Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Infosys an Indian multinational provider of business consulting, technology, engineering, and outsourcing services with revenue of $7,398 million and net income of $1,725 million

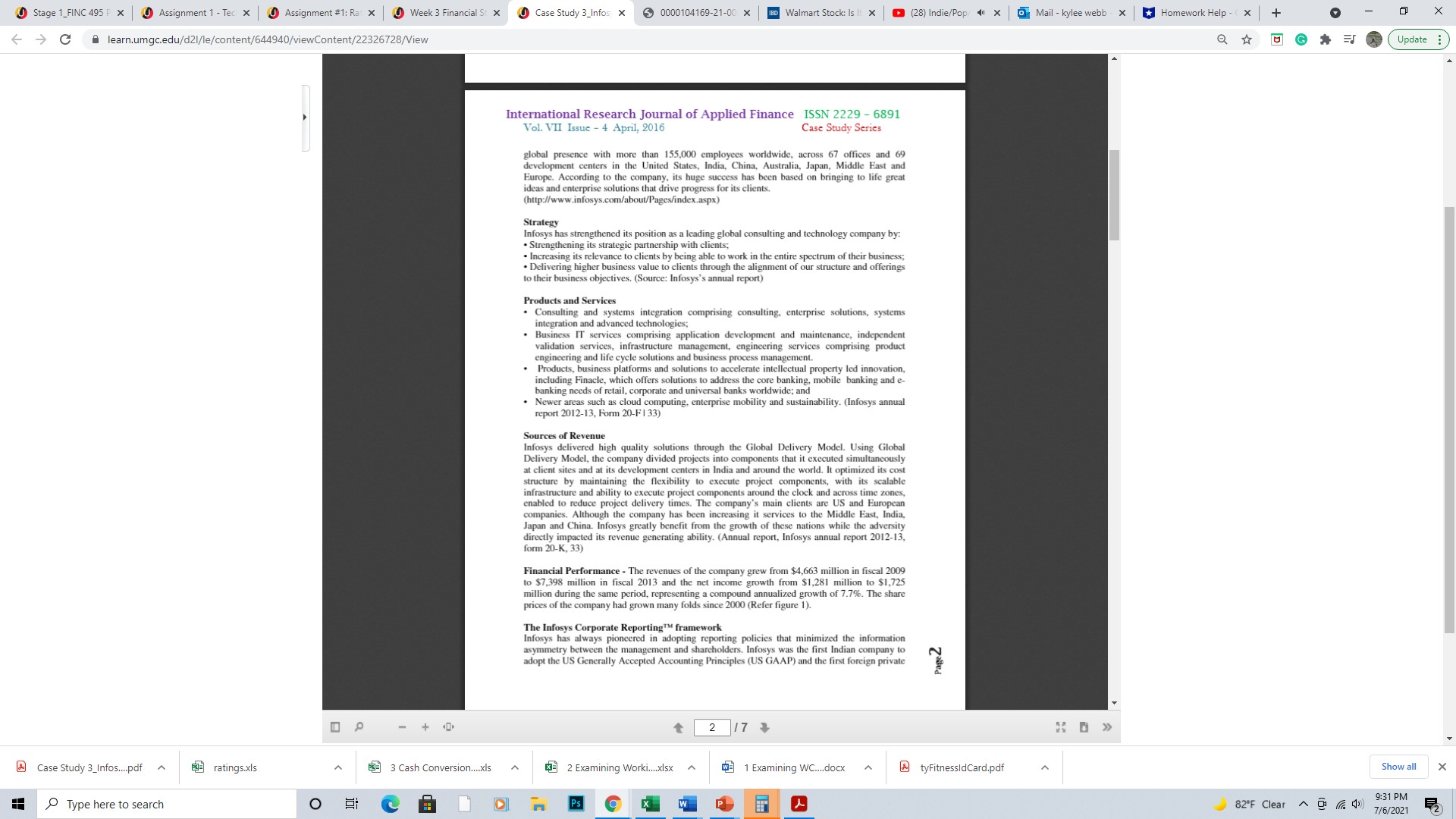

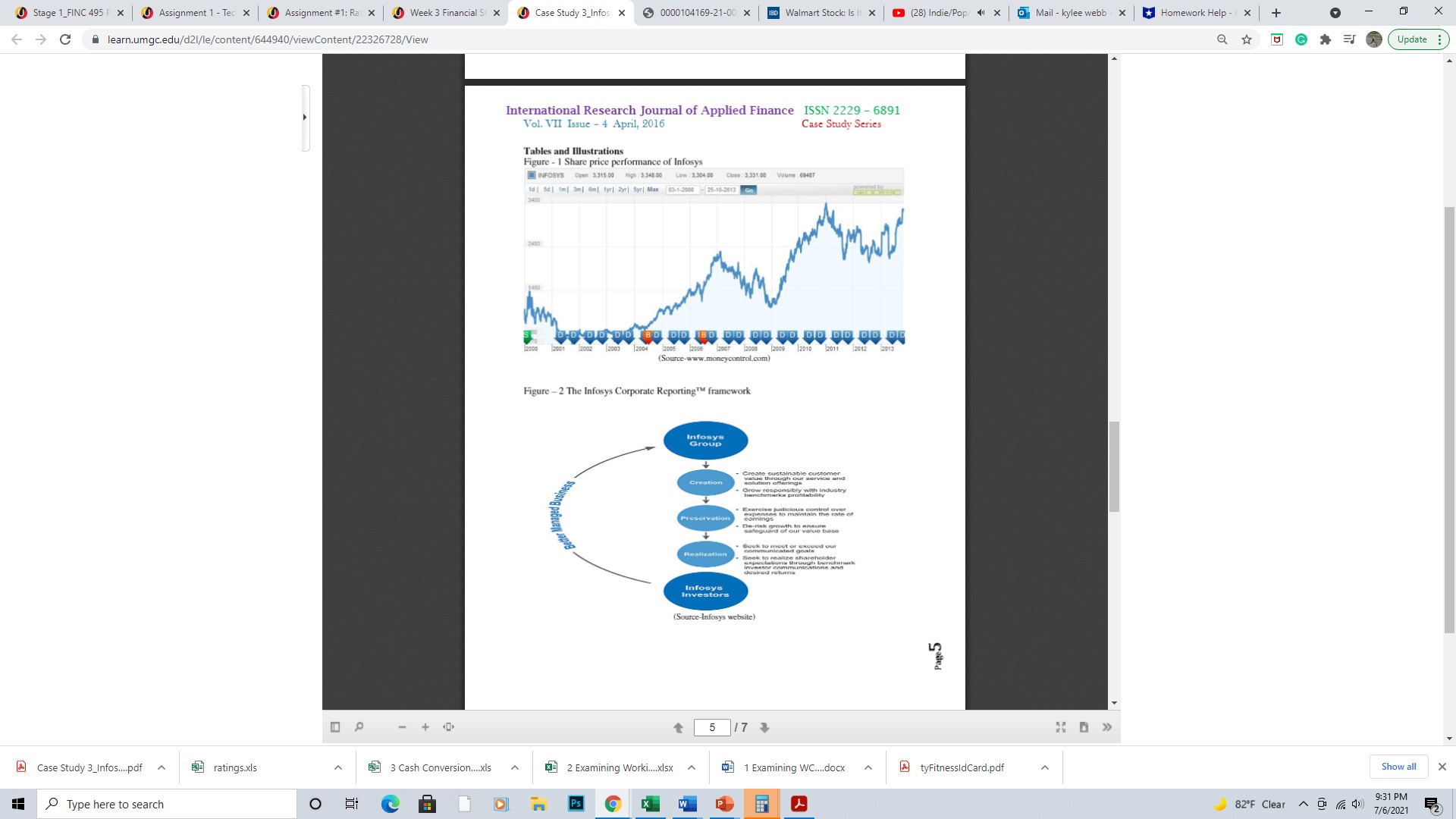

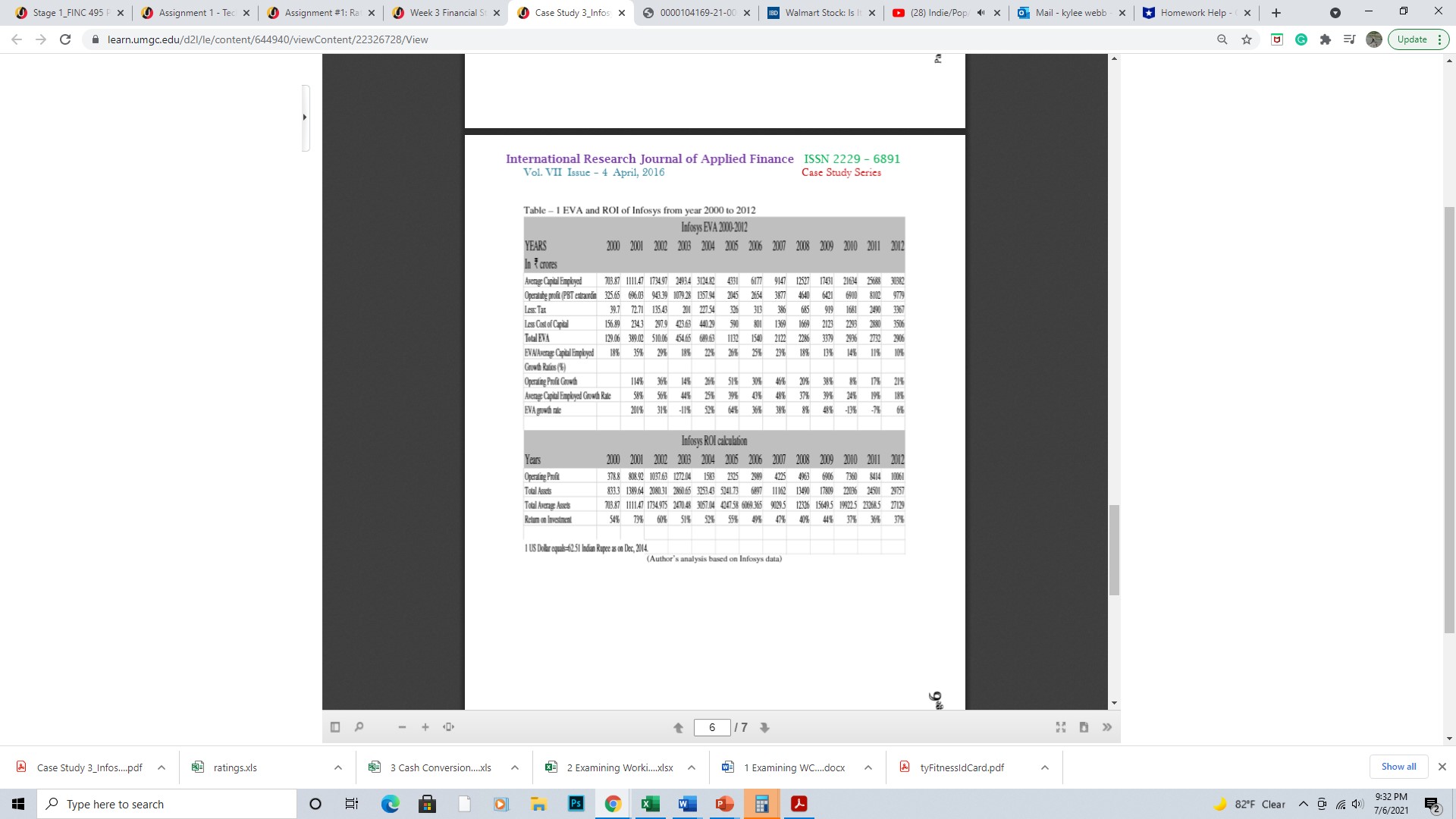

Infosys an Indian multinational provider of business consulting, technology, engineering, and outsourcing services with revenue of $7,398 million and net income of $1,725 million in the fiscal year 2013, has been declaring Economic Value Added (EVA) in its annual reports since 1996. Why Infosys is declaring the EVA, when it's not mandatory to report such figures in annual report? What purpose does the EVA statement in the annual report serve to the investors? Most importantly, what do these EVA figures reflect for zero debt company like Infosys? The case gives an opportunity to analyze and evaluate Economic Value Added by Infosys from year 2000 to 2012 and to draw interpretations regarding the wealth creation done by Infosys over a period. The pedagogical objective of the case is to make students understand and apply the concept of EVA for financial performance evaluation while drawing interpretations out of it. The case brings out the fundamental concept behind adopting and reporting EVA. The case also aims to compare and contrast the EVA with traditional financial accounting measure - Return on Investment (ROI). Key Words: Economic Value Added, Corporate Value reporting policy, Infosys, Return on Investment, Shareholder Wealth Creation The Case Utterly confused with the numbers on Economic Value Added, Mr. Paul, an MBA 1st Semester student sighed while holding a cup of coffee in his hostel room of the LBG business School in India. Even the hot summer season was sending a chill down his spine, since 15 marks, individual case study was due for submission in less than 24 hours. The Infosys EVA appeared to be a mystery to him. Being in MBA 1" semester with B.Com background, he had some basic The Case Utterly confused with the numbers on Economic Value Added, Mr. Paul, an MBA 1st Semester student sighed while holding a cup of coffee in his hostel room of the LBG business School in India. Even the hot summer season was sending a chill down his spine, since 15 marks, individual case study was due for submission in less than 24 hours. The Infosys EVA appeared to be a mystery to him. Being in MBA 1" semester with B.Com background, he had some basic knowledge of accounting, but he regretted missing out the vital session on Economic Value Added. As a result, he was still struggling to solve the case on EVA analysis given by the Finance faculty. After all, analyzing the EVA of Infosys was no joke, especially when 10 year trend needed for a billion dollar company. Although the case gave the basic information, but still he found it to be a massive task to analyze and evaluate the EVA of Infosys. Did Infosys generated the wealth or was a wealth destroyer over the past years, were the questions that constantly challenged him? Paul knew that the only way to solve the case was to go back to the basics and dig out the information about the company and class notes on EVA. About Infosys Infosys limited (formerly Infosys Technologies Limited) is an Indian multinational provider of business consulting, technology, engineering, and outsourcing services. Headquartered in Bangalore, Karnataka, has acquired the third-largest India-based IT services company status by 2012 revenues. It started with just $ 250 in 1981 by the seven engineers, and within few years, it had become a global leader in consulting, technology and outsourcing with revenues of US $ 7.2 billion (Q3 FY13), while managing clients from 30 countries. The company has a Stage 1 FINC 495 I Assignment 1 - Tec X Assignment #1: Rat Week 3 Financial St X Case Study 3 Infos x 0000104169-21-00 x Walmart Stock: Is (28) Indie/Pop X Mail - kylee webb Homework Help - + C learn.umgc.edu/d21/le/content/644940/viewContent/22326728/View Q Update Case Study 3_Infos....pdf ^ Type here to search ratings.xls International Research Journal of Applied Finance ISSN 2229 - 6891 Vol. VII Issue - 4 April, 2016 Case Study Series global presence with more than 155,000 employees worldwide, across 67 offices and 69 development centers in the United States, India, China, Australia, Japan, Middle East and Europe. According to the company, its huge success has been based on bringing to life great ideas and enterprise solutions that drive progress for its clients. (http://www.infosys.com/about/Pages/index.aspx) Strategy Infosys has strengthened its position as a leading global consulting and technology company by: Strengthening its strategic partnership with clients; Increasing its relevance to clients by being able to work in the entire spectrum of their business; Delivering higher business value to clients through the alignment of our structure and offerings to their business objectives. (Source: Infosys's annual report) Products and Services . Consulting and systems integration comprising consulting, enterprise solutions, systems integration and advanced technologies; Business IT services comprising application development and maintenance, independent validation services, infrastructure management, engineering services comprising product engineering and life cycle solutions and business process management. Products, business platforms and solutions to accelerate intellectual property led innovation, including Finacle, which offers solutions to address the core banking, mobile banking and e- banking needs of retail, corporate and universal banks worldwide; and Newer areas such as cloud computing, enterprise mobility and sustainability. (Infosys annual report 2012-13, Form 20-F133) Sources of Revenue Infosys delivered high quality solutions through the Global Delivery Model. Using Global Delivery Model, the company divided projects into components that it executed simultaneously at client sites and at its development centers in India and around the world. It optimized its cost structure by maintaining the flexibility to execute project components, with its scalable infrastructure and ability to execute project components around the clock and across time zones, enabled to reduce project delivery times. The company's main clients are US and European companies. Although the company has been increasing it services to the Middle East, India, Japan and China. Infosys greatly benefit from the growth of these nations while the adversity directly impacted its revenue generating ability. (Annual report, Infosys annual report 2012-13, form 20-K, 33) Financial Performance - The revenues of the company grew from $4,663 million in fiscal 2009 to $7,398 million in fiscal 2013 and the net income growth from $1,281 million to $1,725 million during the same period, representing a compound annualized growth of 7.7%. The share prices of the company had grown many folds since 2000 (Refer figure 1). The Infosys Corporate Reporting framework Infosys has always pioneered in adopting reporting policies that minimized the information asymmetry between the management and shareholders. Infosys was the first Indian company to adopt the US Generally Accepted Accounting Principles (US GAAP) and the first foreign private 2 a > B 3 Cash Conversion....xls Q= C 2 Examining Work.....xlsx ^ 1 Examining WC....docx tyFitnessIdCard.pdf Ps 82F Clear 2 7 Show all x 9:31 PM 7/6/2021 Stage 1 FINC 495 I Assignment 1 - Tec X Assignment #1: Rat Week 3 Financial St X Case Study 3 Infos x > 0000104169-21-00 x Walmart Stock: Is (28) Indie/Pop X Mail - kylee webb Homework Help - + C learn.umgc.edu/d21/le/content/644940/viewContent/22326728/View Q Update Case Study 3_Infos....pdf ^ Type here to search ratings.xls > B a 3 Cash Conversion....xls International Research Journal of Applied Finance ISSN 2229 - 6891 Vol. VII Issue - 4 April, 2016 Tables and Illustrations Figure - 1 Share price performance of Infosys INFOSYS Case Study Series Open 3,315.00 High: 3.348.00 Low 3,304 00 Close: 3.331.00 14 5d 1m 3m 6m 1yr| 2yr Syr Max 03-1-2000 Volume: 69487 -25-10-2013 3400 GEODESIC 2480 BD DID. IBD DD DD DD DD DD DD DE 2008 2009 2010 2011 2012 (Source-www.moneycontrol.com) 2013 2002 2003 2004 Creation Preservation Realization Infosys Investors Create sustainable customer value through our service and - Grow responsibly with industry benchmark probability Exercise judicious control over expenses to maintain the rate of comings De-risk growth to ensure safeguard of our value base Book to meet or exceed communicated god our Seek to realize shareholder expectations through benchmark Investor communications and desired returns || 00000 Figure -2 The Infosys Corporate Reporting framework Infosys (Source-Infosys website) ]' 5 7 2 Examining Worki....xlsx ^ 1 Examining WC....docx tyFitnessIdCard.pdf Ps 2 82F Clear Show all x 9:31 PM 7/6/2021 Stage 1 FINC 495 I Assignment 1 - Tec X Assignment #1: Rat Week 3 Financial St X Case Study 3 Infos X > 0000104169-21-00 x Walmart Stock: Is (28) Indie/Pop X Mail - kylee webb Homework Help - + C learn.umgc.edu/d21/le/content/644940/viewContent/22326728/View Q Update Case Study 3_Infos....pdf ^ Type here to search ratings.xls > B a 3 Cash Conversion....xls International Research Journal of Applied Finance ISSN 2229-6891 Vol. VII Issue 4 April, 2016 Table - 1 EVA and ROI of Infosys from year 2000 to 2012 Infosys EVA 2000-2012 Case Study Series 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 703.87 1111.47 1734.97 24934 3124.82 4331 6177 9147 12527 17431 21634 25688 30382 325.65 696.03 943.39 1079.28 1357.94 2045 2654 3877 4640 6421 6910 8102 9779 39.7 72.71 135.43 201 227.54 326 313 386 685 919 1681 2490 3367 156.89 234.3 297.9 423.63 440.29 129.06 389.02 510.06 454.65 689.63 18% 35% 29% 18% 22% YEARS In crores Average Capital Employed Operating profit (PBT extraordin Less Tax Less Cost of Capital Total EVA EVA/Average Capital Employed Growth Ratios ( Operating Profit Growth Average Capital Employed Growth Rate EVA growth rate 590 801 1132 1540 26% 25% 1369 1669 2123 2293 2880 3506 2122 2286 3379 2936 2732 2906 23% 18% 13% 14% 11% 10% 20% 38% 8% 17% 21% 37% 39% 24% 19% 18% 114% 36% 14% 26 51% 30% 46% 58% 56% 44% 25% 39% 43% 48% 201% 31% -11% 52% 64% 364 38% 8% 48% -13% -7% 6% Infosys ROI calculation 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 378.8 808.92 1037.63 1272.04 1583 2325 2989 4225 4963 6906 7360 8414 10061 833.3 1389.64 2080.31 2860.65 3253.43 5241.73 6897 11162 13490 17809 22036 24501 29757 703.87 1111.47 1734.975 2470.48 30657.04 4247.58 6069.365 9029.5 12326 15649.5 19922.5 23368.5 27129 54% 73% 60% 51% 52% 55% 49% 47% Years Operating Profit Total Assets Total Average Assets Return on Investment 1 US Dollar equal-62.51 Indian Rupee as on Dec, 2014. (Author's analysis based on Infosys data) 40% 44% 37% 36% 37% ]' 6 7 2 Examining Worki....xlsx ^ 1 Examining WC....docx tyFitnessIdCard.pdf Ps 2 82F Clear Show all x 9:32 PM 7/6/2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started