Question: INFORMATION FOR QUESTION The 2016 and 2015 comparative balance sheets and 2016 income statement of Perfect Supply Corp. follow: EE (Click the icon to view

INFORMATION FOR QUESTION

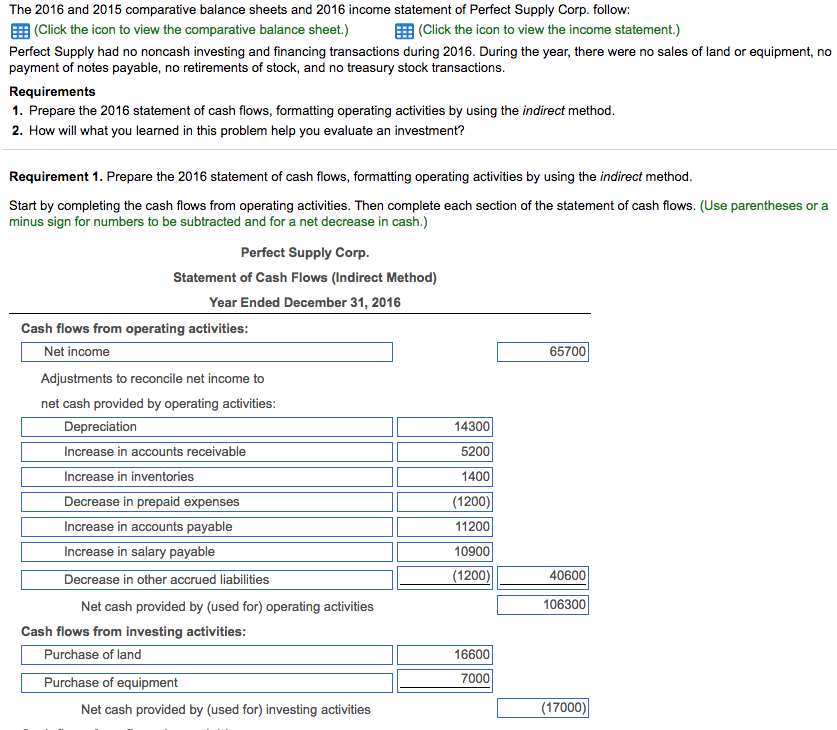

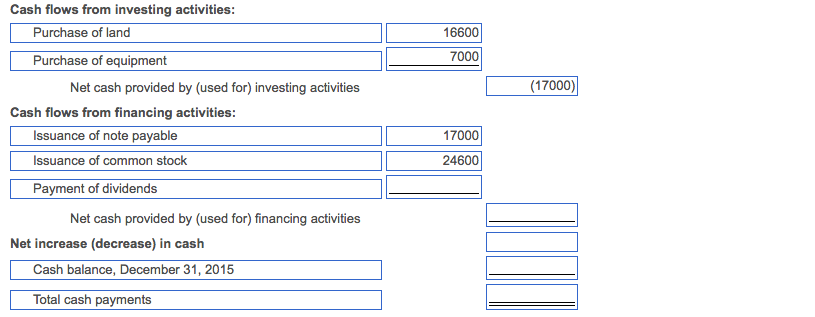

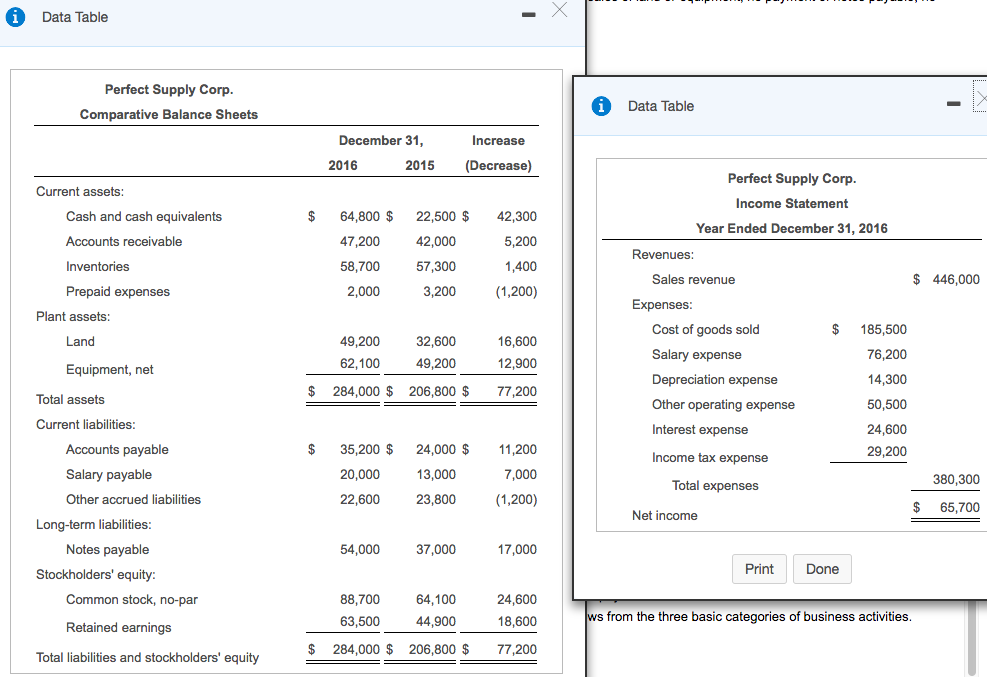

The 2016 and 2015 comparative balance sheets and 2016 income statement of Perfect Supply Corp. follow: EE (Click the icon to view the comparative balance sheet.) ?(Click the icon to view the income statement.) Perfect Supply had no noncash investing and financing transactions during 2016. During the year, there were no sales of land or equipment, no payment of notes payable, no retirements of stock, and no treasury stock transactions Requirements 1. Prepare the 2016 statement of cash flows, formatting operating activities by using the indirect method 2. How will what you learned in t his problem help you evaluate an investment? Requirement 1. Prepare the 2016 statement of cash flows, formatting operating activities by using the indirect method Start by completing the cash flows from operating activities. Then complete each section of the statement of cash flows. (Use parentheses or a minus sign for numbers to be subtracted and for a net decrease in cash.) Perfect Supply Corp. Statement of Cash Flows (Indirect Method) Year Ended December 31, 2016 Cash flows from operating activities Net income Adjustments to reconcile net income to net cash provided by operating activities 65700 Depreciation Increase in accounts receivable Increase in inventories Decrease in prepaid expenses Increase in accounts payable Increase in salary payable Decrease i 14300 5200 1400 (1200) 11200 10900 n other accrued liabilities 40600 Net cash provided by (used for) operating activities 106300 Cash flows from investing activities Purchase of land 16600 7000 Purchase of equipment Net cash provided by (used for) investing activities (17000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts