Question: info needed on first three pictures, question is on the last picture Project Financial Benefit Analysis Frequently used measures Return on Assets (ROA) Net Income

info needed on first three pictures, question is on the last picture

info needed on first three pictures, question is on the last picture

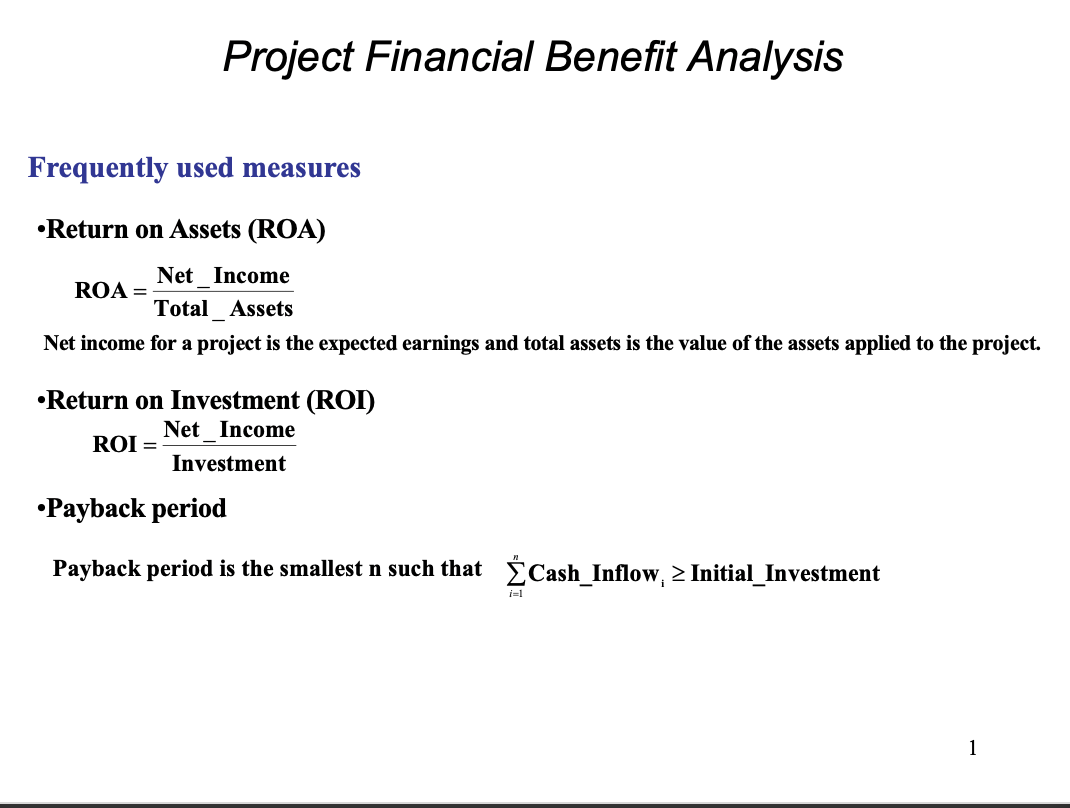

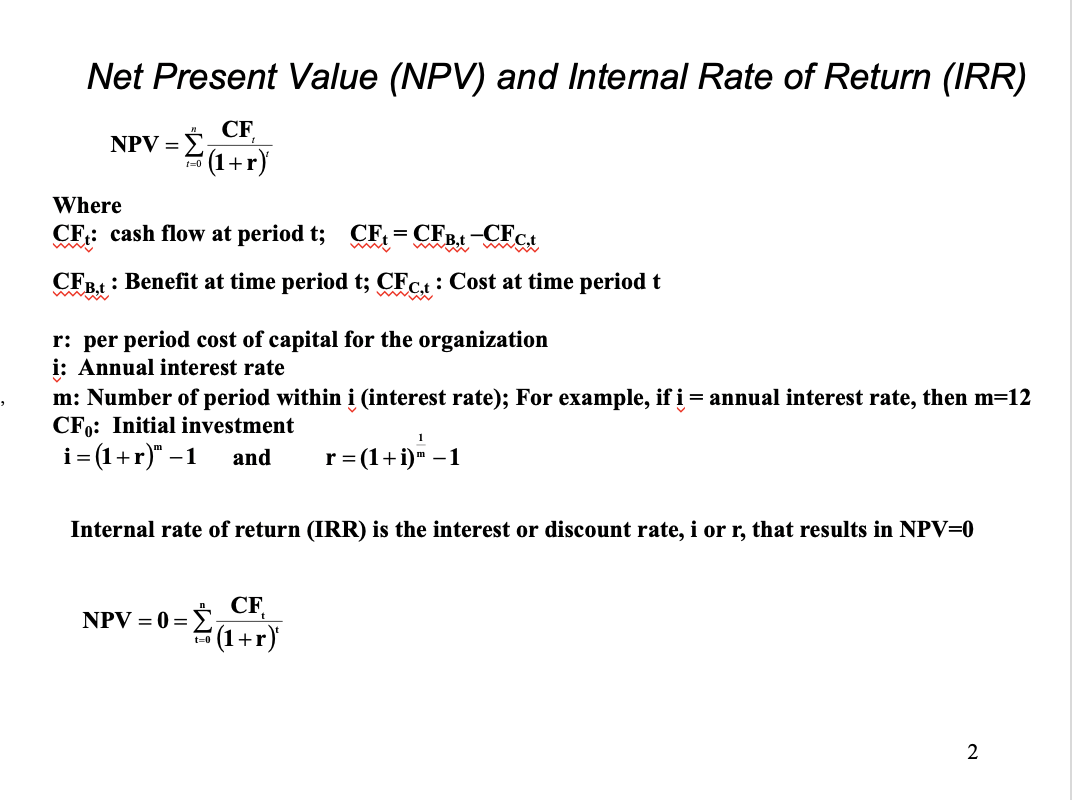

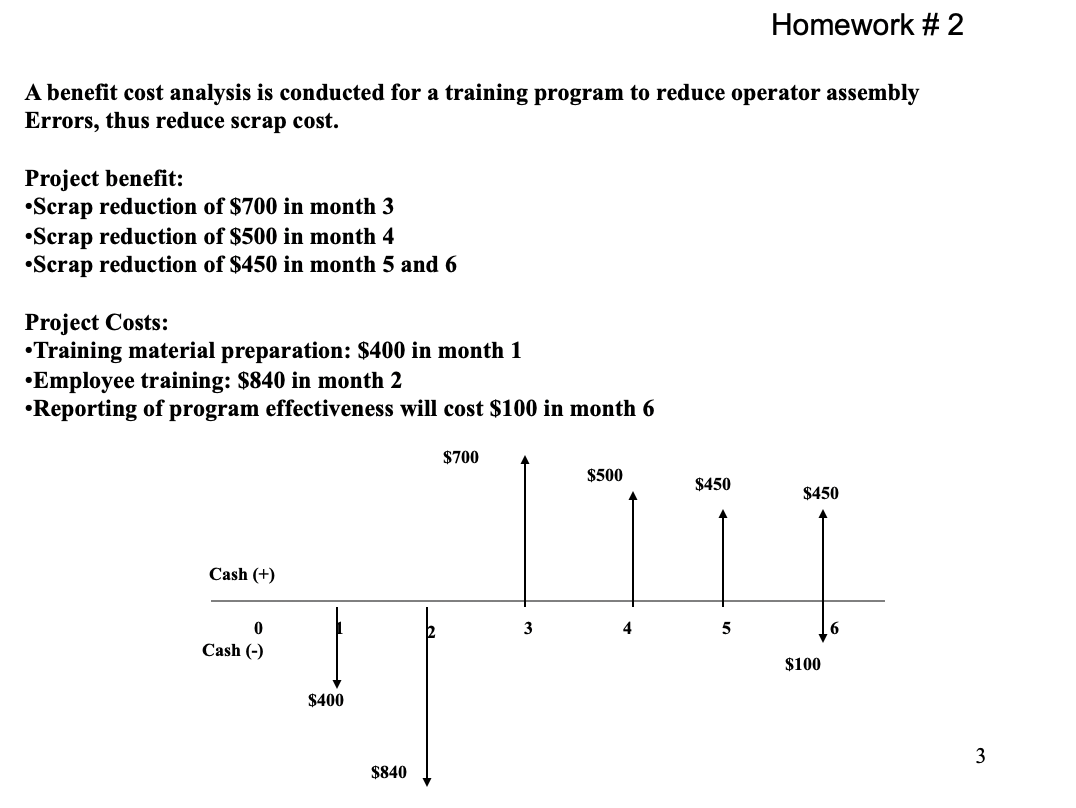

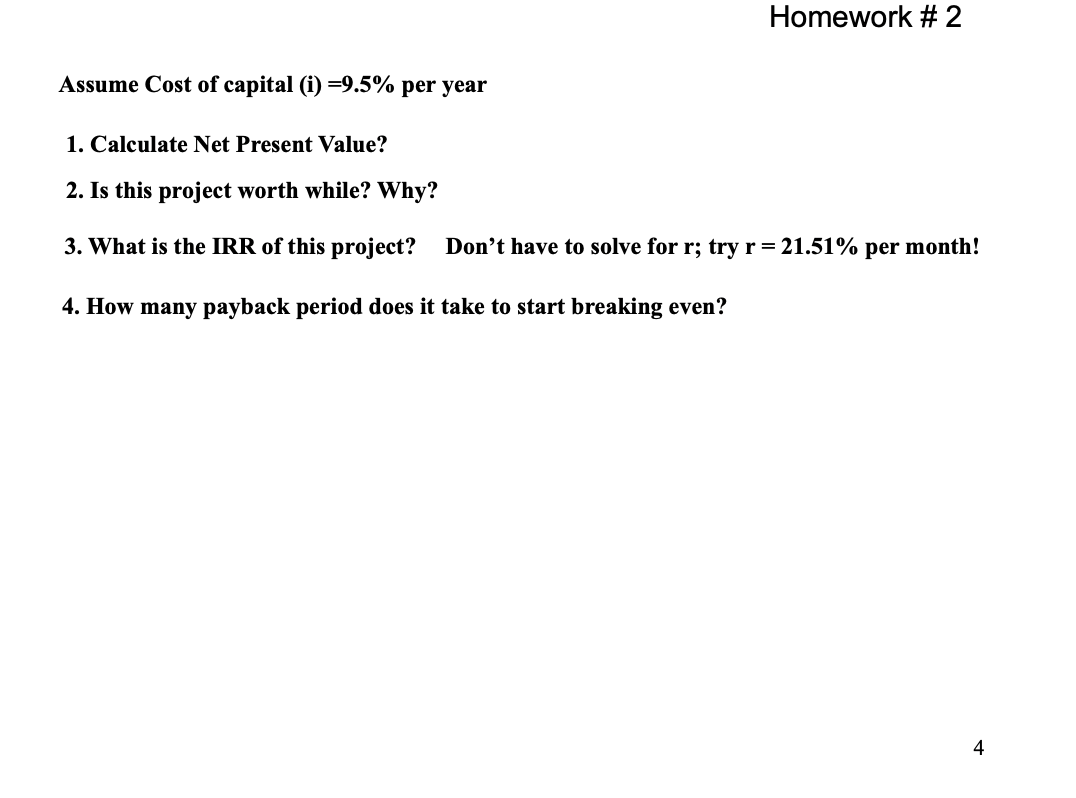

Project Financial Benefit Analysis Frequently used measures Return on Assets (ROA) Net Income ROA= Total Assets Net income for a project is the expected earnings and total assets is the value of the assets applied to the project. Return on Investment (ROI) Net Income ROI = Investment Payback period Payback period is the smallest n such that Cash_Inflow, 2 Initial_Investment 1 Net Present Value (NPV) and Internal Rate of Return (IRR) CF NPV = (1+r) =0 Where CF,: cash flow at period t; CF, = CFB.t-CFc.t CFB.t: Benefit at time period t; CFct: Cost at time period t r: per period cost of capital for the organization i: Annual interest rate m: Number of period within i (interest rate); For example, if i = annual interest rate, then m=12 CF.: Initial investment i=(1+r)" -1 and r =(1+i)= -1 1 Internal rate of return (IRR) is the interest or discount rate, i or r, that results in NPV=0 CF. NPV = 0 = 5 (1+r) t=0 2 Homework #2 A benefit cost analysis is conducted for a training program to reduce operator assembly Errors, thus reduce scrap cost. Project benefit: Scrap reduction of $700 in month 3 Scrap reduction of $500 in month 4 Scrap reduction of $450 in month 5 and 6 Project Costs: Training material preparation: $400 in month 1 Employee training: $840 in month 2 Reporting of program effectiveness will cost $100 in month 6 $700 $500 $450 $450 Cash (+) 3 4 5 0 Cash (-) $100 $400 3 $840 Homework #2 Assume Cost of capital (i) =9.5% per year 1. Calculate Net Present Value? 2. Is this project worth while? Why? 3. What is the IRR of this project? Don't have to solve for r; try r= 21.51% per month! 4. How many payback period does it take to start breaking even? 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts