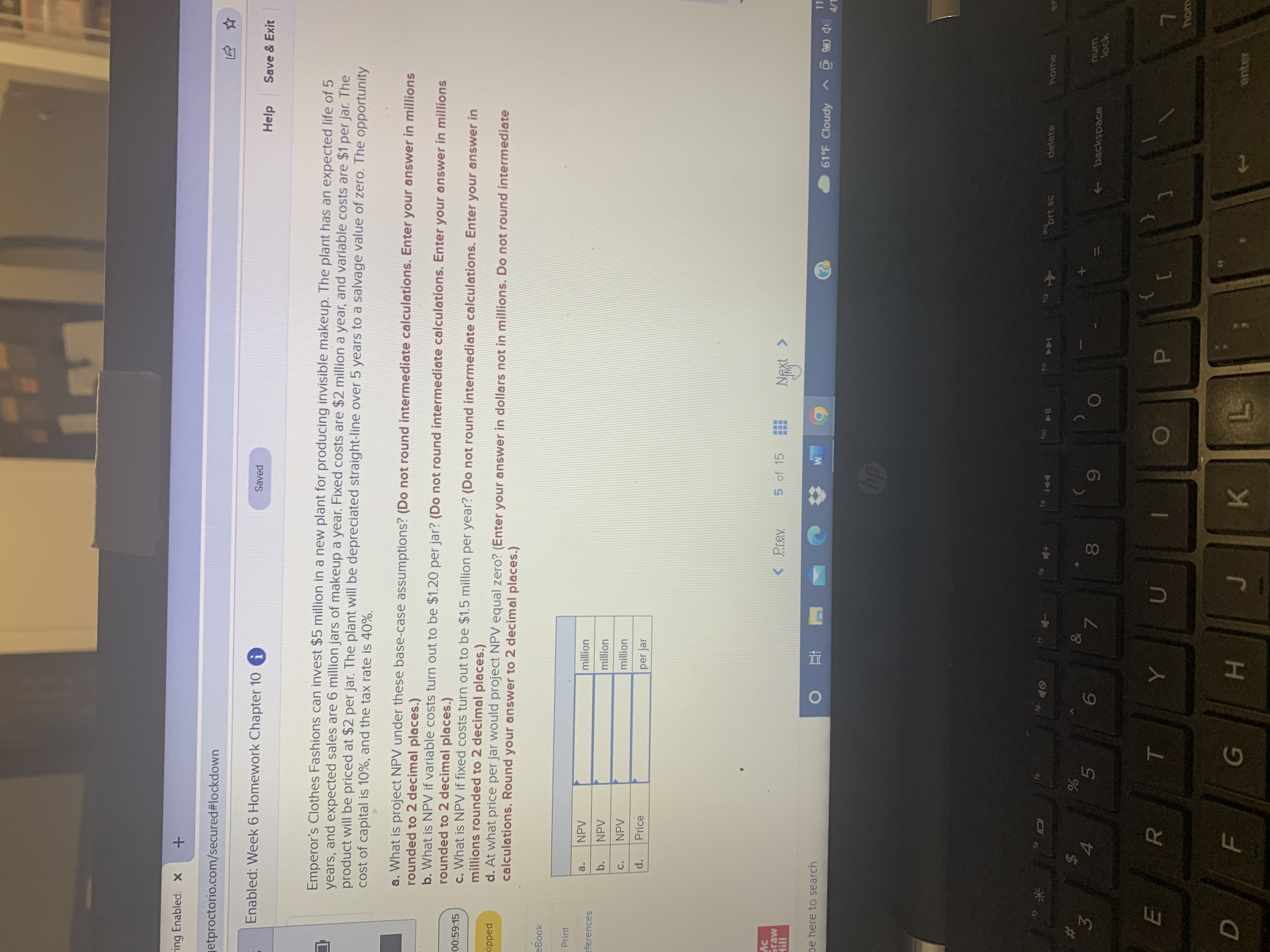

Question: ing Enabled: X etproctorio.com/secured#lockdown Enabled: Week 6 Homework Chapter 10 Saved Help Save & Exit Emperor's Clothes Fashions can invest $5 million in a new

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts