Question: Infinity Inc, a U.S. based company, will receive 1,000,000 in 180 days. Infinity also has payables due in 180 days of 1,200,000. Today's spot rate

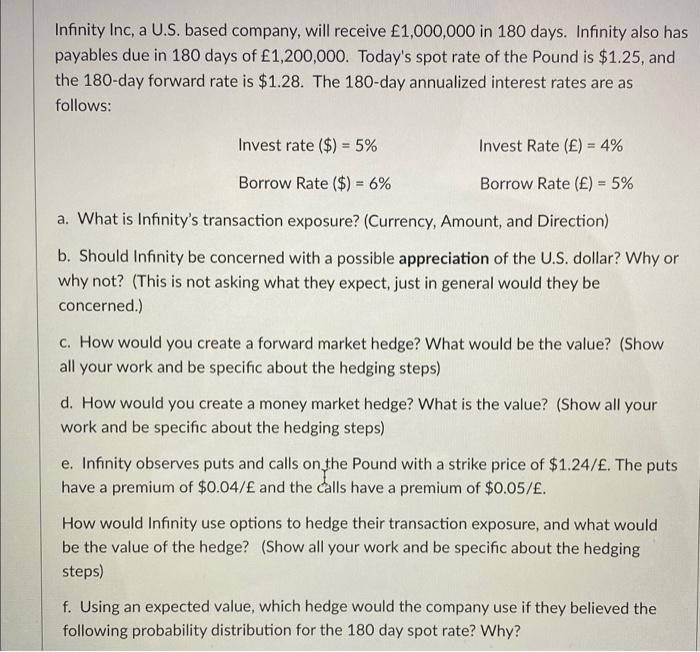

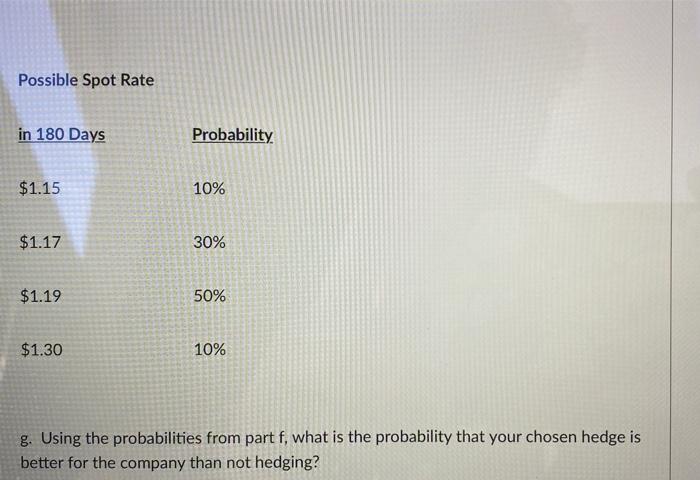

Infinity Inc, a U.S. based company, will receive 1,000,000 in 180 days. Infinity also has payables due in 180 days of 1,200,000. Today's spot rate of the Pound is $1.25, and the 180-day forward rate is $1.28. The 180-day annualized interest rates are as follows: Invest rate ($) = 5% Invest Rate () = 4% Borrow Rate ($) = 6% Borrow Rate () = 5% a. What is Infinity's transaction exposure? (Currency, Amount, and Direction) b. Should Infinity be concerned with a possible appreciation of the U.S. dollar? Why or why not? (This is not asking what they expect, just in general would they be concerned.) c. How would you create a forward market hedge? What would be the value? (Show all your work and be specific about the hedging steps) d. How would you create a money market hedge? What is the value? (Show all your work and be specific about the hedging steps) e. Infinity observes puts and calls on the Pound with a strike price of $1.24/. The puts have a premium of $0.04/ and the calls have a premium of $0.05/. How would Infinity use options to hedge their transaction exposure, and what would be the value of the hedge? (Show all your work and be specific about the hedging steps) f. Using an expected value, which hedge would the company use if they believed the following probability distribution for the 180 day spot rate? Why? Possible Spot Rate in 180 Days Probability $1.15 10% $1.17 30% $1.19 50% $1.30 10% g. Using the probabilities from part f, what is the probability that your chosen hedge is better for the company than not hedging

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts