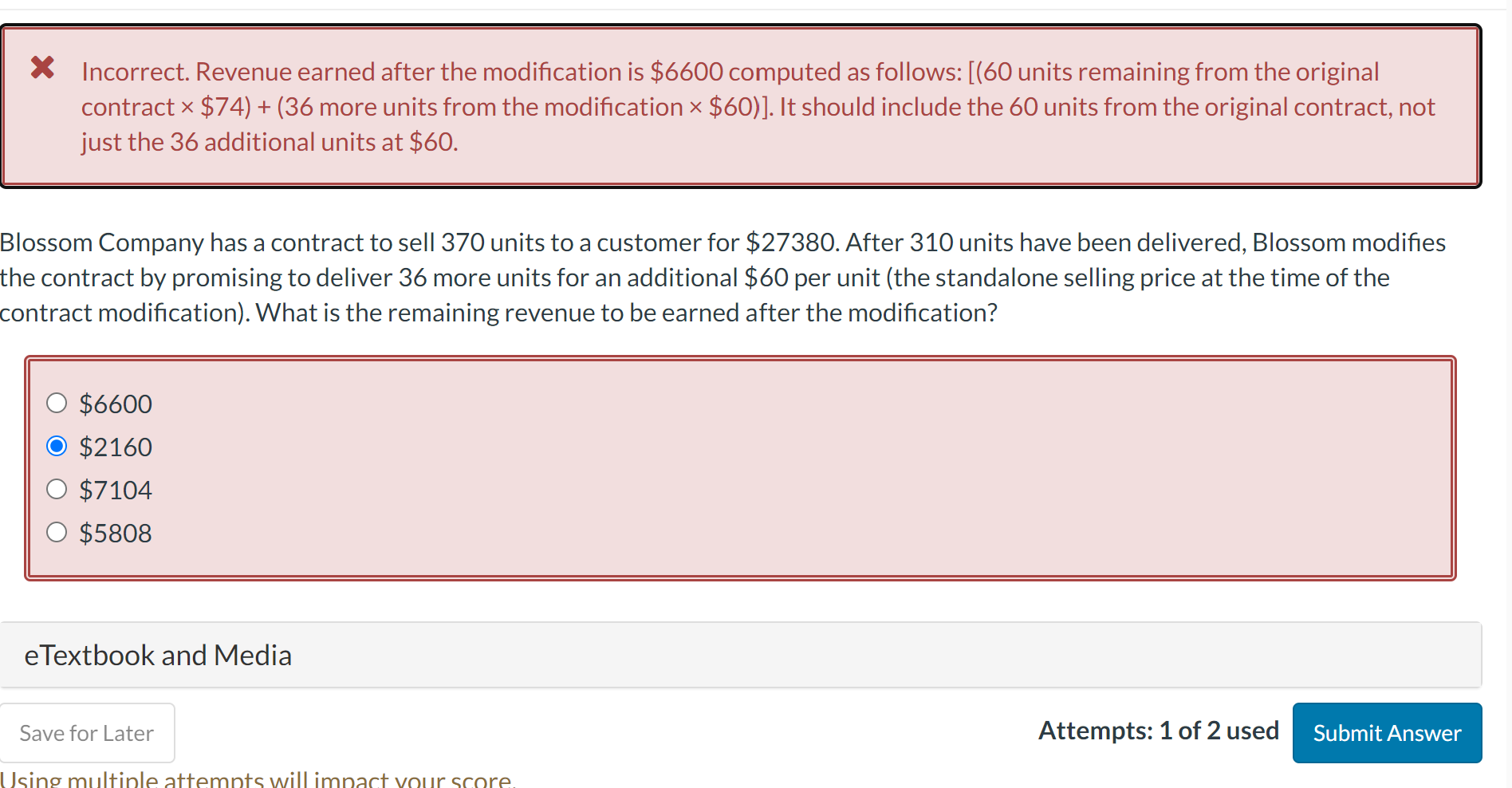

Question: * Incorrect. Revenue earned after the modification is $6600 computed as follows: [(60 units remaining from the original contract $74)+(36 more units from the modification

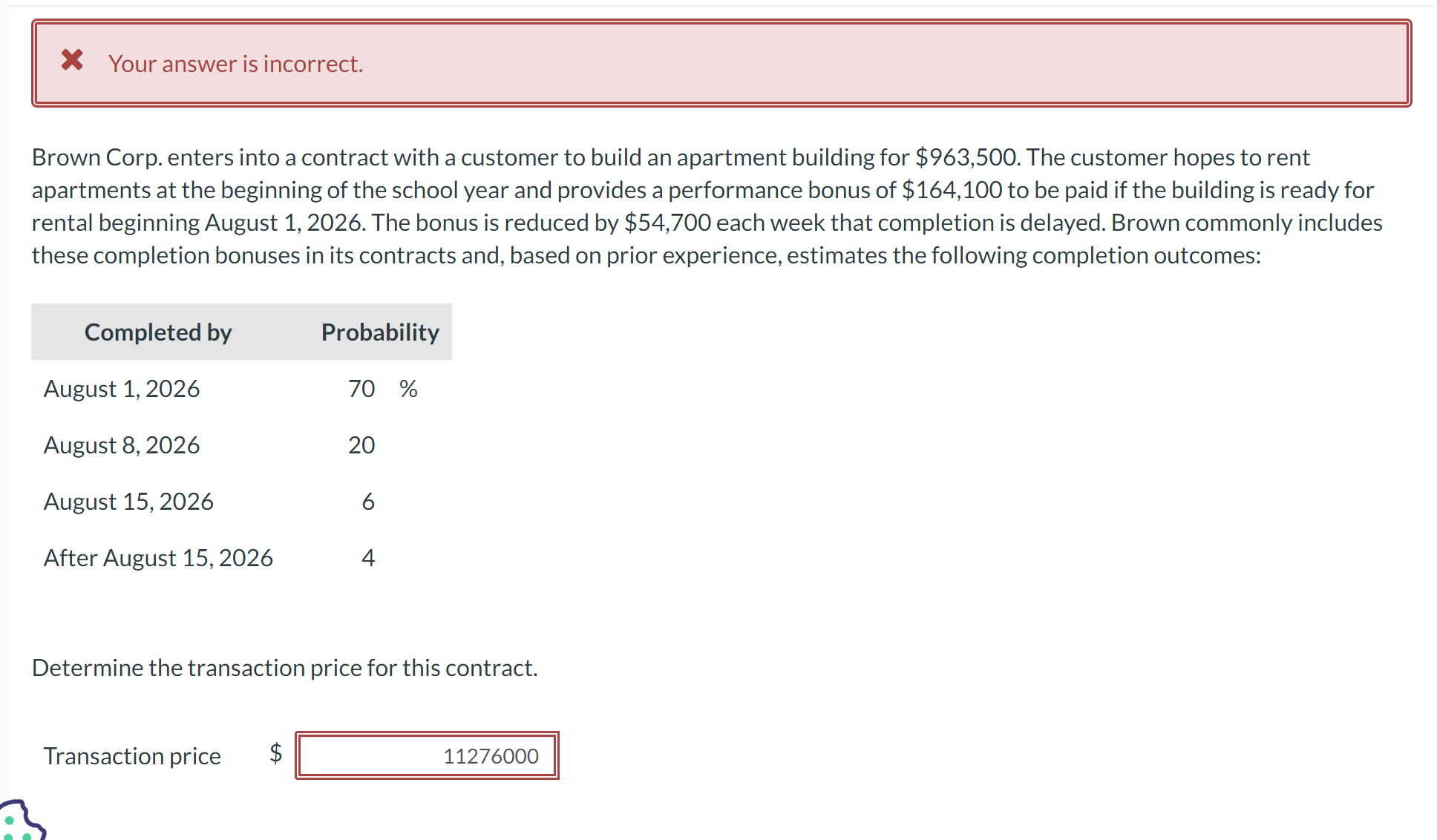

* Incorrect. Revenue earned after the modification is $6600 computed as follows: [(60 units remaining from the original contract $74)+(36 more units from the modification $60) ). It should include the 60 units from the original contract, not just the 36 additional units at $60. Blossom Company has a contract to sell 370 units to a customer for $27380. After 310 units have been delivered, Blossom modifies the contract by promising to deliver 36 more units for an additional $60 per unit (the standalone selling price at the time of the contract modification). What is the remaining revenue to be earned after the modification? $6600$2160$7104$5808 eTextbook and Media Attempts: 1 of 2 used Brown Corp. enters into a contract with a customer to build an apartment building for $963,500. The customer hopes to rent apartments at the beginning of the school year and provides a performance bonus of $164,100 to be paid if the building is ready for rental beginning August 1,2026 . The bonus is reduced by $54,700 each week that completion is delayed. Brown commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Determine the transaction price for this contract. Transaction price $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts