Question: Indicate whether the following statements are TRUE or FALSE (provide your justification at the end). . In the presence of uncertainty, the Gordon Growth Model

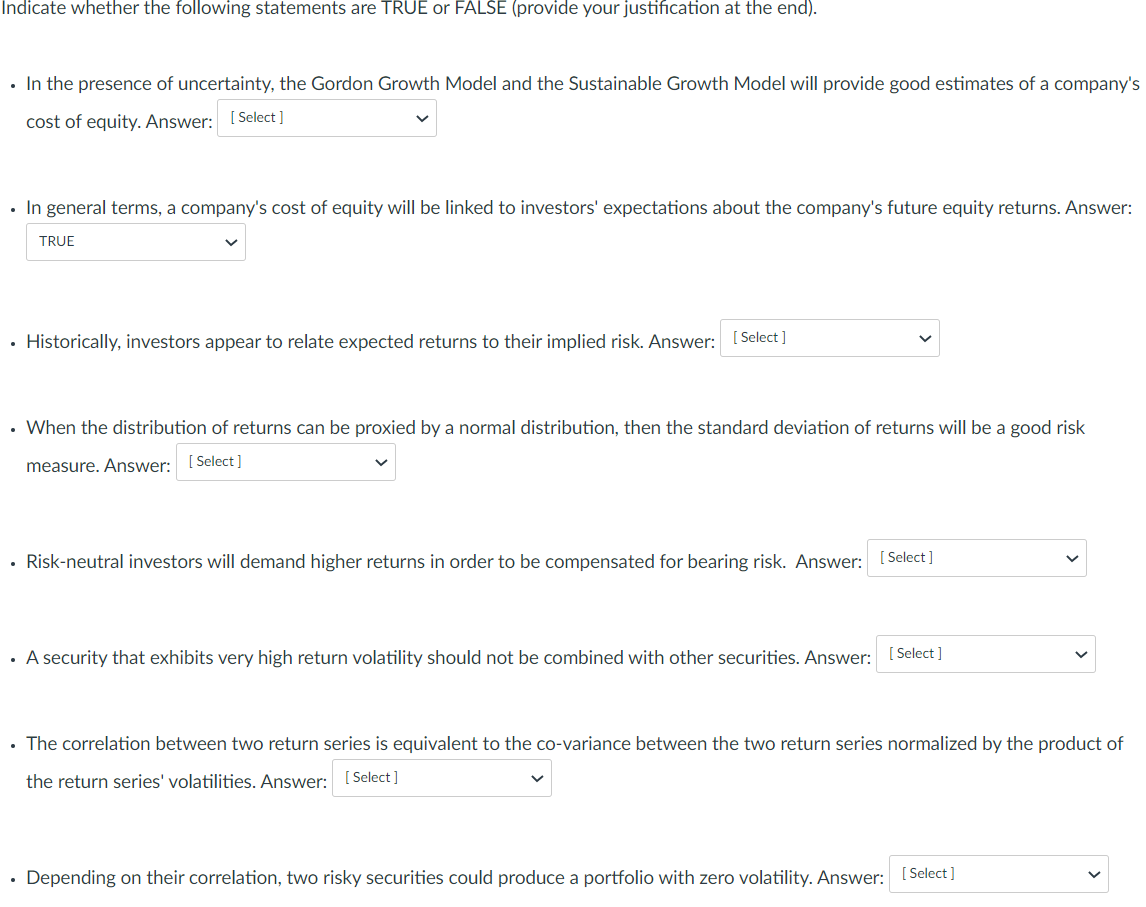

Indicate whether the following statements are TRUE or FALSE (provide your justification at the end). . In the presence of uncertainty, the Gordon Growth Model and the Sustainable Growth Model will provide good estimates of a company's cost of equity. Answer: [Select] . In general terms, a company's cost of equity will be linked to investors' expectations about the company's future equity returns. Answer: TRUE . Historically, investors appear to relate expected returns to their implied risk. Answer: [Select] . When the distribution of returns can be proxied by a normal distribution, then the standard deviation of returns will be a good risk measure. Answer: [Select] . Risk-neutral investors will demand higher returns in order to be compensated for bearing risk. Answer: [Select] A security that exhibits very high return volatility should not be combined with other securities. Answer: [Select ] The correlation between two return series is equivalent to the co-variance between the two return series normalized by the product of the return series' volatilities. Answer: [Select] Depending on their correlation, two risky securities could produce a portfolio with zero volatility. Answer: [Select]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts