Question: Indicate whether the statement is true or false. 36. An S corporation does not recognize a loss when distributing assets that are worth less than

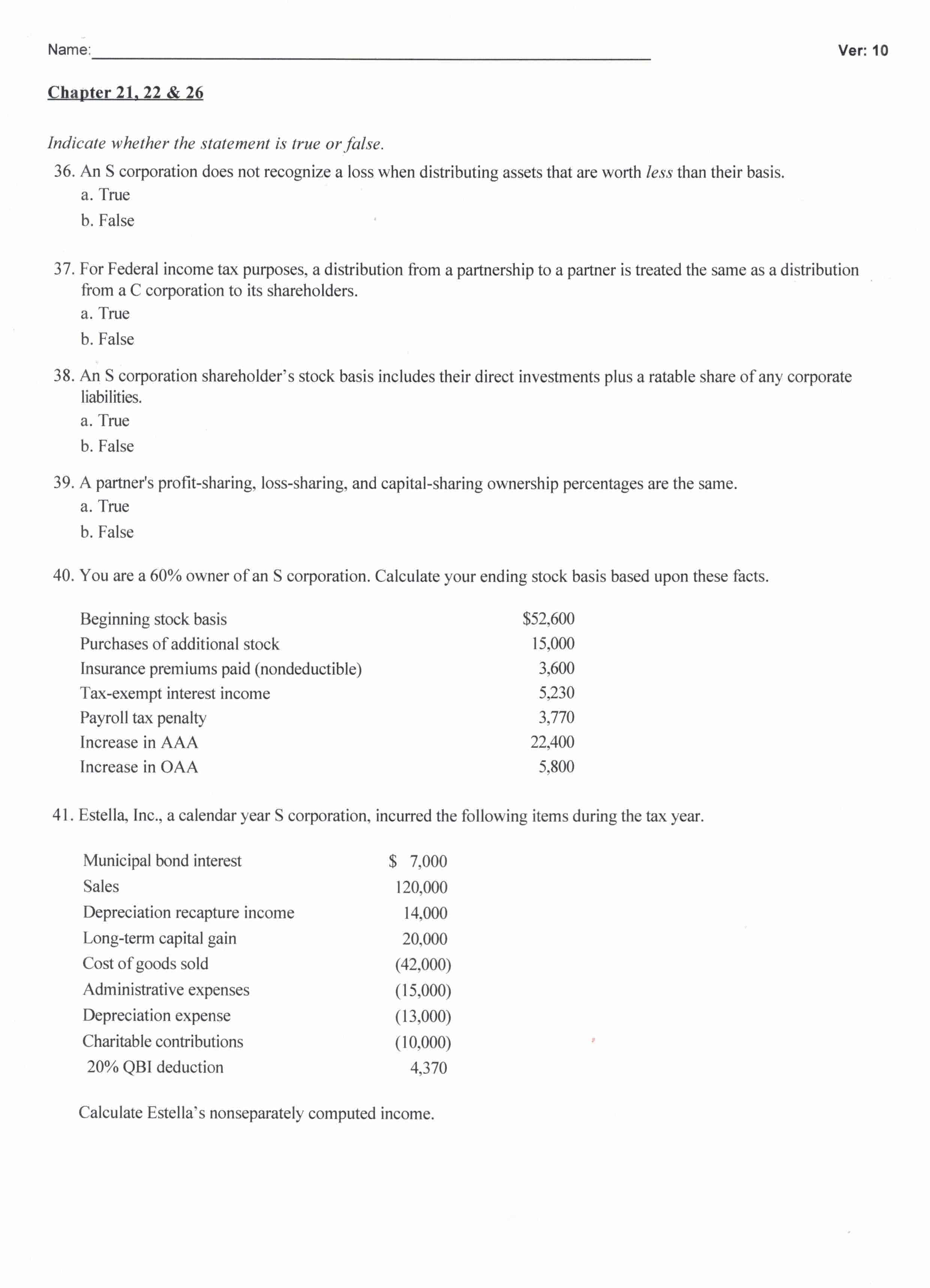

Indicate whether the statement is true or false. 36. An S corporation does not recognize a loss when distributing assets that are worth less than their basis. a. True b. False 37. For Federal income tax purposes, a distribution from a partnership to a partner is treated the same as a distribution from a C corporation to its shareholders. a. True b. False 38. An S corporation shareholder's stock basis includes their direct investments plus a ratable share of any corporate liabilities. a. True b. False 39. A partner's profit-sharing, loss-sharing, and capital-sharing ownership percentages are the same. a. True b. False 40. You are a 60% owner of an S corporation. Calculate your ending stock basis based upon these facts. 41. Estella, Inc., a calendar year S corporation, incurred the following items during the tax year. Calculate Estella's nonseparately computed income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts