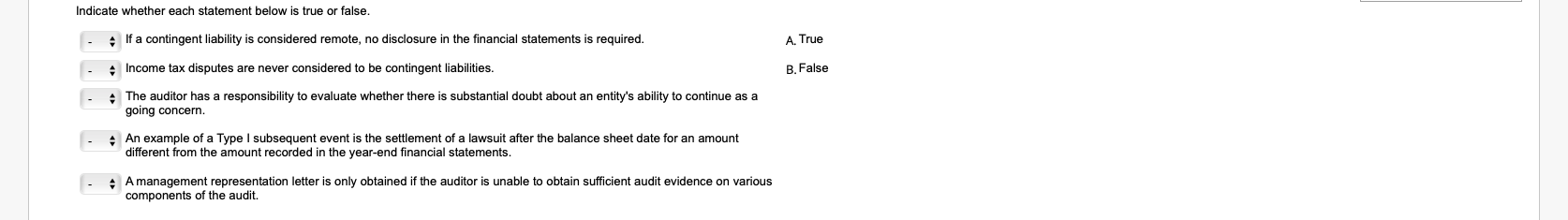

Question: Indicate whether each statement below is true or false. - If a contingent liability is considered remote, no disclosure in the financial statements is required.

Indicate whether each statement below is true or false. - If a contingent liability is considered remote, no disclosure in the financial statements is required. A. True Income tax disputes are never considered to be contingent liabilities. B. False The auditor has a responsibility to evaluate whether there is substantial doubt about an entity's ability to continue as a going concern. An example of a Type I subsequent event is the settlement of a lawsuit after the balance sheet date for an amount different from the amount recorded in the year-end financial statements - A management representation letter is only obtained if the auditor is unable to obtain sufficient audit evidence on various components of the audit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts