Question: Please don't copy from the wrong answers in chegg, as I received multiple incorrect answers already! Also, please prioritize e,f,g, although solving all of them

Please don't copy from the wrong answers in chegg, as I received multiple incorrect answers already! Also, please prioritize e,f,g, although solving all of them would be ideal. If you copy from other sources, or make just absolutely silly calculation errors from not reading the question properly, I would have to give you a dislike and possibly report. Thank you, and I hope you could understand.

The question is mainly related to course materials about spot rates, and its connection to present value and getting the yield spread. Hope this helps.

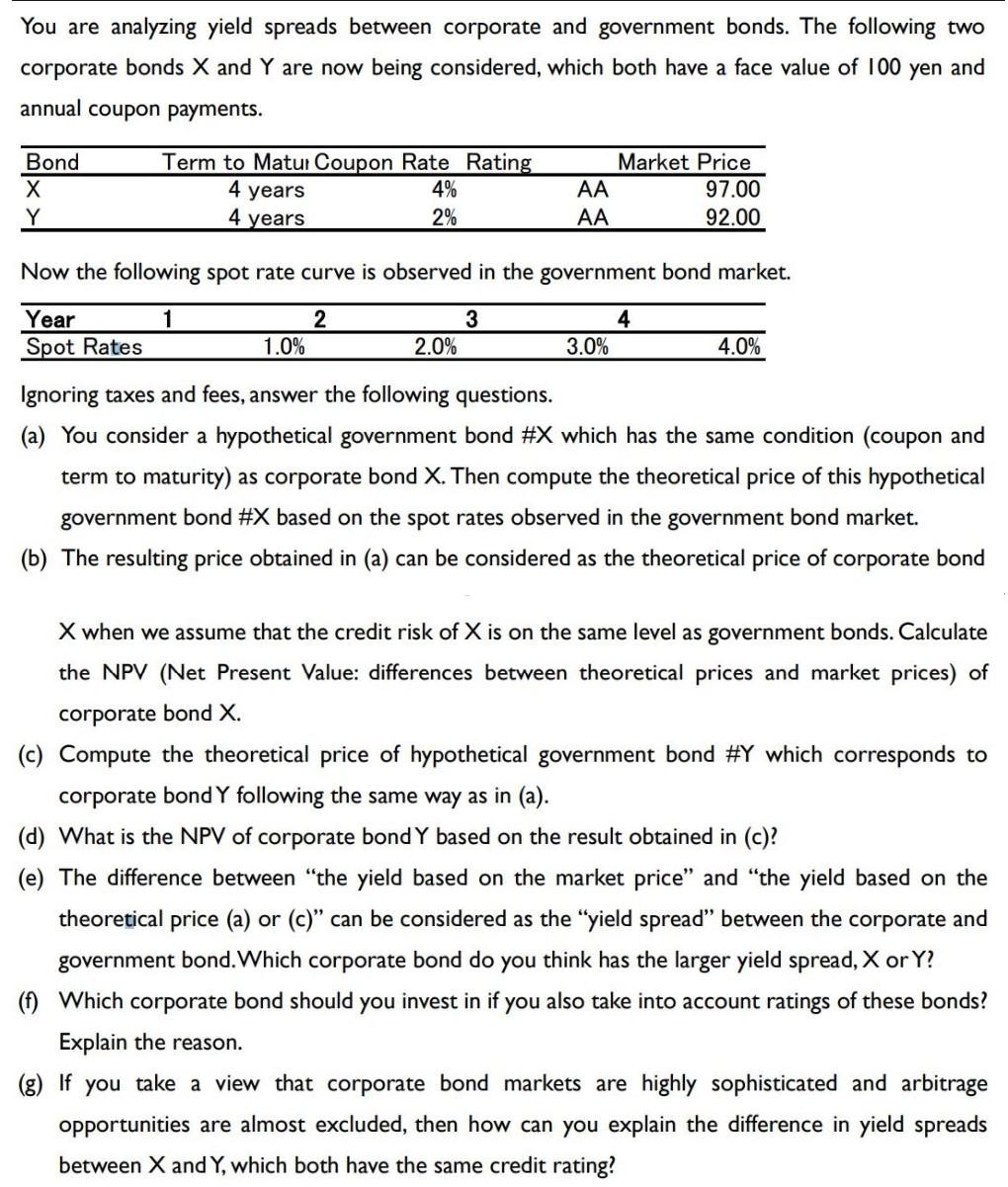

You are analyzing yield spreads between corporate and government bonds. The following two corporate bonds X and Y are now being considered, which both have a face value of 100 yen and annual coupon payments. Now the following spot rate curve is observed in the government bond market. Ignoring taxes and fees, answer the following questions. (a) You consider a hypothetical government bond \#X which has the same condition (coupon and term to maturity) as corporate bond X. Then compute the theoretical price of this hypothetical government bond \#X based on the spot rates observed in the government bond market. (b) The resulting price obtained in (a) can be considered as the theoretical price of corporate bond X when we assume that the credit risk of X is on the same level as government bonds. Calculate the NPV (Net Present Value: differences between theoretical prices and market prices) of corporate bond X. (c) Compute the theoretical price of hypothetical government bond \#Y which corresponds to corporate bond Y following the same way as in (a). (d) What is the NPV of corporate bond Y based on the result obtained in (c)? (e) The difference between "the yield based on the market price" and "the yield based on the theoretical price (a) or (c)" can be considered as the "yield spread" between the corporate and government bond.Which corporate bond do you think has the larger yield spread, X or Y ? (f) Which corporate bond should you invest in if you also take into account ratings of these bonds? Explain the reason. (g) If you take a view that corporate bond markets are highly sophisticated and arbitrage opportunities are almost excluded, then how can you explain the difference in yield spreads between X and Y, which both have the same credit rating

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts