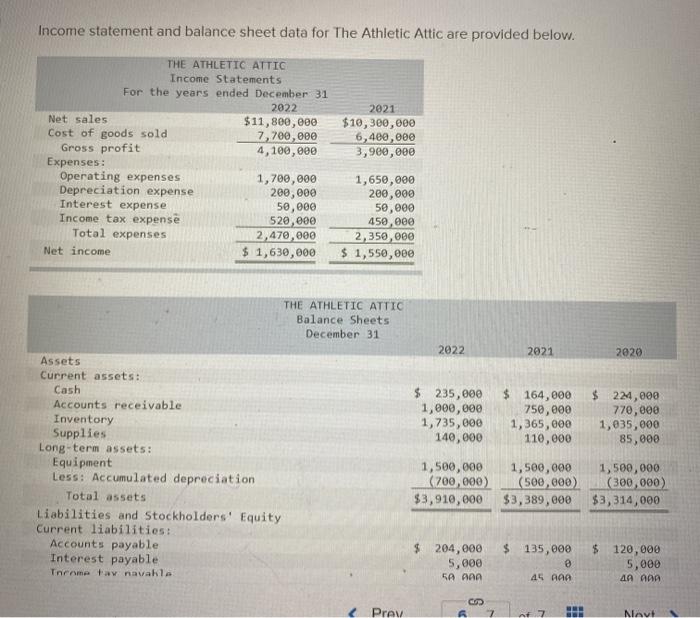

Question: Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022

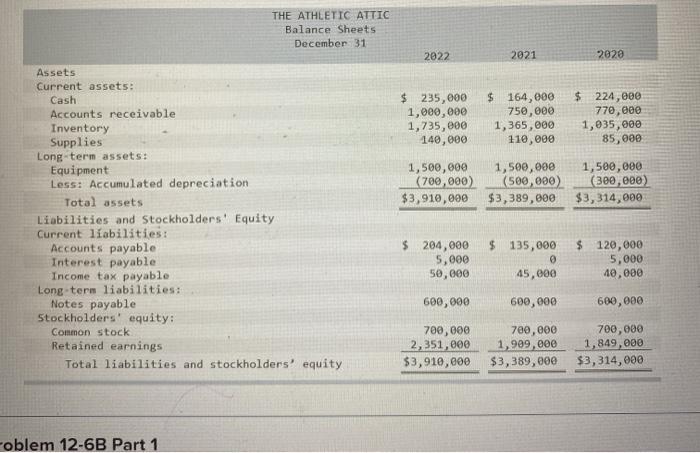

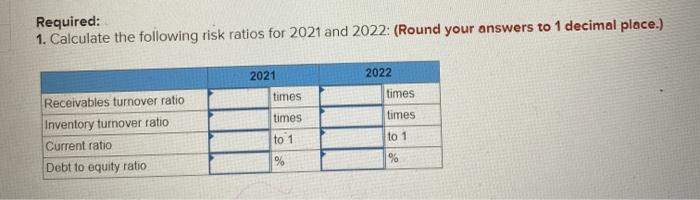

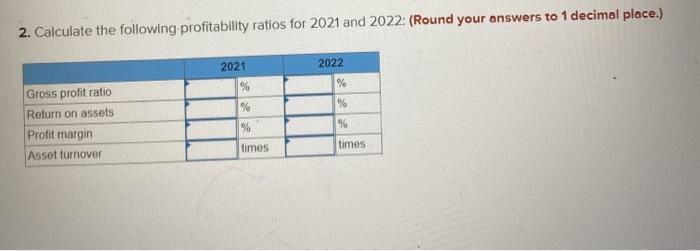

Income statement and balance sheet data for The Athletic Attic are provided below. THE ATHLETIC ATTIC Income Statements For the years ended December 31 2022 Net sales $11,800,000 Cost of goods sold 7,700,000 Gross profit 4,100,000 Expenses: Operating expenses 1,700,000 Depreciation expense 2 , Interest expense 50,000 Income tax expense 520,000 Total expenses 2,470,000 Net income $ 1,630,000 2021 $10,300,000 6,400,000 3,980,000 1,650,000 200,000 50,000 450,000 2,350,000 $ 1,550,000 THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 235,000 1,000,000 1,735,000 140,000 $ 164,000 750,000 1,365,000 110,000 $ 224,000 770,000 1,035,000 85,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Throme ay navalla 1,500,000 (700,000) $3,910,000 1,500,000 (500,000) $3,389,000 1,500,000 (300,000) $3,314,000 $ 135,000 204,000 5,000 5A AAA $ 120,000 5,000 AA AAA 45 AAA Prav Naut THE ATHLETIC ATTIC Balance Sheets December 31 2022 2021 2020 $ 235,000 1,000,000 1,735,000 140,000 $164,000 750,000 1,365,000 110,000 $ 224,000 77 , 1,035,000 85,000 1,500,000 (700,000) $3,910,000 1,500,000 (500,000) $3,389,000 1,500,000 (300,000) $3,314,000 Assets Current assets: Cash Accounts receivable Inventory Supplies Long-term assets: Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity $ 204,000 5,000 50,000 $ 135,000 0 45,000 $ 120,000 5,000 40,000 600,000 600,000 600,000 700,000 2,351,000 $3,910,000 7 700,000 1,909,000 $3,389,000 700,000 1,849,000 $3,314,000 oblem 12-6B Part 1 Required: 1. Calculate the following risk ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2022 2021 times times times Receivables turnover ratio Inventory turnover ratio Current ratio Debt to equity ratio times to 1 % to 1 2. Calculate the following profitability ratios for 2021 and 2022: (Round your answers to 1 decimal place.) 2021 2022 % % % Gross profit ratio Return on assets Profit margin Asset turnover % % % times times

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts