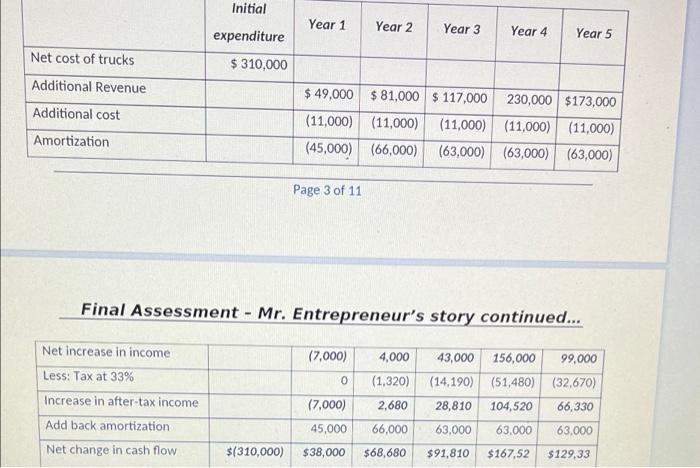

Question: Initial Year 1 Year 2 Year 3 Year 4 Year 5 Net cost of trucks expenditure $ 310,000 Additional Revenue Additional cost Amortization $ 49,000

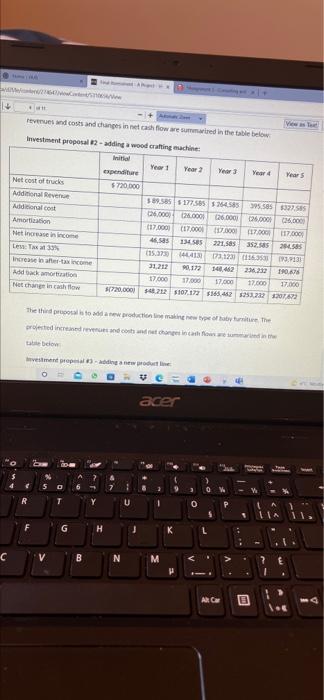

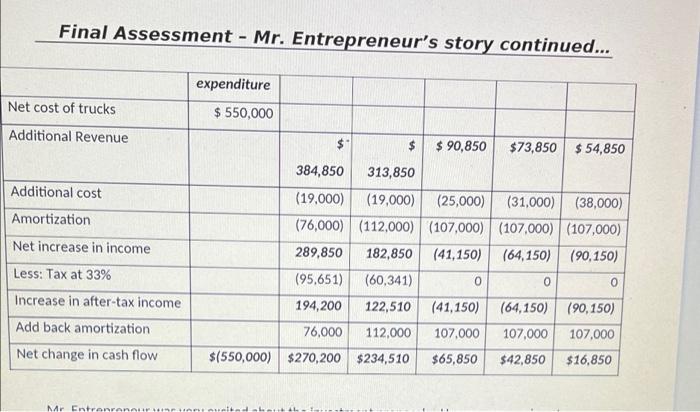

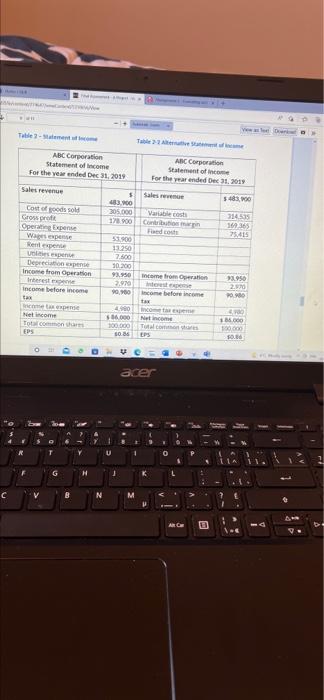

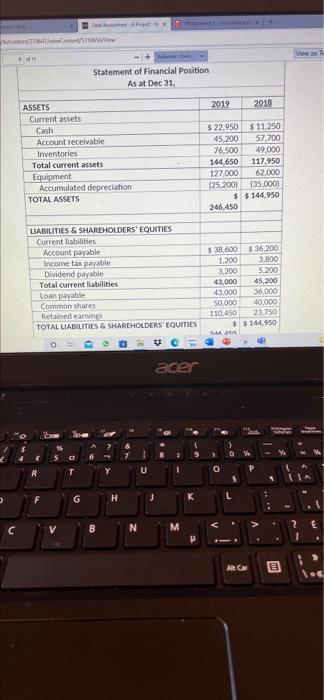

Initial Year 1 Year 2 Year 3 Year 4 Year 5 Net cost of trucks expenditure $ 310,000 Additional Revenue Additional cost Amortization $ 49,000 $ 81,000 $ 117,000 230,000 $173,000 (11,000) (11,000) (11,000) (11.000) (11.000) (45,000) (66,000) (63,000) (63,000) (63,000) Page 3 of 11 Final Assessment - Mr. Entrepreneur's story continued... Net increase in income Less: Tax at 33% Increase in after tax income Add back amortization Net change in cash flow (7,000) 4,000 0 (1,320) (7,000) 2,680 45,000 66,000 $38,000 $68,680 43,000 156,000 99,000 (14,190) (51,480) (32,670) 28,810 104,520 66,330 63,000 63.000 63,000 $(310,000) $91,810 $167,52 $129.33 revenues and costs and changes in flow are sured in the table below Investment proposal 2 adding a wood criting machine Initial Yeart Years Year 4 expenditure Years Netcost of trucks $ 720.000 Additional even 385 5177585 SMS 395.5855331 SIS 26.000 12.000 26.000 26.000 Amortization 17.000 (17.000 1000 117.000 117.000 Met increase in income 46.as 10 SS 221,585 352.83 244585 Len Taxa 15.07 4131 23.1231 01635 193.113 Increase income 31,212 0,172 14462 236.232 T675 Add action 17.000 17.000 17600 17:00 Net changes in cash flow 3720.000 SB.212 107.177 $548,422522220573 The third rosto doctioning with erede indeve content for te below vestment regard acer U F G J K C B ARC Final Assessment - Mr. Entrepreneur's story continued... expenditure $ 550,000 Net cost of trucks Additional Revenue Additional cost Amortization Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $ $ 90,850 $73,850 $ 54,850 384,850 313,850 (19,000) (19,000) (25,000) (31,000) (38,000) (76,000) (112,000) (107,000) (107,000) (107,000) 289,850 182,850 (41,150) (64,150) (90,150) (95,651) (60,341) 0 0 0 194,200 122,510 (41,150) (64.150) (90,150) 76,000 112,000 107.000 107.000 107,000 $(550,000) $270,200 $234,510 $65,850 $42,850 $16,850 Mr Entranrana. Tuile - Sement ABC Corporation Statement of income For the year ended Dec 31, 2019 ABC Corporation Statement of me For the paranded Dec 31, 2019 Sales 5483,00 Sales reven $ 10 205.000 178.900 Variable cost 314695 169365 25.01 Fado Cost of foods sols Groot Operating Expense Wapene ele Deprecense Income from Operation 37.900 13.250 7.500 30.200 93.950 24970 90.900 come from the 23.950 2.70 098 income before income Tax income before income tax wetu income Totona EPS 4480 566.000 100.000 50.86 185.000 Net TO EPS 0.86 O acer 0 G View Statement of Financial Position As at Dec 31, 2019 2018 ASSETS Current assets Cash Account receivable Inventories Total current assets Equipment Accumulated depreciation TOTAL ASSETS $ 22.950 5 11.250 45.200 57.700 76,500 49,000 144,650 117.950 127.000 62.000 (25.2001 (35,000) $ $144.950 246,450 LIABILITIES & SHAREHOLDERS' EQUITIES Current liabilities Account payable Income tax payable Dividend payable Total current abilities Loan payable Common shares Retained earnings TOTAL LIABILITIES & SHAREHOLDERS' EQUITIES $38.600 $36.200 1.200 3 900 3.200 5.200 43.000 45,200 43 000 36.000 50.000 40.000 110.450 23.750 $ $144.950 acer 2 3 0 R Y O G H L V N M Al Ca Initial Year 1 Year 2 Year 3 Year 4 Year 5 Net cost of trucks expenditure $ 310,000 Additional Revenue Additional cost Amortization $ 49,000 $ 81,000 $ 117,000 230,000 $173,000 (11,000) (11,000) (11,000) (11.000) (11.000) (45,000) (66,000) (63,000) (63,000) (63,000) Page 3 of 11 Final Assessment - Mr. Entrepreneur's story continued... Net increase in income Less: Tax at 33% Increase in after tax income Add back amortization Net change in cash flow (7,000) 4,000 0 (1,320) (7,000) 2,680 45,000 66,000 $38,000 $68,680 43,000 156,000 99,000 (14,190) (51,480) (32,670) 28,810 104,520 66,330 63,000 63.000 63,000 $(310,000) $91,810 $167,52 $129.33 revenues and costs and changes in flow are sured in the table below Investment proposal 2 adding a wood criting machine Initial Yeart Years Year 4 expenditure Years Netcost of trucks $ 720.000 Additional even 385 5177585 SMS 395.5855331 SIS 26.000 12.000 26.000 26.000 Amortization 17.000 (17.000 1000 117.000 117.000 Met increase in income 46.as 10 SS 221,585 352.83 244585 Len Taxa 15.07 4131 23.1231 01635 193.113 Increase income 31,212 0,172 14462 236.232 T675 Add action 17.000 17.000 17600 17:00 Net changes in cash flow 3720.000 SB.212 107.177 $548,422522220573 The third rosto doctioning with erede indeve content for te below vestment regard acer U F G J K C B ARC Final Assessment - Mr. Entrepreneur's story continued... expenditure $ 550,000 Net cost of trucks Additional Revenue Additional cost Amortization Net increase in income Less: Tax at 33% Increase in after-tax income Add back amortization Net change in cash flow $ $ 90,850 $73,850 $ 54,850 384,850 313,850 (19,000) (19,000) (25,000) (31,000) (38,000) (76,000) (112,000) (107,000) (107,000) (107,000) 289,850 182,850 (41,150) (64,150) (90,150) (95,651) (60,341) 0 0 0 194,200 122,510 (41,150) (64.150) (90,150) 76,000 112,000 107.000 107.000 107,000 $(550,000) $270,200 $234,510 $65,850 $42,850 $16,850 Mr Entranrana. Tuile - Sement ABC Corporation Statement of income For the year ended Dec 31, 2019 ABC Corporation Statement of me For the paranded Dec 31, 2019 Sales 5483,00 Sales reven $ 10 205.000 178.900 Variable cost 314695 169365 25.01 Fado Cost of foods sols Groot Operating Expense Wapene ele Deprecense Income from Operation 37.900 13.250 7.500 30.200 93.950 24970 90.900 come from the 23.950 2.70 098 income before income Tax income before income tax wetu income Totona EPS 4480 566.000 100.000 50.86 185.000 Net TO EPS 0.86 O acer 0 G View Statement of Financial Position As at Dec 31, 2019 2018 ASSETS Current assets Cash Account receivable Inventories Total current assets Equipment Accumulated depreciation TOTAL ASSETS $ 22.950 5 11.250 45.200 57.700 76,500 49,000 144,650 117.950 127.000 62.000 (25.2001 (35,000) $ $144.950 246,450 LIABILITIES & SHAREHOLDERS' EQUITIES Current liabilities Account payable Income tax payable Dividend payable Total current abilities Loan payable Common shares Retained earnings TOTAL LIABILITIES & SHAREHOLDERS' EQUITIES $38.600 $36.200 1.200 3 900 3.200 5.200 43.000 45,200 43 000 36.000 50.000 40.000 110.450 23.750 $ $144.950 acer 2 3 0 R Y O G H L V N M Al Ca

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts