Question: INDITEX IS ZARA. PLEASE USE THAT COLUMN AS A REPRESENTATION OF ZARAS DATA! The table below is calculated from the Exhibit 6 of Zara (INDITEX)

INDITEX IS ZARA. PLEASE USE THAT COLUMN AS A REPRESENTATION OF ZARAS DATA!

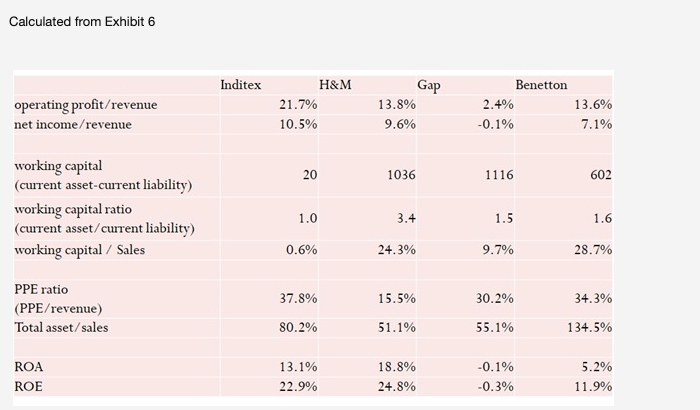

The table below is calculated from the Exhibit 6 of Zara (INDITEX) case. What is the worst interpretation regarding the competitive advantage of Zara (i.e., Inditex) based on the table below?

Calculated from Exhibit 6

(a) To interpret Zaras competitive advantage, it is better to compare Zara with H&M, rather than GAP or Benetton because Zara and H&M is in the same strategic group.

(b) Zara has competitive advantages in terms of operating efficiency compared to H&M.

(c) Zara has competitive advantages in terms of working capital compared to H&M.

(d) Zara has competitive advantages in terms of fixed-asset capital compared to H&M.

Calculated from Exhibit 6 Inditex operating profit/revenue net income/revenue H&M 21.7% 10.5% Gap 13.8% 9.6% Benetton 2.4% -0.1% 13.6% 7.1% 20 1036 1116 602 working capital (current asset-current liability) working capital ratio (current asset/current liability) working capital / Sales 1.0 3.4 1.5 1.6 0.6% 24.3% 9.7% 28.7% 37.8% 15.5% 30.2% 34.3% PPE ratio (PPE/revenue) Total asset/sales 80.2% 51.1% 55.1% 134.5% ROA ROE 13.1% 22.9% 18.8% 24.8% -0.1% -0.3% 5.2% 11.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts