Question: INDUSTRIAL ORGANIZATION AND ANTITRUST POLICY Econ class Reference - Modern Industrial Organization by Dennis W. Carlton and Jeffrey M. Perloff, 4th edition, 2015. Question 1

INDUSTRIAL ORGANIZATION AND ANTITRUST POLICY Econ class

Reference - Modern Industrial Organization by Dennis W. Carlton and Jeffrey M. Perloff, 4th edition, 2015.

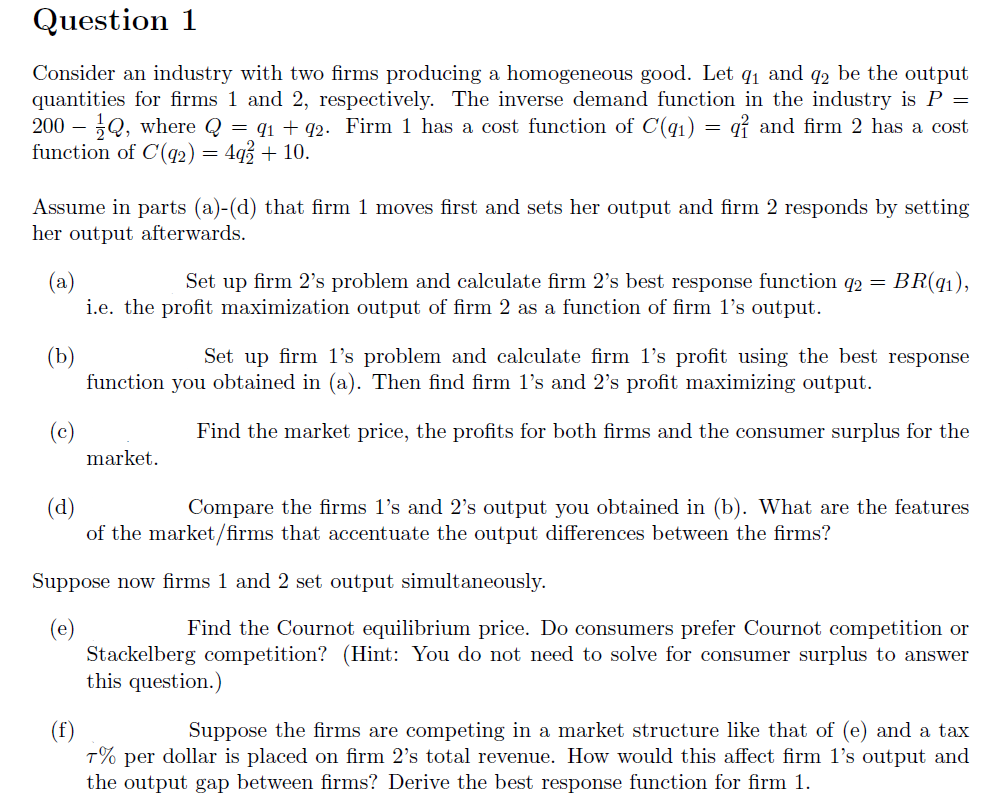

Question 1 Consider an industry with two rms producing a homogeneous good. Let ql and Q? be the output quantities for rms 1 and 2, respectively. The inverse demand function in the industry is P = 200 %Q, where Q = q1 + 9'2. Firm 1 has a cost function of 0031) = q? and rm 2 has a cost function of C(qg) = in + 10. Assume in parts (a)-(d) that rm 1 moves rst and sets her output and rm 2 responds by setting her output afterwards. (a) Set up rm 2's problem and calculate rm 2's best response function 9'2 2 BR(q1), i.e. the prot maximization output of rm 2 as a function of rm 1's output. (b) Set up rm 1's problem and calculate rm 1's prot using the best response fmetion you obtained in (a). Then nd rm 1's and 2's prot maximizing output. (c) _ Find the market price, the prots for both rms and the consumer surplus for the market. (d) Compare the rms 1's and 2's output you obtained in (b). What are the features of the market / rms that accentuate the output differences between the rms? Suppose now rms 1 and 2 set output simultaneously. (e) Find the Cournot equilibrium price. Do consumers prefer Cournot competition or Stackelberg competition? (Hint: You do not need to solve for consumer surplus to answer this question.) (f) _ Suppose the rms are competing in a market structure like that of (e) and a tax 7% per dollar is placed on rm 2's total revenue. How would this aect rm 1's output and the output gap between rms? Derive the best response fmetion for rm 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts