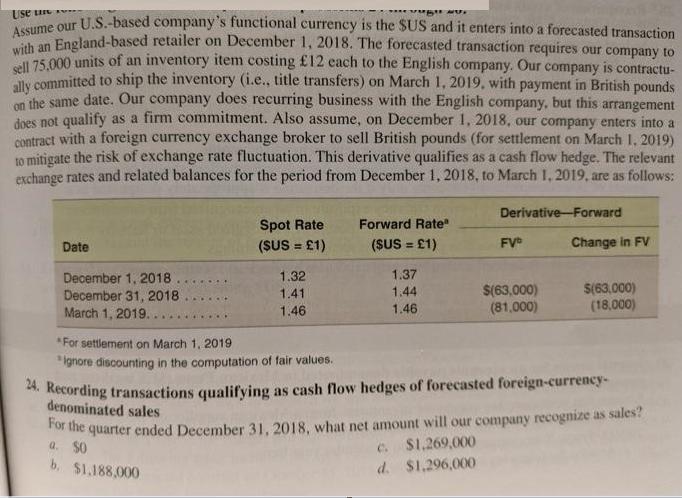

Question: Use ue ume our U.S.-based company's functional currency is the SUS and it enters into a forecasted transaction England-based retailer on December 1, 2018.

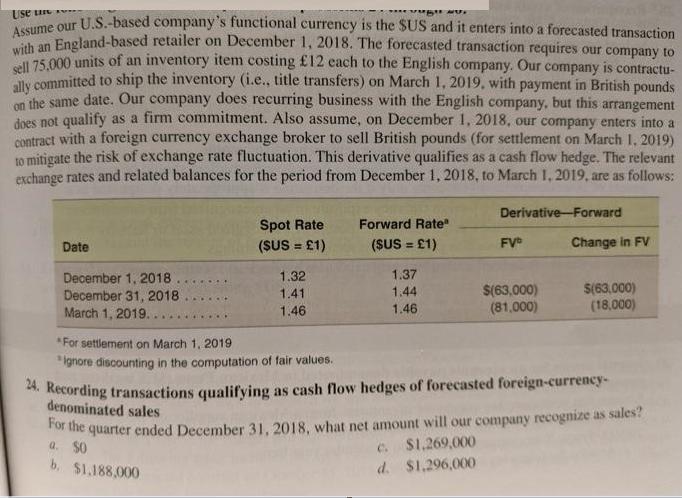

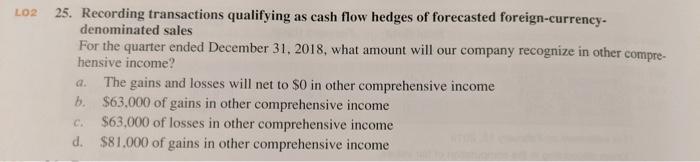

Use ue ume our U.S.-based company's functional currency is the SUS and it enters into a forecasted transaction England-based retailer on December 1, 2018. The forecasted transaction requires our company to with an ll 75.000 units of an inventory item costing 12 each to the English company. Our company is contractu- lly committed to ship the inventory (i.e., title transfers) on March 1, 2019, with payment in British pounds a the same date. Our company does recurring business with the English company, but this arrangement does not qualify as a firm commitment. Also assume, on December 1, 2018, our company enters into a contract with a foreign currency exchange broker to sell British pounds (for settlement on March 1, 2019) 10 mitigate the risk of exchange rate fluctuation. This derivative qualifies as a cash flow hedge. The relevant exchange rates and related balances for the period from December 1, 2018, to March 1, 2019, are as follows: Derivative-Forward Spot Rate (SUS = 1) Forward Rate" Date (SUS = 1) FV Change in FV %3D %3D 1.32 1.37 December 1, 2018 December 31, 2018 March 1, 2019. . S(63,000) (81,000) S(63,000) (18,000) 1.41 1.44 1.46 1.46 *For settlement on March 1, 2019 *Ignore discounting in the computation of fair values. *. Recording transactions qualifying as cash flow hedges of forecasted foreign-currency- denominated sales or the quarter ended December 31, 2018, what net amount will our company recognize as sales? a. $0 c. S1.269,000 d. $1.296,000 b. $1,188,000 Use ue ume our U.S.-based company's functional currency is the SUS and it enters into a forecasted transaction England-based retailer on December 1, 2018. The forecasted transaction requires our company to with an ll 75.000 units of an inventory item costing 12 each to the English company. Our company is contractu- lly committed to ship the inventory (i.e., title transfers) on March 1, 2019, with payment in British pounds a the same date. Our company does recurring business with the English company, but this arrangement does not qualify as a firm commitment. Also assume, on December 1, 2018, our company enters into a contract with a foreign currency exchange broker to sell British pounds (for settlement on March 1, 2019) 10 mitigate the risk of exchange rate fluctuation. This derivative qualifies as a cash flow hedge. The relevant exchange rates and related balances for the period from December 1, 2018, to March 1, 2019, are as follows: Derivative-Forward Spot Rate (SUS = 1) Forward Rate" Date (SUS = 1) FV Change in FV %3D %3D 1.32 1.37 December 1, 2018 December 31, 2018 March 1, 2019. . S(63,000) (81,000) S(63,000) (18,000) 1.41 1.44 1.46 1.46 *For settlement on March 1, 2019 *Ignore discounting in the computation of fair values. *. Recording transactions qualifying as cash flow hedges of forecasted foreign-currency- denominated sales or the quarter ended December 31, 2018, what net amount will our company recognize as sales? a. $0 c. S1.269,000 d. $1.296,000 b. $1,188,000 LO2 25. Recording transactions qualifying as cash flow hedges of forecasted foreign-currency- denominated sales For the quarter ended December 31, 2018, what amount will our company recognize in other compre- hensive income? The gains and losses will net to $0 in other comprehensive income b. $63,000 of gains in other comprehensive income $63,000 of losses in other comprehensive income d. $81.000 of gains in other comprehensive income a. C.

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Solution 24 Option a is correct Zero Sales will be recog... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

63609300cb935_232805.pdf

180 KBs PDF File

63609300cb935_232805.docx

120 KBs Word File