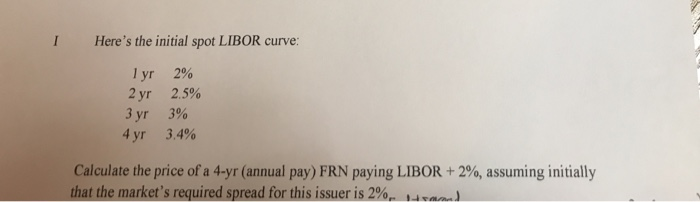

Question: info needed problem i need answer to I Here's the initial spot LIBOR curve lyr 2% 2yr 2.5% 3yr 3% 4yr 3.490 Calculate the price

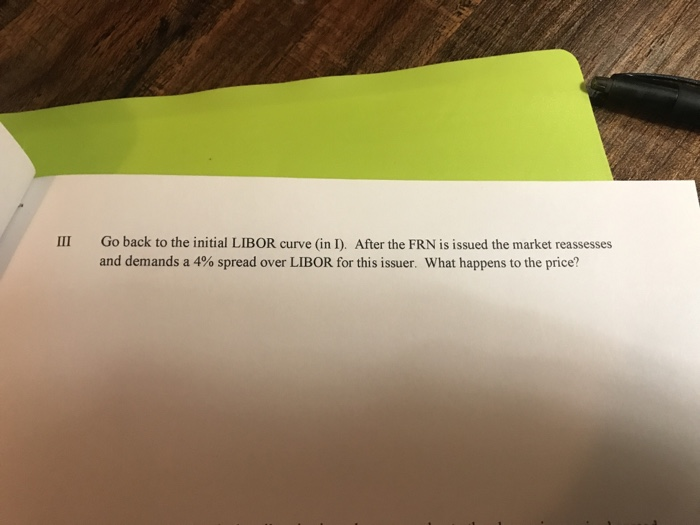

I Here's the initial spot LIBOR curve lyr 2% 2yr 2.5% 3yr 3% 4yr 3.490 Calculate the price of a 4-yr (annual pay) FRN paying LIBOR + 2%, assuming initially that the market's required spread for this issuer is 2% Go back to the initial LIBOR curve (in 1). After the FRN is issued the market reassesses and demands a 4% spread over LIBOR for this issuer, what happens to the price?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts