Question: Information content, or signaling, hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock

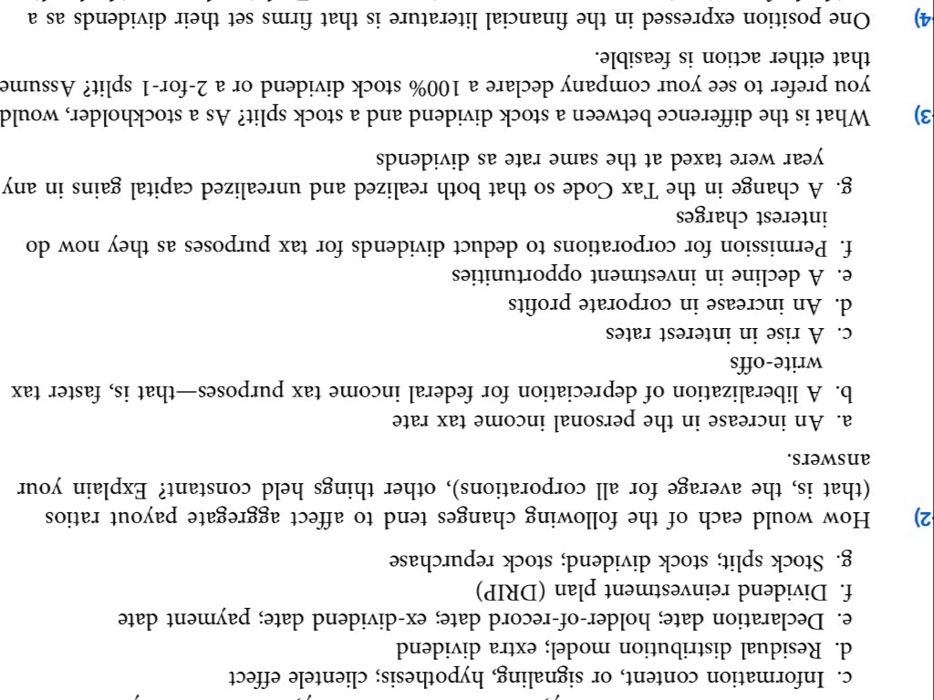

Information content, or signaling, hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock split; stock dividend; stock repurchase How would each of the following changes tend to affect aggregate payout ratios (that is, the average for all corporations), other things held constant? Explain your answers. An increase in the personal income tax rate A liberalization of depreciation for federal income tax purposes-that is, faster tax write-offs A rise in interest rates An increase in corporate profits A decline in investment opportunities Permission for corporations to deduct dividends for tax purposes as they now do interest charges A change in the Tax Code so that both realized and unrealized capital gains in any year were taxed at the same rate as dividends What is the difference between a stock dividend and a stock split? As a stockholder, would you prefer to see your company declare a 100% stock dividend or a 2-for-1 split? Assume that either action is feasible. One position expressed in the financial literature is that firms set their dividends as a Information content, or signaling, hypothesis; clientele effect Residual distribution model; extra dividend Declaration date; holder-of-record date; ex-dividend date; payment date Dividend reinvestment plan (DRIP) Stock split; stock dividend; stock repurchase How would each of the following changes tend to affect aggregate payout ratios (that is, the average for all corporations), other things held constant? Explain your answers. An increase in the personal income tax rate A liberalization of depreciation for federal income tax purposes-that is, faster tax write-offs A rise in interest rates An increase in corporate profits A decline in investment opportunities Permission for corporations to deduct dividends for tax purposes as they now do interest charges A change in the Tax Code so that both realized and unrealized capital gains in any year were taxed at the same rate as dividends What is the difference between a stock dividend and a stock split? As a stockholder, would you prefer to see your company declare a 100% stock dividend or a 2-for-1 split? Assume that either action is feasible. One position expressed in the financial literature is that firms set their dividends as a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts