Question: Indicate whether each statement is true or false. 1. A partnership agreement can be oral or written 2. A partnership may adopt any tax year

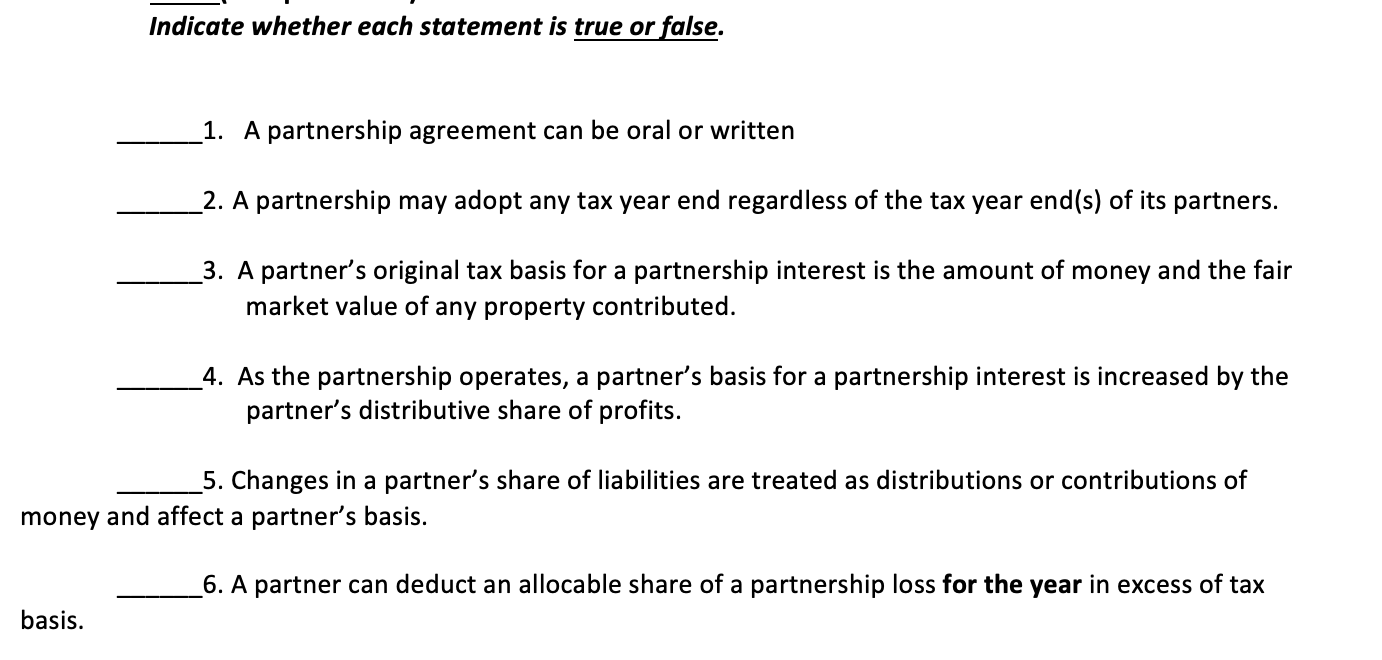

Indicate whether each statement is true or false. 1. A partnership agreement can be oral or written 2. A partnership may adopt any tax year end regardless of the tax year end(s) of its partners. 3. A partner's original tax basis for a partnership interest is the amount of money and the fair market value of any property contributed. 4. As the partnership operates, a partner's basis for a partnership interest is increased by the partner's distributive share of profits. 5. Changes in a partner's share of liabilities are treated as distributions or contributions of money and affect a partner's basis. 6. A partner can deduct an allocable share of a partnership loss for the year in excess of tax basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts