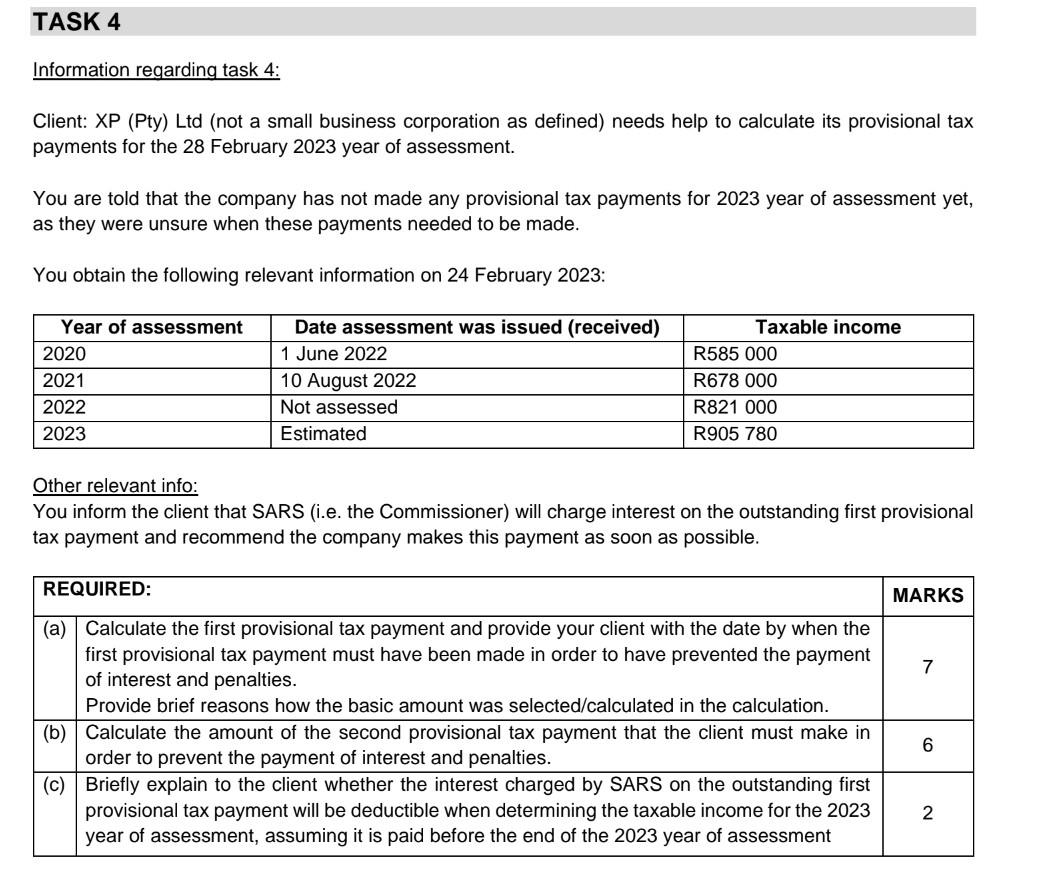

Question: Information regarding task 4 : Client: XP (Pty) Ltd (not a small business corporation as defined) needs help to calculate its provisional tax payments for

Information regarding task 4 : Client: XP (Pty) Ltd (not a small business corporation as defined) needs help to calculate its provisional tax payments for the 28 February 2023 year of assessment. You are told that the company has not made any provisional tax payments for 2023 year of assessment yet, as they were unsure when these payments needed to be made. You obtain the following relevant information on 24 February 2023: [ Other relevant info: You inform the client that SARS (i.e. the Commissioner) will charge interest on the outstanding first provisional tax payment and recommend the company makes this payment as soon as possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts