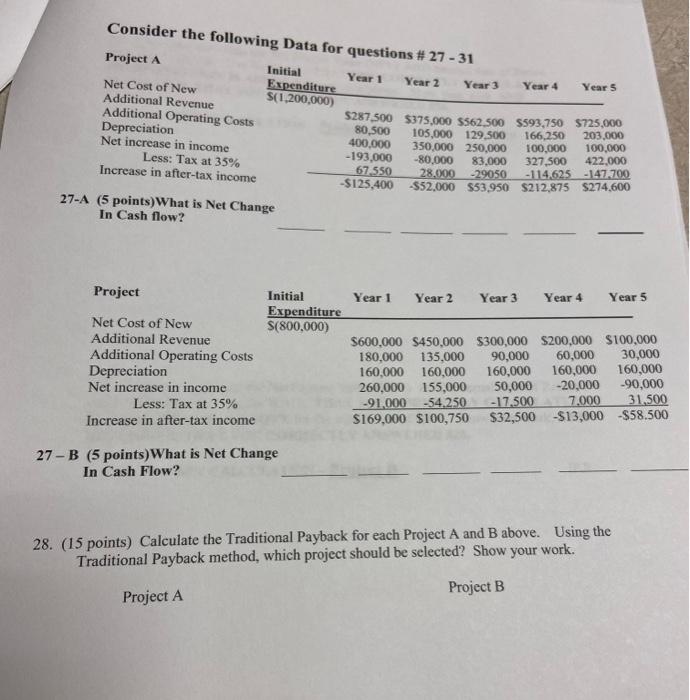

Question: please answer both questions Consider the following Data for questions # 27 - 31 Project A Initial Year 1 Year 2 Year 3 Year 4

Consider the following Data for questions # 27 - 31 Project A Initial Year 1 Year 2 Year 3 Year 4 Year 5 Net Cost of New Expenditure Additional Revenue S(1,200,000) Additional Operating Costs $287.500 $375,000 $562,500 $593,750 $725,000 80.500 105,000 129.500 166,250 Depreciation 203.000 400.000 Net increase in income 350.000 250.000 100,000 100,000 -193,000 -80,000 83.000 327,500 Less: Tax at 35% 422.000 67.550 28.000 -29050 -114.625-147,700 Increase in after-tax income -$125,400 552,000 $53,950 $212,875 $274,600 27-A (5 points) What is Net Change In Cash flow? Project Net Cost of New Additional Revenue Additional Operating Costs Depreciation Net increase in income Less: Tax at 35% Increase in after-tax income Initial Year 1 Year 2 Year 3 Year 4 Year 5 Expenditure S(800,000) $600,000 $450,000 $300,000 $200,000 $100,000 180,000 135,000 90,000 60,000 30,000 160,000 160,000 160,000 160,000 160,000 260.000 155,000 50,000 -20,000 -90,000 -91.000 -54.250 -17.500 7.000 31.500 $169,000 $100,750 $32,500 -$13,000 $58.500 27-B (5 points) What is Net Change In Cash Flow? 28. (15 points) Calculate the Traditional Payback for each Project A and B above. Using the Traditional Payback method, which project should be selected? Show your work. Project B Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts