Question: Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each

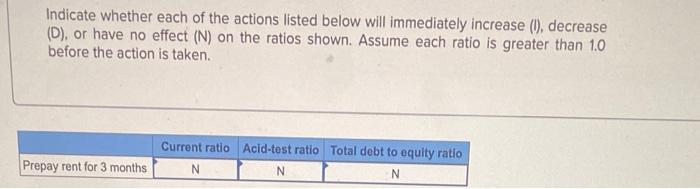

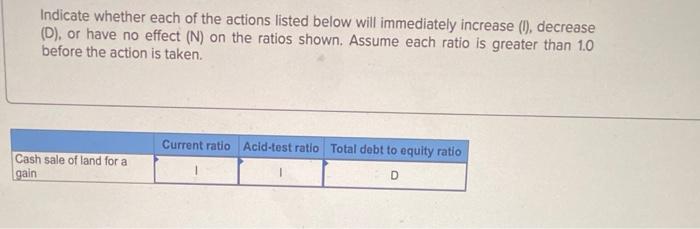

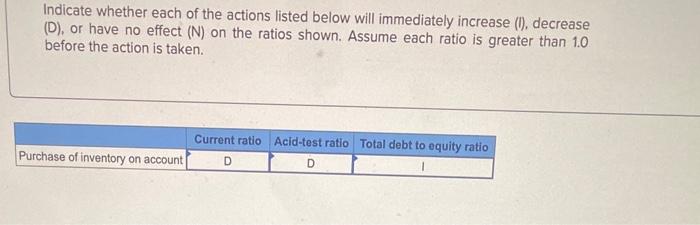

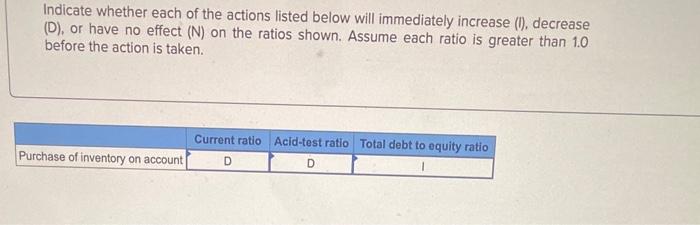

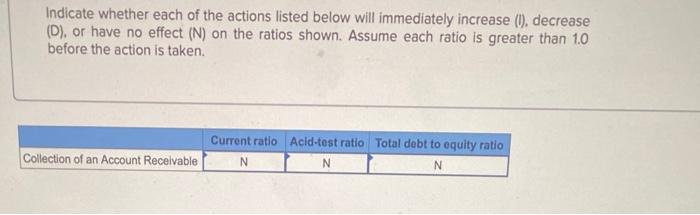

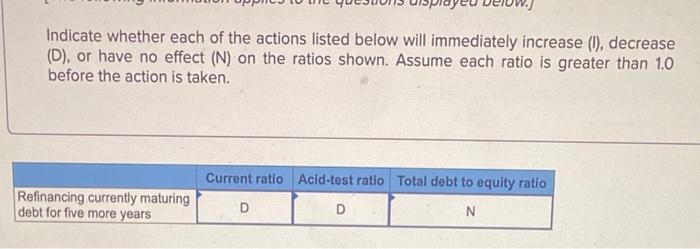

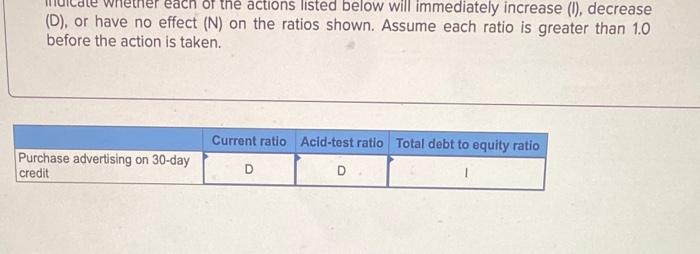

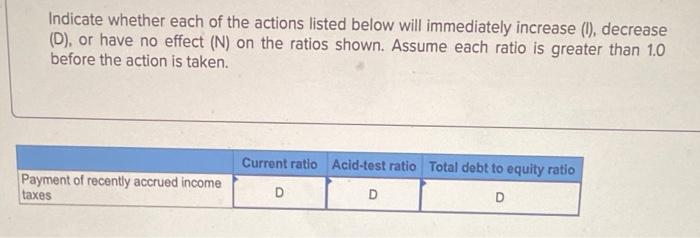

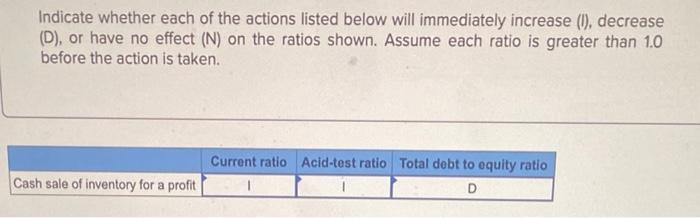

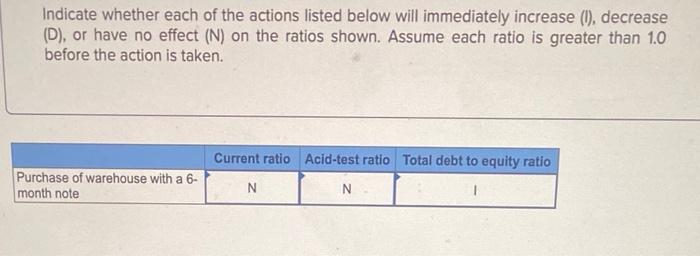

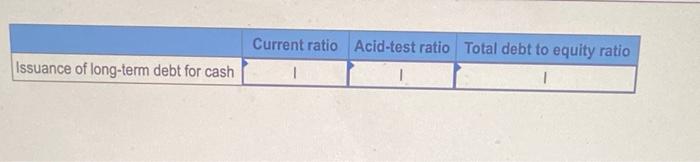

Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to oquity ratio N N N Prepay rent for 3 months Indicate whether each of the actions listed below will immediately increase (I), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio Cash sale of land for a gain D Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Purchase of inventory on account Current ratio Acid-test ratio Total debt to equity ratio D D Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Purchase of inventory on account Current ratio Acid-test ratio Total debt to equity ratio D D Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio N N N Collection of an Account Receivable Indicate whether each of the actions listed below will immediately increase (0), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio Refinancing currently maturing debt for five more years D D N each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Purchase advertising on 30-day credit Current ratio Acid-test ratio Total debt to equity ratio D D Indicate whether each of the actions listed below will immediately increase (I), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio Payment of recently accrued income taxes D D D Indicate whether each of the actions listed below will immediately increase (I), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio D Cash sale of inventory for a profit Indicate whether each of the actions listed below will immediately increase (1), decrease (D), or have no effect (N) on the ratios shown. Assume each ratio is greater than 1.0 before the action is taken. Current ratio Acid-test ratio Total debt to equity ratio Purchase of warehouse with a 6- month note N N Current ratio Acid-test ratio Total debt to equity ratio Issuance of long-term debt for cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts