Question: 1. The Salisbury Corporation is considering four mutually exclusive alternatives for a major capital investment project. All alternatives have a useful life of 10

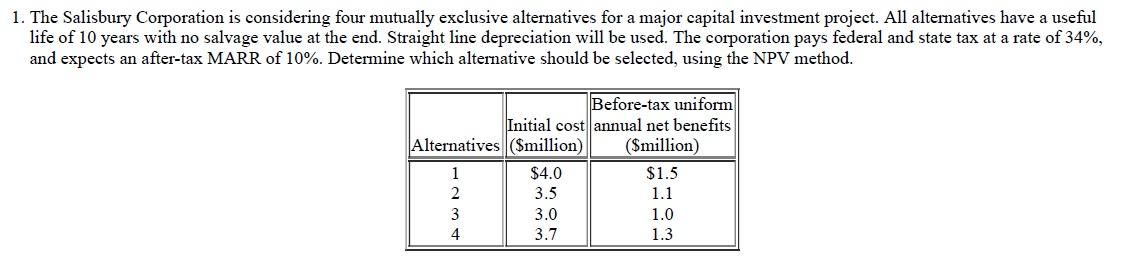

1. The Salisbury Corporation is considering four mutually exclusive alternatives for a major capital investment project. All alternatives have a useful life of 10 years with no salvage value at the end. Straight line depreciation will be used. The corporation pays federal and state tax at a rate of 34%, and expects an after-tax MARR of 10%. Determine which alternative should be selected, using the NPV method. Before-tax uniform Initial cost annual net benefits Alternatives ($million) ($million) 1 3 4 $4.0 3.5 3.0 3.7 $1.5 1.1 LE 1.0 1.3

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Answer To determine which alternative should be selected using the Net Present Value NPV method we f... View full answer

Get step-by-step solutions from verified subject matter experts