Question: indexes computed in part (5). attractiveness (5). s Based the analyses, comment on the relative on ranked in parts (6) and (7) s Series B

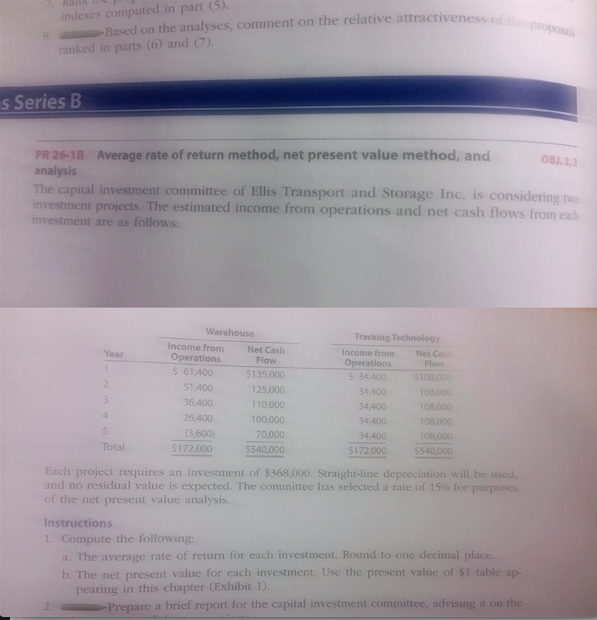

indexes computed in part (5). attractiveness (5). s Based the analyses, comment on the relative on ranked in parts (6) and (7) s Series B PR 26-18 Average rate of return method, net present value method, and OBJ, 2, 3 analysis The capital investment committee of Ellis Transport and Storage Inc. is considering two investment projects. The estimated income from operations and net cash flows from each investment are as follows Tracking Technology Net Cash Operations Flow operations $135,000 51,400 110,000 (3,600) S 172,000 S172009 S540009 Each project requires an investment of $368,000. Straight-line depreciation will be used and no residual value is expected. The committee has selected a rate of 15% for purposes of the net present value analysis. Instructions 1. Compute the following: a. The average rate of return for each investment. Round to one decimal place. b The net present value for each investment. Use the present value of s1 table ap pearing in this chapter (Exhibit 1) 2. Prepare a brief report for the capital investment committee, advising it on the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts