Question: Indicate whether the following statemanks are True or False regarding the rules designed to limit the tax benefis a taxparer may obtain from a tax

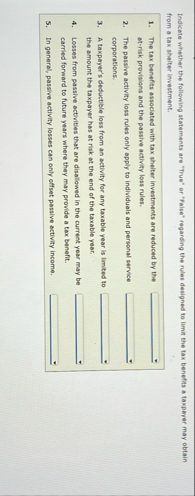

Indicate whether the following statemanks are "True" or "False" regarding the rules designed to limit the tax benefis a taxparer may obtain from a tax sheiter investment.

The tax benefiss associated with tax shelter investments are reduced by the atrisk provisiond and the passlve activify loss rules.

The passive activity loss rules only apply to individuals and personal service corporations.

A taxpayer's deductible loss from an activity for any taxable year is limited to the amount the taxpayer has at risk at the end of the taxable year.

Losses from passive activities that are disallowed in the current year may be carried forward to future years where they may provide a tax benent.

In general, passive activity losses can only offset passive activity income.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock