Question: info is complete any missing can be assumed (3) Determine the capitalized cost of a research laboratory which requires Php 5,000,000 for original construction Php

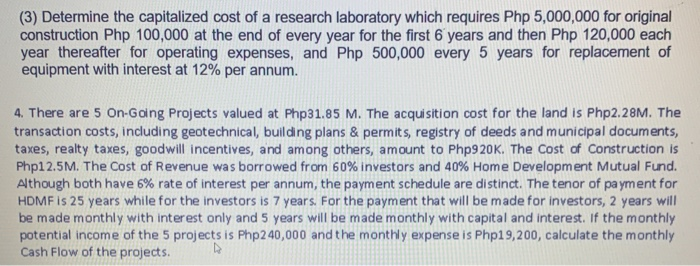

(3) Determine the capitalized cost of a research laboratory which requires Php 5,000,000 for original construction Php 100,000 at the end of every year for the first 6 years and then Php 120,000 each year thereafter for operating expenses, and Php 500,000 every 5 years for replacement of equipment with interest at 12% per annum. 4. There are 5 On-Going Projects valued at Php31.85 M. The acquisition cost for the land is Php2.28M. The transaction costs, including geotechnical, building plans & permits, registry of deeds and municipal documents, taxes, realty taxes, goodwill incentives, and among others, amount to Php9 20K. The cost of construction is Php12.5M. The cost of Revenue was borrowed from 60% investors and 40% Home Development Mutual Fund. Although both have 6% rate of interest per annum, the payment schedule are distinct. The tenor of payment for HDMF is 25 years while for the investors is 7 years. For the payment that will be made for investors, 2 years will be made monthly with interest only and 5 years will be made monthly with capital and interest. If the monthly potential income of the 5 projects is Php240,000 and the monthly expense is Php19, 200, calculate the monthly Cash Flow of the projects. (3) Determine the capitalized cost of a research laboratory which requires Php 5,000,000 for original construction Php 100,000 at the end of every year for the first 6 years and then Php 120,000 each year thereafter for operating expenses, and Php 500,000 every 5 years for replacement of equipment with interest at 12% per annum. 4. There are 5 On-Going Projects valued at Php31.85 M. The acquisition cost for the land is Php2.28M. The transaction costs, including geotechnical, building plans & permits, registry of deeds and municipal documents, taxes, realty taxes, goodwill incentives, and among others, amount to Php9 20K. The cost of construction is Php12.5M. The cost of Revenue was borrowed from 60% investors and 40% Home Development Mutual Fund. Although both have 6% rate of interest per annum, the payment schedule are distinct. The tenor of payment for HDMF is 25 years while for the investors is 7 years. For the payment that will be made for investors, 2 years will be made monthly with interest only and 5 years will be made monthly with capital and interest. If the monthly potential income of the 5 projects is Php240,000 and the monthly expense is Php19, 200, calculate the monthly Cash Flow of the projects

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts