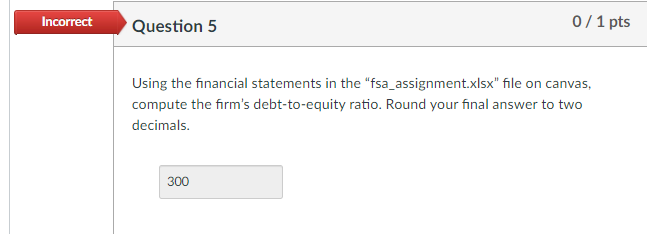

Question: Incorrect Question 5 0 / 1 pts Using the financial statements in the fsa_assignment.xlsx file on canvas, compute the firm's debt-to-equity ratio. Round your final

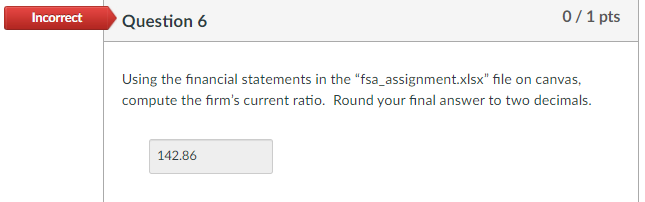

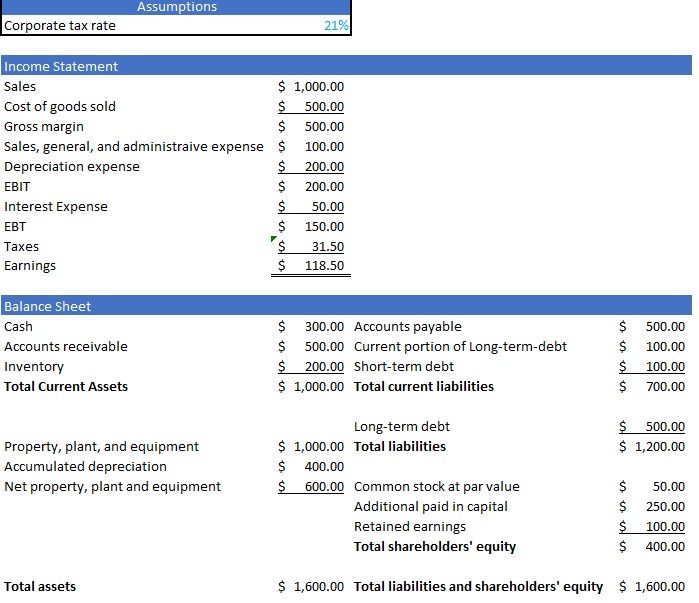

Incorrect Question 5 0 / 1 pts Using the financial statements in the "fsa_assignment.xlsx" file on canvas, compute the firm's debt-to-equity ratio. Round your final answer to two decimals. 300 Incorrect Question 6 0/1 pts Using the financial statements in the "fsa_assignment.xlsx" file on canvas, compute the firm's current ratio. Round your final answer to two decimals. 142.86 Assumptions Corporate tax rate 21% Income Statement Sales $ 1,000.00 Cost of goods sold $ 500.00 Gross margin $ 500.00 Sales, general, and administraive expense $ 100.00 Depreciation expense $ 200.00 EBIT $ 200.00 Interest Expense $ 50.00 EBT $ 150.00 Taxes 's 31.50 Earnings $ 118.50 Balance Sheet Cash Accounts receivable Inventory Total Current Assets $ 300.00 Accounts payable $ 500.00 Current portion of Long-term-debt $ 200.00 Short-term debt $ 1,000.00 Total current liabilities $ $ $ $ 500.00 100.00 100.00 700.00 $ 500.00 $ 1,200.00 Property, plant, and equipment Accumulated depreciation Net property, plant and equipment Long-term debt $ 1,000.00 Total liabilities $ 400.00 $ 600.00 Common stock at par value Additional paid in capital Retained earnings Total shareholders' equity 50.00 250.00 $ $ $ $ 100.00 400.00 Total assets $ 1,600.00 Total liabilities and shareholders' equity $ 1,600.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts